- United States

- /

- Software

- /

- NYSE:ORCL

Oracle (NYSE:ORCL) Powers Lyntia Networks' Expansion With Advanced Cloud Solutions

Reviewed by Simply Wall St

Oracle (NYSE:ORCL) saw a 10% price increase over the last month, buoyed by key client announcements from Lyntia Networks, which is harnessing Oracle's solutions to propel growth in the connectivity sector. This aligns with other recent Oracle partnerships and product advancements, such as the collaboration with Chicago Public Schools and Red Hat, enhancing their cloud solutions. These initiatives likely reinforced investor confidence against a backdrop where major indices like the S&P 500 also posted strong monthly performances, indicating investor optimism. Despite broader market fluctuations, Oracle's innovations and partnerships provided substantial positive sentiment for the stock.

We've spotted 1 warning sign for Oracle you should be aware of.

The recent collaboration news has bolstered Oracle's share performance, complementing its strategic move in the cloud sector. The company's partnerships with Lyntia Networks and enhancements with Chicago Public Schools and Red Hat highlight its focus on expanding cloud solutions, which aligns with its broader narrative. Over the past five years, Oracle's total shareholder return, encompassing both share price appreciation and dividends, has been a very large 223.50%, showcasing notable long-term investor confidence. Over the last year, Oracle's performance exceeded major indices like the S&P 500 and outpaced the US Software industry, which posted a 23.4% gain, signaling its competitiveness and market standing.

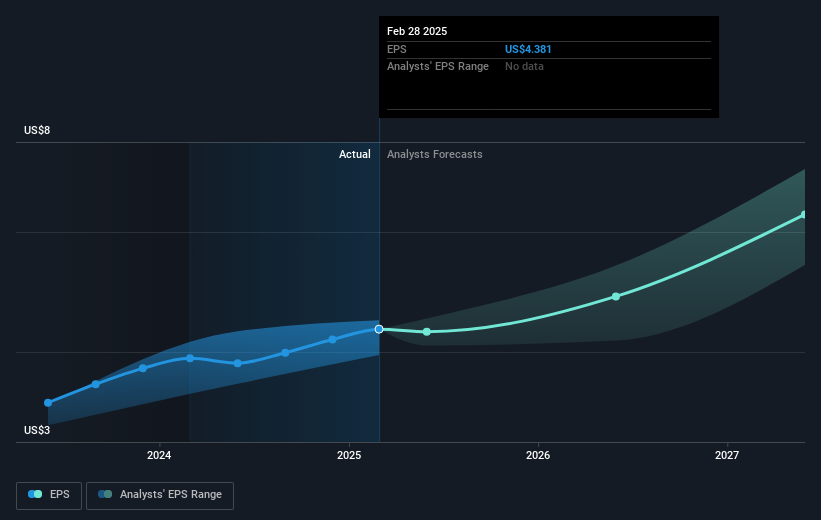

The bump in share price due to the recent news also provides context to Oracle's revenue and earnings forecasts. Oracle is expected to maintain a 15.8% annual revenue growth over the next three years, driven by its expansion in cloud partnerships with AWS, Google, and Azure. This positive sentiment around its cloud strategy translates to increased earnings projections, with expectations of earnings reaching $19.5 billion by 2028. Given the current share price of $147.7, this potential aligns with the consensus analyst price target of US$178.12, suggesting a 17.1% upside. The ongoing enhancements and partnerships could further strengthen these financial forecasts, reinforcing Oracle's market position.

Evaluate Oracle's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)