- United States

- /

- Software

- /

- NYSE:IOT

Samsara (NYSE:IOT) Price Dips 12% Amid U.S. Tariff Concerns

Reviewed by Simply Wall St

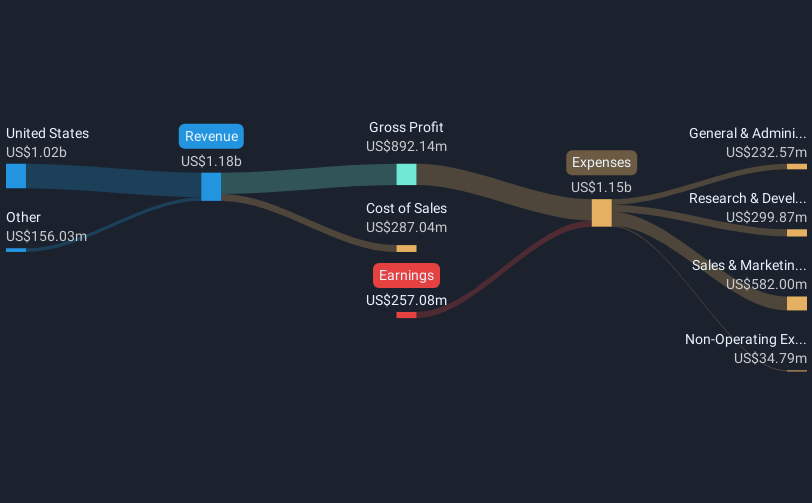

Samsara (NYSE:IOT) experienced a price decline of 12% over the past week, coinciding with a market environment characterized by uncertainty stemming from potential tariff changes and mixed economic news. The broader market, which saw a 3% decline during the same period, was influenced by investors reacting to new import tariffs imposed by the U.S., such as the heightened concerns of economic stability and the mixed results reflecting crowd sentiment. While major stock indexes wavered, with the Dow Jones slightly up, Samsara's performance stood out as it significantly underperformed. External factors such as weak payroll numbers contrast with strong factory order figures, further muddying the investment landscape. Although the company's share price faced challenges, broader factors like geopolitical developments and fluctuating investor confidence largely influenced these broader market dynamics, suggesting that Samsara's performance may not have been solely dictated by isolated company events.

Click here and access our complete analysis report to understand the dynamics of Samsara.

Despite recent share price challenges, Samsara (NYSE:IOT) has posted a total return of 172.42% over the last three years. This remarkable growth can be partly attributed to its robust revenue increases, notably with sales reaching US$652.55 million in FY 2022, up from US$428.35 million the previous year. The company's introduction of innovative products, such as the AI-driven Samsara Intelligence suite launched in December 2024, has also greatly contributed to its market position and long-term performance.

Furthermore, Samsara's strategic partnerships and expansions have bolstered its presence in key regions. In early 2025, the integration with European vehicle telematics provider Mobilisights enabled significant advancements for fleet operators. Additionally, the company addressed growing demands by opening a new office in Mexico City in April 2024, catering to local trucking companies. Such initiatives reflect Samsara's commitment to expanding its footprint and enhancing operational efficiencies, which have resonated positively with investors over the three-year timeframe.

- Get the full picture of Samsara's valuation metrics and investment prospects—click to explore.

- Explore the potential challenges for Samsara in our thorough risk analysis report.

- Got skin in the game with Samsara? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IOT

Samsara

Provides solutions that connects physical operations data to its connected operations cloud in the United States and internationally.

Flawless balance sheet and fair value.