- United States

- /

- Software

- /

- NYSE:ORCL

Oracle (NYSE:ORCL) Reports Q3 Revenue of US$14 Billion and Increases Dividend by 25% to US$0.50 Per Share

Reviewed by Simply Wall St

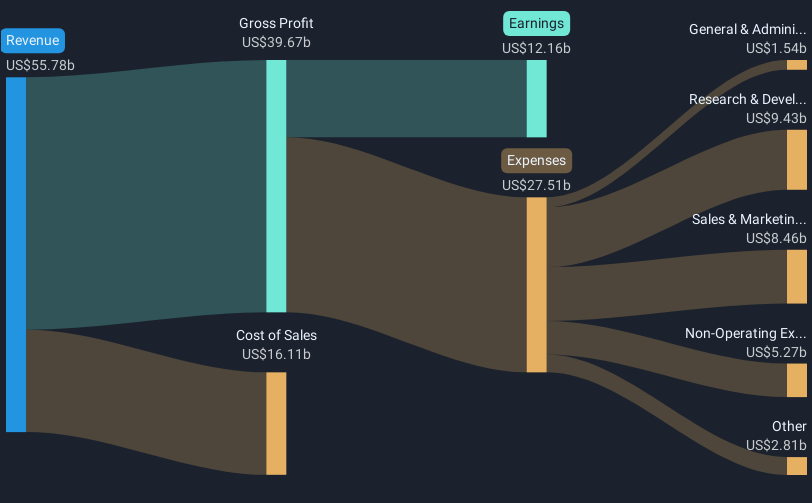

Oracle (NYSE:ORCL) recently announced strong financial growth for its third quarter of 2025, reporting increased revenues and net income alongside a significant 25% dividend hike. Despite these positive developments, Oracle's stock experienced a price drop of 8% over the past week. This decline coincided with broader market movements, including trade uncertainties spurred by heightened tariffs on Canadian imports announced by the Trump administration, which contributed to market volatility. The Dow Jones and S&P 500 both saw declines of 1.2% and 0.8%, respectively, while the tech-heavy Nasdaq fell 0.3%. In this bearish climate, technology stocks have generally faced pressure, contributing to Oracle's recent performance. As markets remain sensitive to economic indicators and geopolitical tensions, Oracle's stock movement reflects the intertwined nature of corporate performance with external market forces.

Click here and access our complete analysis report to understand the dynamics of Oracle.

Oracle's total shareholder returns reached 275.48% over the last five years, showcasing remarkable long-term growth. This substantial increase was accompanied by continual revenue and profit growth, illustrated by the 2023 earnings reports where annual revenue climbed to US$49.95 billion and net income to US$8.50 billion. Coupled with frequent dividend hikes, such as the 25% increase in March 2023, these metrics reflect Oracle's sustained shareholder value creation.

The company's innovative advancements also played a part in its performance. Collaborations with tech giants like Microsoft and Google Cloud, alongside product offerings such as the AI-Integrated Oracle Fusion Cloud SCM, exemplify its proactive approach in adapting to market needs. Notably, over the past year, Oracle's stock returns surpassed those of the US Market and the US Software industry, further reinforcing its competitive position despite a high debt load and an expensive Price-To-Earnings Ratio compared to industry peers.

- Learn how Oracle's intrinsic value compares to its market price with our detailed valuation report.

- Explore the potential challenges for Oracle in our thorough risk analysis report.

- Already own Oracle? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives