- United States

- /

- Software

- /

- NYSE:PCOR

A Look At Procore Technologies (PCOR) Valuation After The Datagrid Acquisition And AI Growth Push

Procore Technologies (PCOR) recently acquired Datagrid, a move aimed at accelerating its AI roadmap by linking fragmented construction data and automating complex workflows, a key focus as AI driven software competition intensifies.

See our latest analysis for Procore Technologies.

Procore’s shares trade at US$65.64, and despite a 0.97% 1 day share price return, the 30 day share price return of 11.57% and year to date share price return of 6.28% indicate pressure on recent momentum. The 3 year total shareholder return of 14.49% contrasts with a 1 year total shareholder return of 15.84%, suggesting a mixed picture around how the market is weighing growth potential against rising competitive and AI related risks.

If this kind of construction tech story has your attention, it could be worth scanning high growth tech and AI stocks to see which other software names are trying to ride the same AI wave in different ways.

With Procore posting a 1 year total shareholder return of 15.84% alongside a 3 year total return of 14.49%, yet trading below some estimated value markers, the question is whether this recent weakness signals opportunity or whether the market is already pricing in future growth.

Most Popular Narrative: 24.4% Undervalued

Procore Technologies last closed at $65.64, while the most followed narrative pins fair value closer to $86.83. This creates a wide gap that hinges on future earnings power and cash generation.

The ongoing expansion of Procore's product suite and successful cross-selling initiatives, evidenced by the increasing attach rate of financial modules and broader adoption across diverse industry verticals, indicate greater average revenue per customer, higher net retention, and improved durability of revenue growth. Procore's continued penetration into global markets, demonstrated by significant new wins in Japan, UAE, and with multinational firms, is diversifying revenue streams and positioning the company to benefit from increased urbanization and global infrastructure investments, which are expected to be long-term drivers of revenue acceleration.

Curious how this story gets to a higher fair value than today’s price? The narrative focuses on faster revenue growth, rising margins, and a rich future earnings multiple. Want to see how those moving parts combine into that $86.83 estimate using an 8.44% discount rate and specific long term earnings assumptions? Read the full breakdown behind this valuation call.

Result: Fair Value of $86.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still real watchpoints, including heavy North American exposure and tougher construction conditions that could cap revenue growth and squeeze future margin ambitions.

Find out about the key risks to this Procore Technologies narrative.

Another Angle: Revenue Multiple Paints A Richer Picture

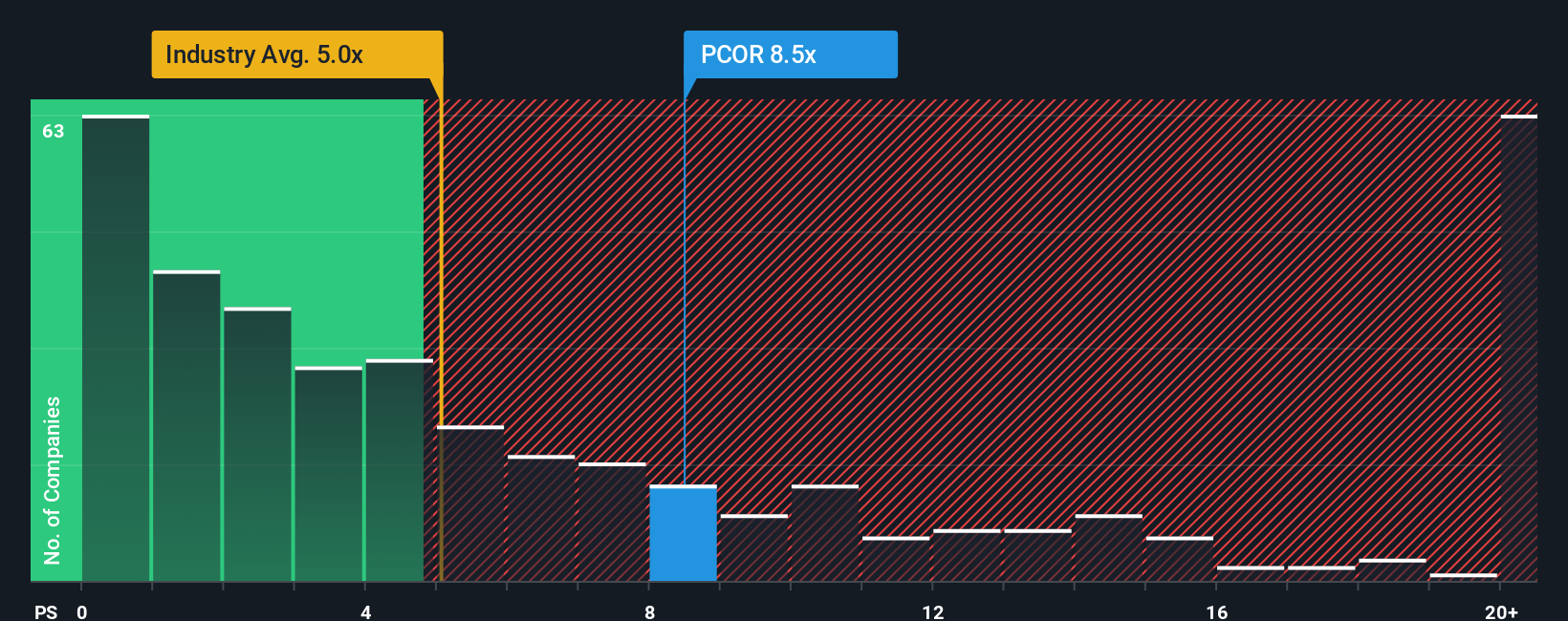

While the narrative and SWS fair value point to Procore as undervalued, the P/S ratio of 8x tells a different story. It is higher than the US Software industry at 4.5x and above the 7x fair ratio the market could move towards, so how much cushion do you really have if sentiment cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Procore Technologies Narrative

If you see the numbers differently or prefer to weigh the assumptions yourself, you can build and stress test your own Procore view in minutes: Do it your way.

A great starting point for your Procore Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Procore has sharpened your focus on quality research, do not stop here. Widen your watchlist with a few focused idea lists built from real data.

- Target cash flow value by checking out these 864 undervalued stocks based on cash flows that screen for businesses trading below what their cash flows might justify.

- Spot early tech trends by scanning these 24 AI penny stocks that group companies tied to artificial intelligence themes.

- Strengthen your income watchlist with these 13 dividend stocks with yields > 3% that focus on payouts above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PCOR

Procore Technologies

Provides a cloud-based construction management platform and related products and services in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

The global leader in cash handling

Wolters Kluwer - A Fundamental and Historical Valuation

METHODE ELECTRONICS (MEI): A Short Circuit or Just a Blown Fuse?

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!