- United States

- /

- Software

- /

- NYSE:QBTS

D-Wave Quantum (QBTS) Rides 83% APAC Booking Surge After Showcasing AI Partnerships at Qubits Japan 2025

Reviewed by Simply Wall St

- D-Wave Quantum recently held its inaugural Qubits Japan 2025 conference in Tokyo, highlighting an 83% increase in Asia Pacific bookings and new customer successes, including a quantum AI drug discovery pilot with Japan Tobacco and a network optimization project with NTT DOCOMO.

- The company is drawing organizational interest across the region as enterprises explore practical quantum computing applications for optimization and artificial intelligence initiatives.

- To assess D-Wave Quantum's investment narrative, we’ll consider how rapid Asia-Pacific adoption of its technology shapes long-term growth prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is D-Wave Quantum's Investment Narrative?

For an investor to consider a position in D-Wave Quantum, confidence in the commercialization path of quantum computing is essential, as the company sits at the intersection of rapid revenue expansion, major industry buzz, and persistent financial losses. The extraordinary surge in Asia Pacific bookings and high-profile projects showcased at Qubits Japan 2025 suggest increasing momentum and organizational buy-in, especially for real-world optimization and AI deployments. This news event could significantly shift near-term catalysts: strong regional adoption and commercial partnerships may now have a tangible effect on sales growth, investor sentiment, and execution risk, helping offset concerns about heavy losses and share dilution. On the other hand, fundamental risks remain, including the unproven economics of D-Wave's technology at scale, volatility following critical short reports, and ongoing questions about the path to sustainable profitability. The intense stock gains draw attention, but not all underlying risks have faded.

However, there are ongoing questions about the commercial feasibility of D-Wave’s technology.

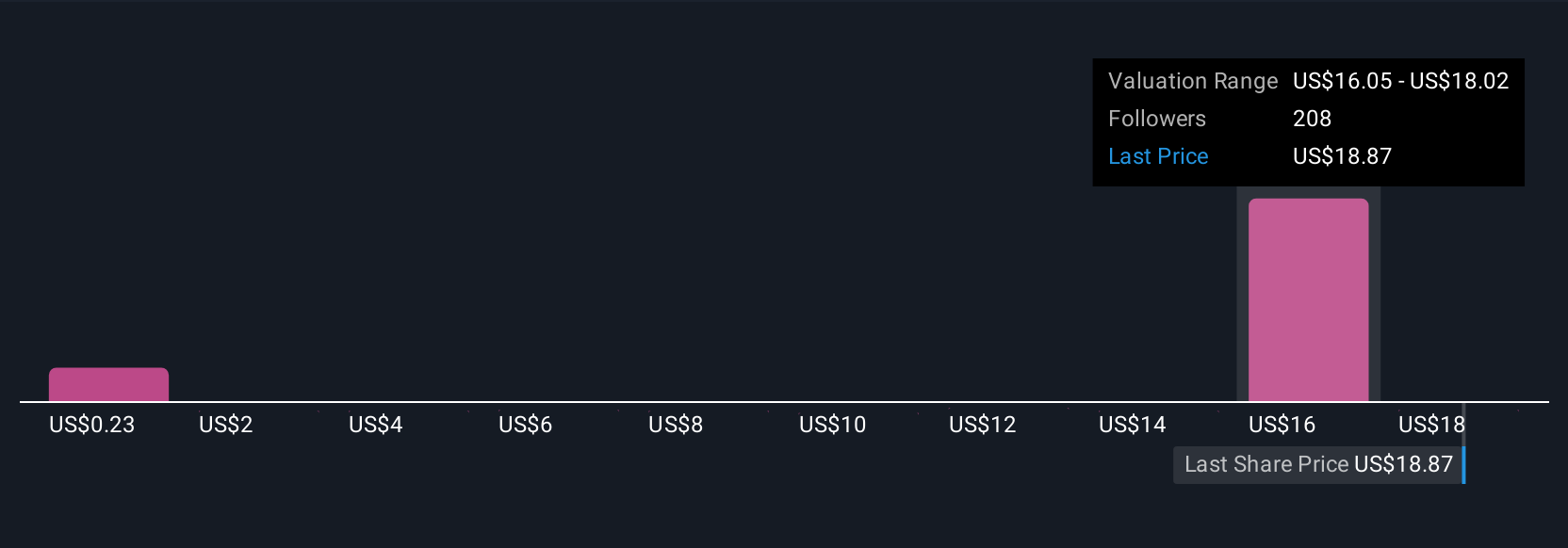

Our comprehensive valuation report raises the possibility that D-Wave Quantum is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore 73 other fair value estimates on D-Wave Quantum - why the stock might be worth as much as $22.60!

Build Your Own D-Wave Quantum Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your D-Wave Quantum research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free D-Wave Quantum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate D-Wave Quantum's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QBTS

D-Wave Quantum

Develops and delivers quantum computing systems, software, and services worldwide.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)