- United States

- /

- Software

- /

- NYSE:ORCL

Oracle (NYSE:ORCL) Launches AI Centre Of Excellence In Singapore To Drive AI Adoption Across Southeast Asia

Reviewed by Simply Wall St

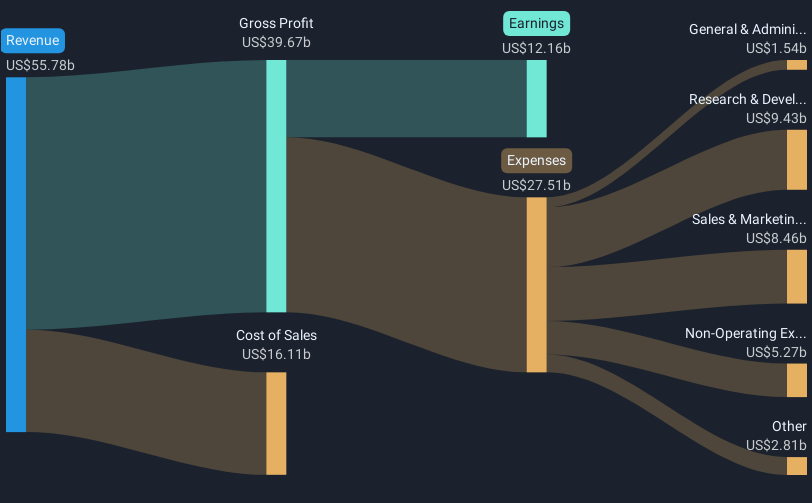

Oracle (NYSE:ORCL) launched its AI Centre of Excellence in Singapore last week, aiming to bolster AI adoption across Southeast Asia. Despite this development, Oracle's shares experienced a 2% decline over the same period. The market saw a tech sector rally, with companies like Nvidia and Palantir posting significant gains, reflecting investor confidence in tech stocks following a general market rebound. The broader market, however, was volatile, with the S&P 500 dropping and then partially recovering from steep losses driven by economic uncertainties. This environment might have overshadowed Oracle's positive earnings report where revenue and net income showed year-over-year growth, along with a substantial dividend increase. Despite these fundamentals, Oracle's stock price movement may have been influenced more by broader market sentiment rather than the company's specific developments. The divergent trends between Oracle's performance and overall market gains highlight the complexity of market conditions amidst global economic uncertainties.

In the last five years, Oracle Corporation achieved a total shareholder return of 253.20%, reflecting a combination of share price appreciation and dividends. This period saw Oracle foster innovation and expand its global presence. Notable developments included the launch of Oracle's Enterprise Communications Platform in February 2024, which enhanced connectivity across IoT devices, and a significant partnership with NVIDIA in March 2024 to deliver AI solutions. Furthermore, Oracle has engaged in sound financial management, marked by steady increases in dividends, such as the recent rise to $0.50 per share announced in March 2025.

Despite these achievements, Oracle's earnings had a slow recovery over the five-year period, initially showing a 0.9% annual decline before pivoting to an impressive 14.3% growth recently. This growth outpaced the US Software industry's 4.3% return, underscoring Oracle's resilience. Additionally, cost-efficient product innovations like Oracle Cloud Infrastructure AI services introduced in July 2022, played a vital role in maintaining its competitive edge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives