- United States

- /

- Software

- /

- NYSE:ORCL

Oracle (NYSE:ORCL) Expands Cloud Capabilities with AI Partnerships and Advanced GPU Technology

Reviewed by Simply Wall St

Recent announcements from Oracle (NYSE:ORCL) underscore its collaboration with TakeUp, Seekr, and AMD to enhance AI capabilities and performance. These developments may have contributed to Oracle's impressive 34% price increase over the last quarter. The stock's robust performance contrasts with a turbulent market where geopolitical tensions shook global markets, yet Oracle managed to buck the trend, likely benefiting from strong earnings and strategic cloud partnerships. While the broader market faced fluctuations due to geopolitical tensions, technological advancements and substantial revenue growth appear to have reinforced Oracle's upward trajectory.

You should learn about the 1 risk we've spotted with Oracle.

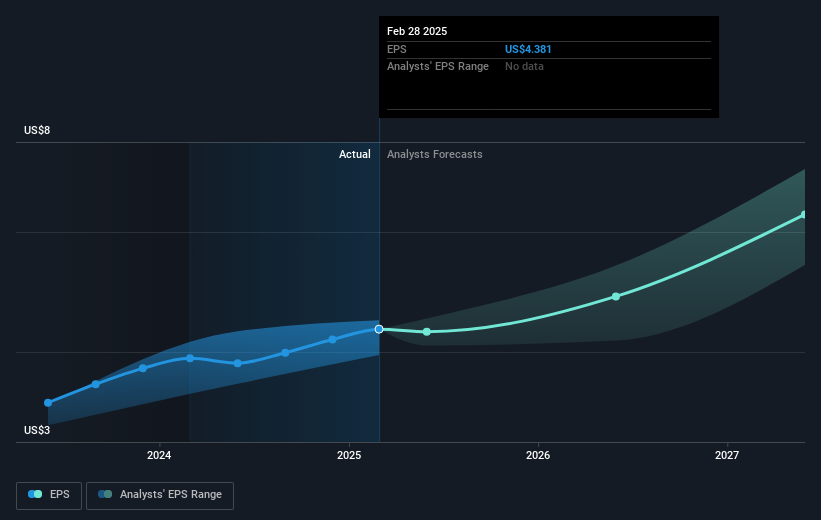

Oracle's recent collaborations with TakeUp, Seekr, and AMD highlight its commitment to enhancing AI capabilities, potentially providing a substantial boost to its revenue and earnings forecasts. These partnerships align with Oracle's strategic multi-cloud expansions with AWS, Google, and Azure, aiming to accelerate its cloud services growth. As analysts forecast annual revenue growth of 15.8% and an earnings rise to US$19.5 billion by 2028, these initiatives could reinforce Oracle's upward trajectory in the tech sector. The strong demand for AI and cloud capabilities may further drive Oracle's future performance, supporting its long-term growth narrative.

Over the last five years, Oracle's total shareholder return, incorporating share price and dividends, was over 300%, a testament to its resilience and successful execution of growth strategies. In the past year alone, Oracle outperformed the US market, which saw an 11.7% increase, and exceeded the US Software industry's return of 20.9%. Although the current share price of US$147.7 has surged, it remains below analysts' consensus price target of US$178.12, indicating room for potential appreciation. With the analysts suggesting this target is 17.1% higher than today's price, Oracle's shares appear to hold further growth potential.

Examine Oracle's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)