- United States

- /

- IT

- /

- NYSE:NET

3 US Growth Companies With High Insider Ownership Expecting Up To 33% Earnings Growth

Reviewed by Simply Wall St

As major U.S. stock indexes hover near record highs, driven by a rally in chipmakers and robust earnings reports, investors are keenly observing companies with strong growth potential and significant insider ownership. In this environment, stocks that combine expected earnings growth with high insider stakes can be particularly appealing, as they may indicate confidence from those closest to the company's operations.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.2% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Clene (NasdaqCM:CLNN) | 21.6% | 59.1% |

| BBB Foods (NYSE:TBBB) | 22.9% | 40.4% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 33.8% |

| Ultralife (NasdaqGM:ULBI) | 36% | 43.8% |

| Myomo (NYSEAM:MYO) | 12.7% | 56.7% |

| Duos Technologies Group (NasdaqCM:DUOT) | 39.4% | 90.4% |

Here we highlight a subset of our preferred stocks from the screener.

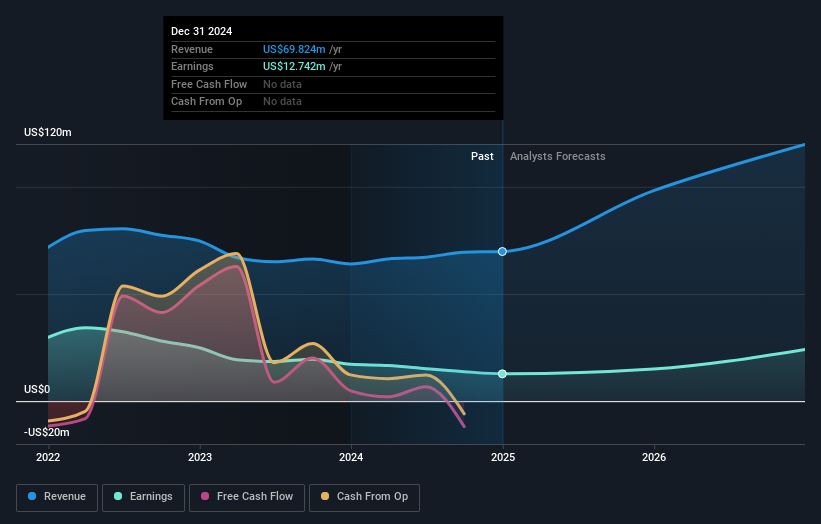

FinWise Bancorp (NasdaqGM:FINW)

Simply Wall St Growth Rating: ★★★★★☆

Overview: FinWise Bancorp is the bank holding company for FinWise Bank, offering a range of banking products and services to individual and corporate customers in Utah, with a market cap of $260.13 million.

Operations: The company generates its revenue primarily from its banking segment, which amounts to $69.82 million.

Insider Ownership: 32.2%

Earnings Growth Forecast: 33% p.a.

FinWise Bancorp is trading significantly below its estimated fair value, suggesting potential undervaluation. Despite a decline in net income and profit margins in the latest earnings report, the company is expected to experience substantial annual earnings growth of 33%, outpacing the broader US market. However, challenges include a high level of non-performing loans at 6.6%. No recent insider trading activity has been reported, indicating stability among key stakeholders.

- Click to explore a detailed breakdown of our findings in FinWise Bancorp's earnings growth report.

- In light of our recent valuation report, it seems possible that FinWise Bancorp is trading behind its estimated value.

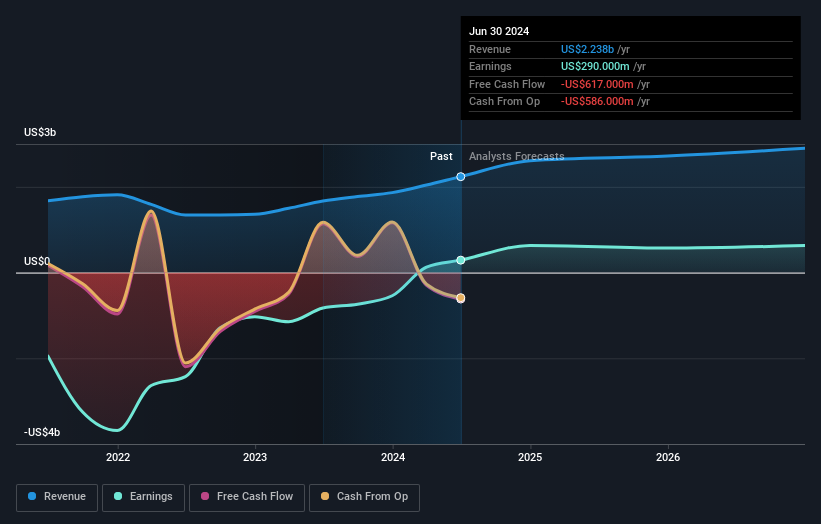

Robinhood Markets (NasdaqGS:HOOD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Robinhood Markets, Inc. operates a financial services platform in the United States and has a market cap of approximately $46.48 billion.

Operations: The company's revenue primarily comes from its brokerage segment, which generated $2.41 billion.

Insider Ownership: 14.1%

Earnings Growth Forecast: 24% p.a.

Robinhood Markets has demonstrated substantial insider ownership with no significant insider selling recently. The company achieved profitability this year, and its earnings are forecast to grow significantly at 24% annually, outpacing the US market. Revenue growth is expected to be 14.8% per year, faster than the broader US market but below high-growth benchmarks. Recent strategic moves include acquisitions of Bitstamp and TradePMR, aiming to enhance shareholder value through complementary business integration and product innovation.

