- United States

- /

- Software

- /

- NYSE:ORCL

Oracle (NYSE:ORCL) Secures Major U.S. Government Contracts Expanding Cloud Capabilities

Reviewed by Simply Wall St

Oracle (NYSE:ORCL) saw its share price climb 6% last week following several significant client announcements. The USDA's selection of Oracle Cloud for its STRATUS program and the integration of Pop Menu solutions with Oracle Simphony POS highlight Oracle's growing influence in the cloud services sector. Additionally, Oracle's collaboration with the U.S. Department of Defense under a firm-fixed price task order emphasizes its expanding footprint in defense and federal sectors. These events, amidst a market rise driven by tech stocks and geopolitical stability, provided additional momentum to Oracle's price movement, aligning with broader market gains.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Oracle's recent client announcements, including collaborations with the USDA and the Department of Defense, bolster its narrative of expanding influence in cloud services and defense sectors. Over the past five years, Oracle has delivered a total shareholder return of 168.94%, showcasing robust long-term performance. This contrasts with a significant industry underperformance in the past year, as Oracle's earnings growth of 14.3% outpaced the US software industry's 1.5% rise. However, its annual earnings increase did not match the industry's previous 25.4% surge.

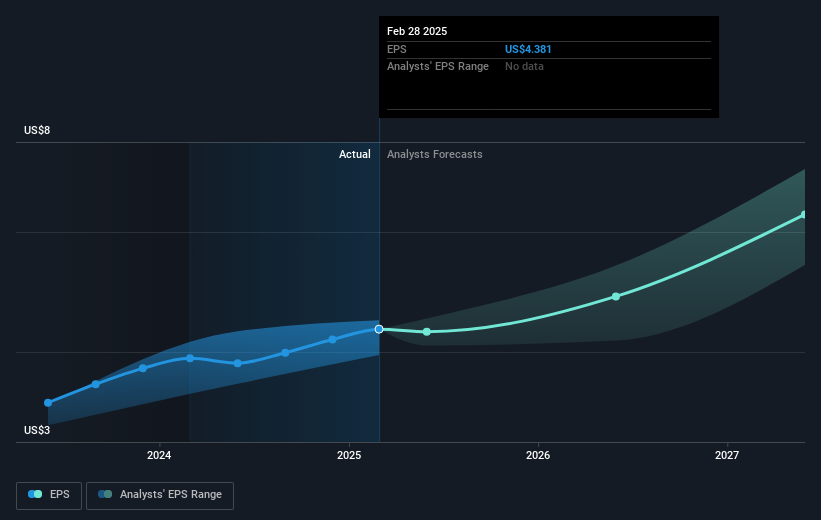

The recent news aligns with Oracle's strategic focus on cloud capacity and partnerships, potentially boosting revenue and earnings forecasts. Expectations of a 16.0% annual revenue growth over the next three years and earnings hitting $19.5 billion by 2028 underpin this positive outlook. Despite component delays impacting growth, analysts' consensus price target of US$184.41 implies a 32.5% upside from the current share price of US$124.5, suggesting market optimism about Oracle's growth prospects and improved profit margins. The ongoing cloud partnerships with AWS, Google, and Azure further support these optimistic forecasts, contributing to substantial database migration and revenue increases.

Review our historical performance report to gain insights into Oracle's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)