- United States

- /

- Software

- /

- NYSE:ORCL

Oracle (NYSE:ORCL) Enhances Cloud Capabilities With Hammerspace Solution On Oracle Cloud Marketplace

Reviewed by Simply Wall St

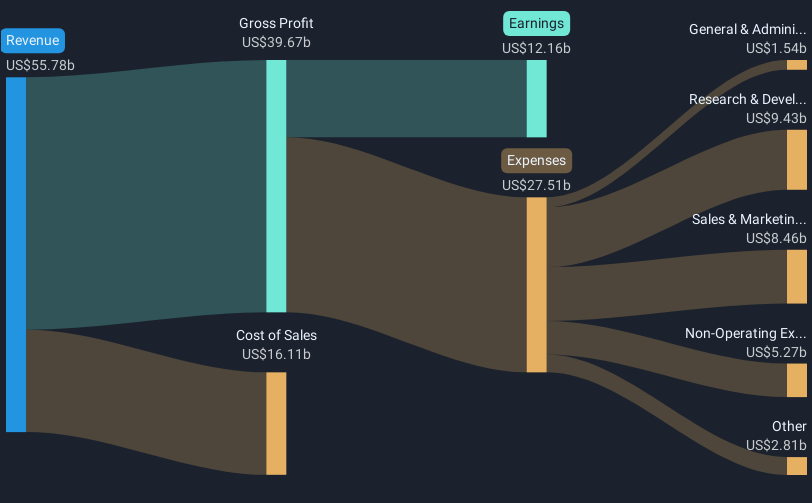

Oracle (NYSE:ORCL) recently experienced a 39% increase in its stock price over the last quarter. This surge can be associated with several significant announcements. A key development was the availability of the Hammerspace Solution on the Oracle Cloud Marketplace, enabling enhanced access to GPU resources and potentially catalyzing increased demand for Oracle's cloud services. Additionally, Oracle reported strong earnings for Q4 2025, with revenue and net income both rising year-over-year, possibly solidifying market confidence. These company-specific advancements complemented the general market performance, which remained stable amidst geopolitical tensions and varied stock performances.

We've identified 1 weakness for Oracle that you should be aware of.

Oracle's substantial 39% stock price increase over the last quarter underscores the market's positive reception to pivotal announcements, such as the integration of Hammerspace Solution in the Oracle Cloud Marketplace. This enhances access to GPU resources, potentially boosting demand for Oracle's cloud services. Over a five-year period, Oracle achieved an exceptional total return of 319.11%, marking significant long-term gains. These developments imply potential for enhanced revenue and earnings growth, as the company continues to expand its cloud capabilities and partnerships, which could drive demand for its services.

In terms of performance, Oracle's earnings grew by 18.9% over the past year, surpassing both the US Software industry and overall market returns, which stood at 17.7% and 10.4%, respectively. The firm's cloud region expansion and escalating power capacity are expected to sustain this growth trajectory, coupled with strategic partnerships with AWS, Google, and Azure.

The recent share price move places Oracle on the path toward the analysts' consensus price target of US$178.12, which is 17.1% above its current price of US$147.7. However, the forecast also carries risks, such as potential delays in cloud expansion and currency volatility, which may impact future earnings and revenue projections. Oracle's anticipated revenue growth rate of 14% per year aligns closely with market forecasts, while its earnings are projected to reach US$19.5 billion by 2028, reflecting an upward trend buoyed by robust demand for AI and cloud solutions.

Understand Oracle's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)