- Unlock comprehensive insights into our analysis of Robinhood Markets stock in this growth report.

- According our valuation report, there's an indication that Robinhood Markets' share price might be on the expensive side.

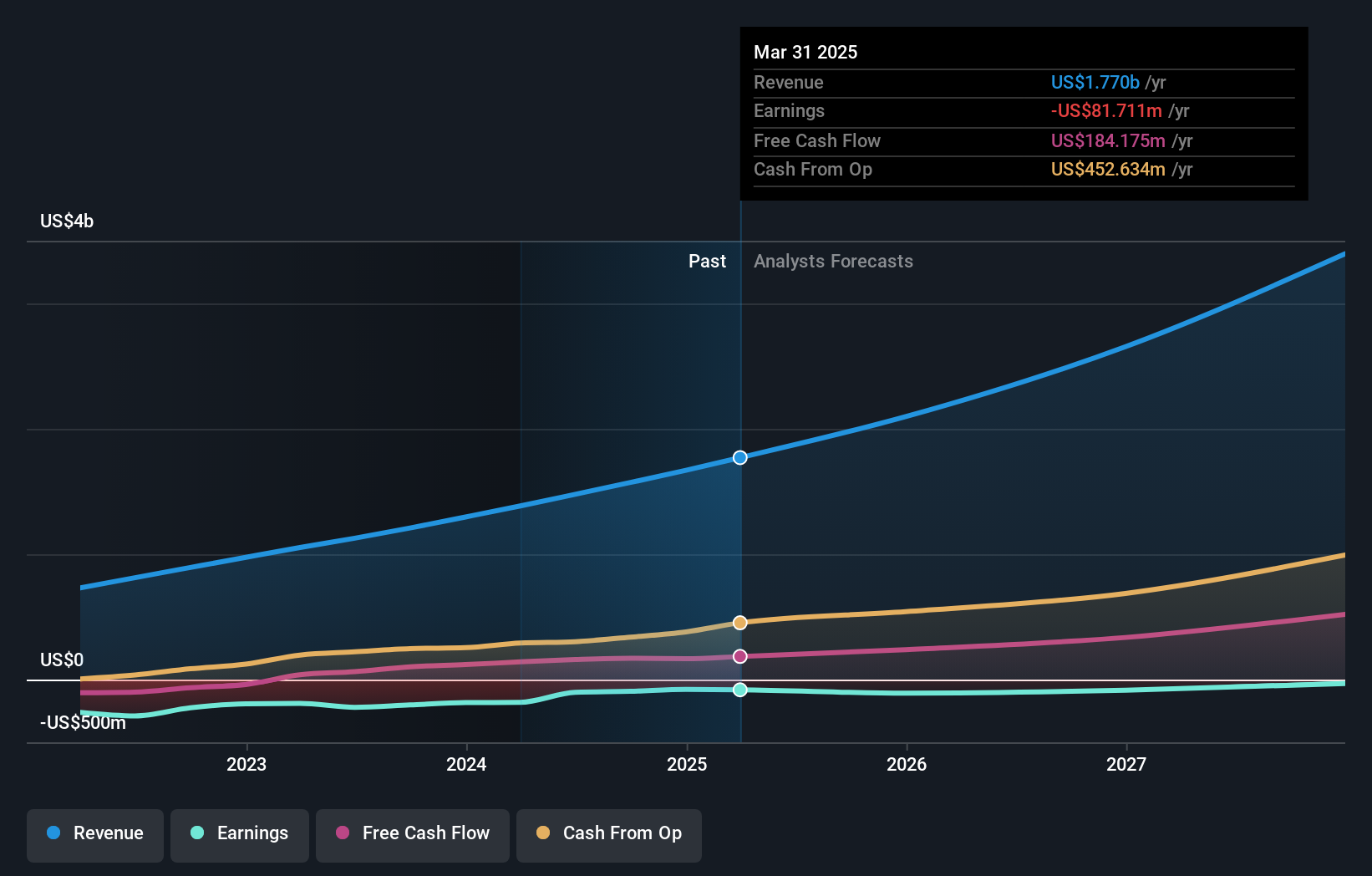

Cloudflare (NYSE:NET)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cloudflare, Inc. is a cloud services provider offering a variety of services to businesses globally, with a market cap of approximately $48.10 billion.

Operations: Cloudflare's revenue segment includes Internet Telephone services, generating approximately $1.57 billion.

Insider Ownership: 11%

Earnings Growth Forecast: 32.2% p.a.

Cloudflare has demonstrated strong growth potential with revenue forecasted to grow at 18.4% annually, surpassing the US market average. Despite significant insider selling recently, the company is expected to achieve profitability within three years, indicating above-average market growth prospects. Recent initiatives like integrating Content Credentials into its network highlight Cloudflare's focus on innovation and content authenticity, potentially enhancing its competitive edge in digital security and media verification sectors.

- Click here and access our complete growth analysis report to understand the dynamics of Cloudflare.

- The valuation report we've compiled suggests that Cloudflare's current price could be inflated.

Key Takeaways

- Gain an insight into the universe of 205 Fast Growing US Companies With High Insider Ownership by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NET

Cloudflare

Operates as a cloud services provider that delivers a range of services to businesses worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives