- United States

- /

- Software

- /

- NYSE:ORCL

Oracle (NYSE:ORCL) Advances AI Cloud Infrastructure And Defense Innovations With New Partnerships

Reviewed by Simply Wall St

Recent developments at Oracle (NYSE:ORCL) underscore the company’s robust focus on cloud infrastructure and AI, highlighted by partnerships with AI innovators and the introduction of its Oracle Compute Cloud@Customer Isolated service. Oracle's recent 37% rise in share price over the last quarter coincides with such announcements. Although global markets displayed volatility due to geopolitical tensions, Oracle's price movement is aligned with broader tech stock trends, bolstered by strong earnings and strategic client acquisitions. These factors could have reinforced Oracle’s market position amidst a generally stable market, adding to the positive sentiment.

Every company has risks, and we've spotted 1 possible red flag for Oracle you should know about.

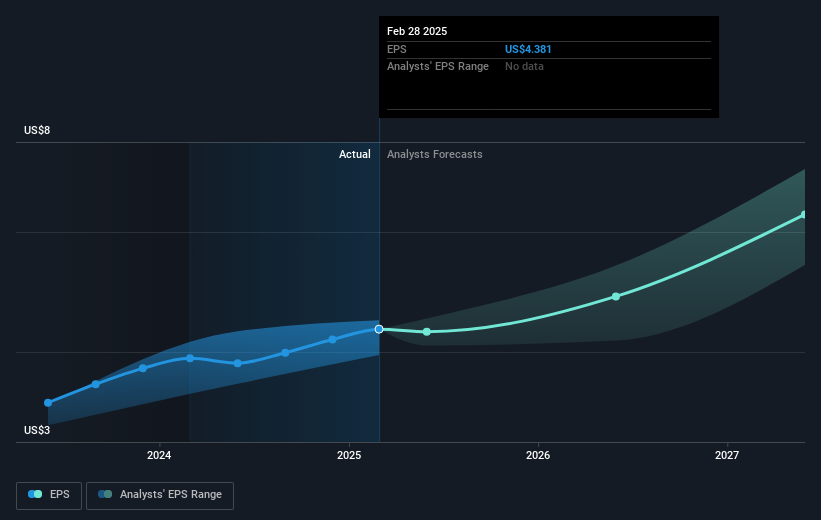

The recent developments at Oracle, centered around its advanced cloud infrastructure and AI collaborations, suggest potential for robust future revenue and earnings growth. These initiatives are aimed at capturing the escalating demand for AI-driven solutions and enhancing cloud capabilities. The strategic partnerships with AWS, Google, and Azure are particularly instrumental in accelerating database migration and expanding Oracle's cloud footprint, contributing to its long-term growth narrative. The forecasted increase in Oracle’s power capacity and rise in performance obligations reinforces expectations for continued revenue acceleration, which aligns with analysts' projected annual revenue growth of 15.8% over the next three years.

Oracle's shares have exhibited a long-term growth trajectory, with a total return of over 300% over five years, highlighting substantial shareholder value creation. Comparatively, Oracle outperformed both the broader market and the US Software industry over the past year, where the latter achieved an 18.6% return. This sustained performance reflects Oracle's ability to maintain growth momentum despite market challenges, further supported by its strategic initiatives and expanding market penetration.

The recent 37% share price increase over the last quarter may signal positive sentiment around these announcements and Oracle's strategic direction. However, the share price currently sits at US$147.70, indicating a discount to the consensus analyst price target of US$178.12, suggesting potential market confidence in further upside. These elements, along with the projected increase in earnings to US$19.5 billion by 2028, underpin the company's valuation discussions in the market. Nevertheless, Oracle's execution risks such as cloud capacity delays and currency volatility must be acknowledged as potential headwinds for achieving these forecasts.

Review our growth performance report to gain insights into Oracle's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORCL

Oracle

Offers products and services that address enterprise information technology environments worldwide.

Exceptional growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)