- United States

- /

- Software

- /

- NYSE:PATH

UiPath (NYSE:PATH) Unveils AI Medical Summarization Agent In Collaboration With Google Cloud

Reviewed by Simply Wall St

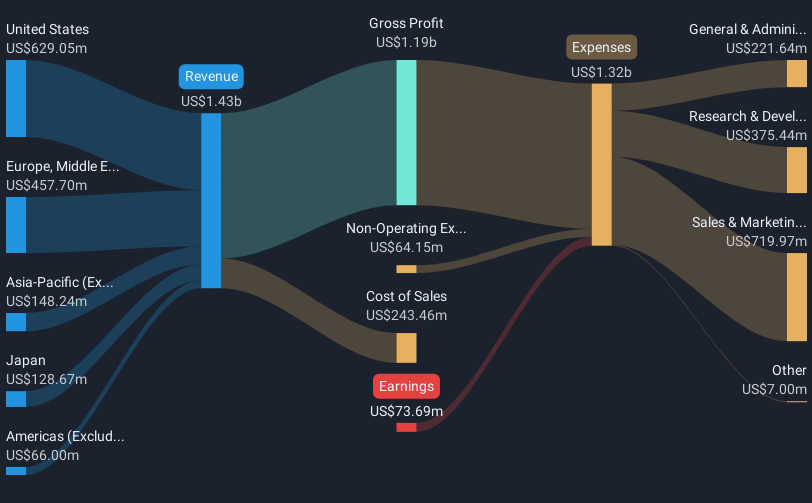

UiPath (NYSE:PATH) recently launched its AI-based Medical Record Summarization Agent at the Google Cloud Next 2025 event, emphasizing efficiency and cost savings in healthcare. Despite these promising advancements, the company's stock saw a price movement of 6% over the last week amidst broader market volatility driven by uncertainty surrounding new U.S. tariffs. While the company's innovative partnerships with Google Cloud could potentially enhance its market positioning, the general market turbulence, marking a 12% decline, has likely exerted downward pressure on UiPath's share price in line with the broader indexes.

The recent unveiling of UiPath's AI-based Medical Record Summarization Agent at Google Cloud Next 2025 potentially strengthens its positioning in the healthcare sector. This innovation may bolster revenue and earnings forecasts as the company continues its trajectory towards deeper customer relationships and market expansion. However, short-term share price volatility—impacted by new U.S. tariffs and market declines—has to be considered in light of the company's long-term total return of a significant 50.20% decline over three years. This, alongside underperformance against the U.S. Software industry in the past year, illustrates the company's protracted challenges.

Despite these headwinds, the analyst consensus indicates optimism with a price target of US$12.42, reflecting a 15.4% potential upside over the current price. This suggests that, if UiPath successfully leverages its innovations and strategic partnerships, it could align its future revenue and earnings closer to expectations. The restructuring and focus on AI-driven products, including the new agent, have the potential to improve operational efficiency, leading to future earnings growth. Nonetheless, for the current fiscal year, analysts are cautious about revenue growth due to geopolitics and FX headwinds, implying that UiPath's ability to meet these forecasts remains an area to watch closely.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PATH

UiPath

Provides an end-to-end automation platform that offers a range of robotic process automation (RPA) solutions primarily in the United States, Romania, the United Kingdom, the Netherlands, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives