- United States

- /

- Software

- /

- NYSE:ORCL

Oracle (ORCL) Is Up 5.4% After AI Suite Launch and Chip Partnerships at AI World Conference

Reviewed by Sasha Jovanovic

- Oracle unveiled extensive new AI-powered product suites, infrastructure partnerships, and client wins at its AI World conference, including major agreements with AMD and Nvidia for next-generation chips and the launch of advanced enterprise AI capabilities across cloud, database, and applications.

- A unique aspect of these announcements is Oracle's move to embed AI agents and in-database intelligence into its core platforms, signaling an effort to differentiate through integrated, enterprise-ready AI solutions and multi-cloud flexibility.

- We’ll examine how Oracle’s comprehensive launch of AI-native products and infrastructure partnerships impacts its investment narrative and future growth outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Oracle Investment Narrative Recap

To own shares of Oracle today, an investor needs to believe that surging demand for AI-powered cloud infrastructure will continue to drive exceptional top-line growth, offsetting concerns about the company’s heavy capital expenditure and reliance on a handful of marquee customers. While Oracle’s massive new partnership with AMD to deploy 50,000 advanced GPUs underscores its commitment to scaling for future AI workloads, this news does not materially reduce the pivotal short-term risk around the company’s ability to profitably utilize its newly built data center capacity given ongoing CapEx pressures.

Among the recent announcements, the launch of the Oracle Cloud Infrastructure (OCI) A4 compute shapes stands out as particularly relevant. Optimized for AI inference and built on AmpereOne M processors, these new compute instances further Oracle’s push to differentiate in enterprise AI, but their eventual impact depends on sustained customer adoption, especially as competition from hyperscale rivals intensifies around similar offerings.

But as Oracle’s growth ambitions accelerate, investors should be aware of ...

Read the full narrative on Oracle (it's free!)

Oracle’s current analysis projects $99.5 billion in revenue and $25.3 billion in earnings by 2028. Achieving these targets implies 20.1% annual revenue growth and a $12.9 billion increase in earnings from the current level of $12.4 billion.

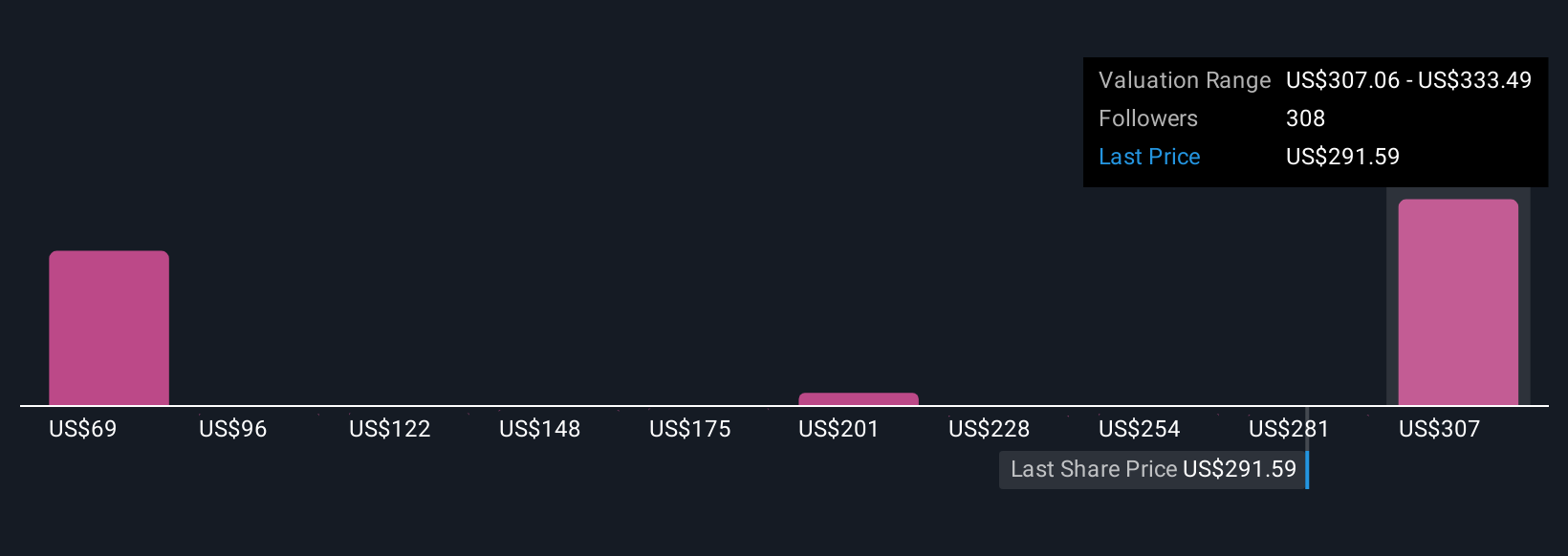

Uncover how Oracle's forecasts yield a $333.49 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Twenty-six fair value estimates from the Simply Wall St Community range from US$161.98 to US$333.93 per share. These views span well below to above current prices, while Oracle’s reliance on massive AI infrastructure demand remains a key factor shaping future performance expectations.

Explore 26 other fair value estimates on Oracle - why the stock might be worth 48% less than the current price!

Build Your Own Oracle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oracle research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Oracle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oracle's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)