- United States

- /

- Software

- /

- NYSE:PATH

UiPath (NYSE:PATH) Expands Global Healthcare Services Through New EMR Agreement With Leading AI Automation

Reviewed by Simply Wall St

Last week, UiPath (NYSE:PATH) secured a new global consulting agreement with an Electronic Medical Records platform, aiming to enhance its professional services in 16 additional countries, including Australia and Germany. Despite this, the company's share price fell by 7.1% over the week. This decline unfolded amidst broader market downturns, with major indices like the Dow Jones and Nasdaq also experiencing declines, attributed in part to disappointing U.S. manufacturing data and inflation concerns. The automation sector is sensitive to such economic indicators, and while UiPath's entry into a broader healthcare market underlines its long-term growth ambitions, immediate investor sentiment was likely swayed by the market's overall apprehension about interest rates and economic stability. As major stocks, including key players in the AI space like Nvidia, succumbed to similar pressures, it's plausible UiPath mirrored broader market sentiment rather than individual company shortcomings.

Take a closer look at UiPath's potential here.

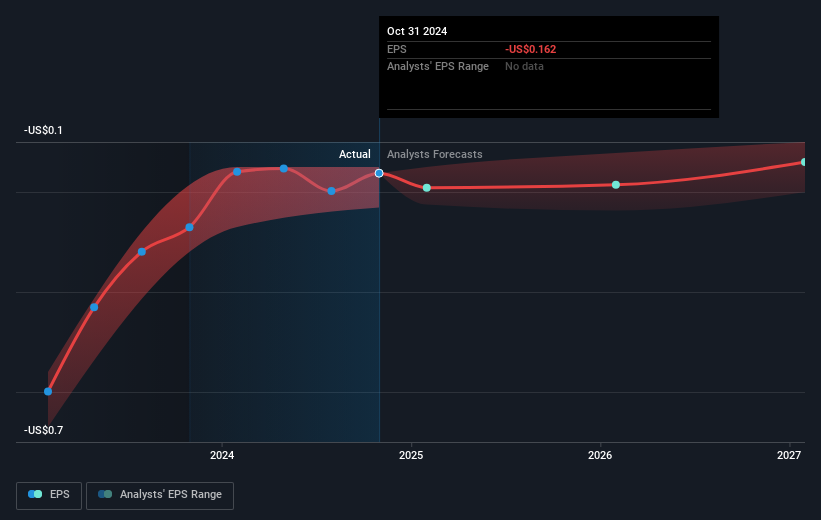

Over the past year, UiPath's total shareholder return, incorporating share price and dividends, was a decline of 48.01%. This performance contrasts sharply with the US Software industry, which returned 4.4%, and the broader US Market, which saw a return of 15.3%. Several pivotal developments potentially influenced this downturn. The company's Q2 earnings report revealed increased revenue to US$316.25 million but a widened net loss of US$86.1 million. Additionally, UiPath's buyback program, completed in December 2024, saw 37.58 million shares repurchased for US$492.02 million, yet it didn't decisively bolster share price.

On the client front, UiPath's partnership with Banco Azteca in October 2024 underscored its push into financial service automation, while Fujitsu's expansion of its UiPath integration aimed to enhance operational efficiencies. Despite these promising collaborations and innovative product enhancements, such as the launch of Generative AI features in July 2024, investor concerns seemed to linger over profitability challenges as UiPath remained unprofitable and underperformed market expectations.

- Discover whether UiPath is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Uncover the uncertainties that could impact UiPath's future growth—read our risk evaluation here.

- Already own UiPath? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PATH

UiPath

Provides an end-to-end automation platform that offers a range of robotic process automation (RPA) solutions primarily in the United States, Romania, the United Kingdom, the Netherlands, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives