- United States

- /

- Software

- /

- NYSE:ORCL

Will Oracle’s (ORCL) AI Healthcare Push Redefine Its Competitive Edge in Cloud Solutions?

Reviewed by Simply Wall St

- In the past week, Oracle and its partners made a series of announcements, including new collaborations to advance AI-driven drug discovery and precision medicine, as well as the launch of AI-powered applications and resources aimed at improving healthcare outcomes and operational efficiency. Notably, DNAnexus announced plans to bring genomic data to select Oracle Health clinical applications, while Absci revealed it will leverage Oracle Cloud Infrastructure and AMD for generative AI drug creation, and Oracle Health outlined a vision for streamlined provider-payer collaboration through AI automation.

- These developments highlight Oracle's increasing integration of artificial intelligence across healthcare solutions, underscoring the company's ongoing push to combine advanced cloud infrastructure with next-generation medical technology and large-scale industry partnerships.

- We'll explore how Oracle's expanded leadership in AI-powered healthcare platforms and cloud client wins impacts its long-term investment case.

Find companies with promising cash flow potential yet trading below their fair value.

Oracle Investment Narrative Recap

To own Oracle shares, investors must believe that accelerating demand for AI-powered cloud infrastructure and enterprise applications will drive multi-year revenue and earnings growth, more than offsetting the risks from heavy capital expenditure and concentrated AI client exposure. The recent wave of healthcare AI collaborations reinforces Oracle’s long-term positioning, but does not materially change the most important short-term catalyst, large-scale cloud contract wins, or the key risk, which remains Oracle’s reliance on sustained, rapid AI workload adoption.

Among the recent news, the agreement with DNAnexus to bring genomic data into Oracle Health’s clinical applications stands out. This move enhances Oracle’s precision medicine capabilities and underlines the tangible client interest in Oracle’s AI offerings. It directly ties to the company’s cloud adoption catalyst, demonstrating how Oracle’s differentiated technology is being embedded deeper into mission-critical industries.

By contrast, there’s information investors should be aware of about Oracle’s dependence on several large AI clients for future growth, which could...

Read the full narrative on Oracle (it's free!)

Oracle's outlook projects $99.5 billion in revenue and $25.3 billion in earnings by 2028. This requires 20.1% annual revenue growth and a $12.9 billion increase in earnings from the current level of $12.4 billion.

Uncover how Oracle's forecasts yield a $253.13 fair value, a 13% downside to its current price.

Exploring Other Perspectives

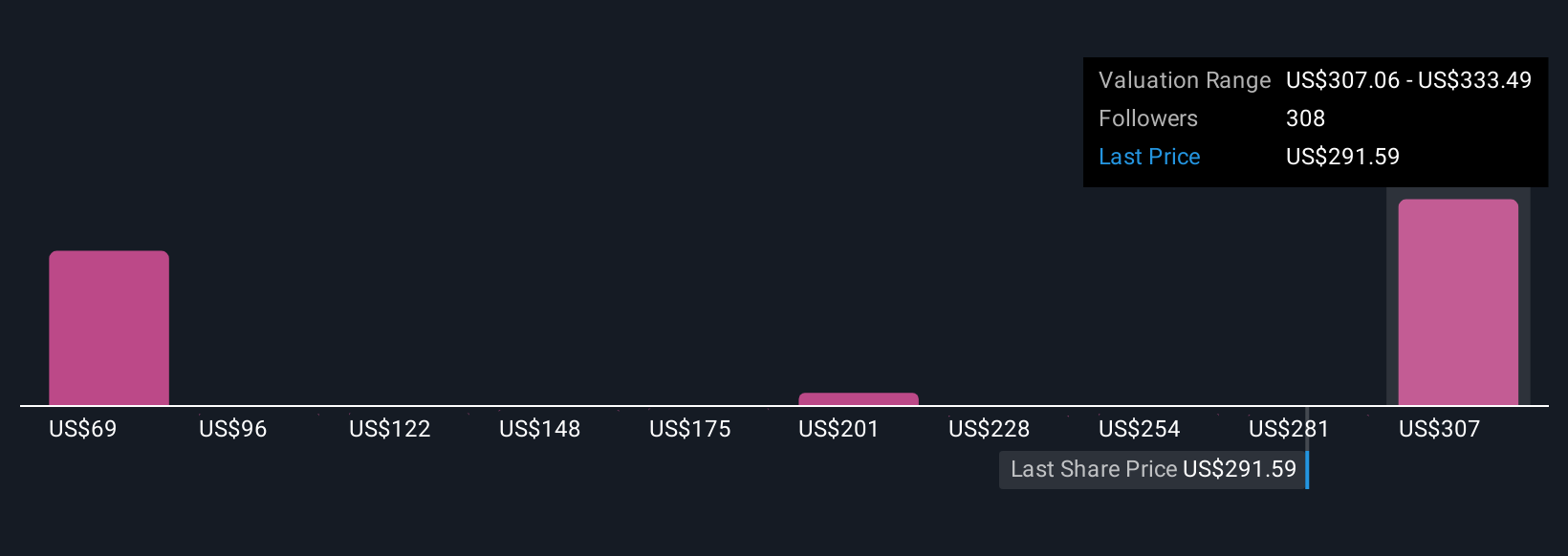

The Simply Wall St Community’s 26 fair value estimates for Oracle range from US$150 to US$485, with opinions spanning the full spectrum. With Oracle’s cloud infrastructure growth driven by concentrated AI demand, these differing viewpoints show just how widely investor expectations can vary.

Explore 26 other fair value estimates on Oracle - why the stock might be worth 49% less than the current price!

Build Your Own Oracle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oracle research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Oracle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oracle's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)