- United States

- /

- Software

- /

- NYSE:IOT

Samsara (NYSE:IOT) Partners With Hyundai Translead For Advanced Trailer Monitoring Across North America

Reviewed by Simply Wall St

Samsara (NYSE:IOT) recently announced a partnership with Hyundai Translead to enhance North American fleet safety and operations, yet its stock was down 25% over the last quarter. This drop coincided with broader market volatility, where investor concerns over new tariffs impacted stocks industry-wide, including automakers and tech sectors linked to Samsara's ventures. Despite Samsara's revenue growth and narrowed net loss, the wider economic uncertainty, exacerbated by tariff fears, influenced its market performance. The market, reflected by the Dow Jones and Nasdaq, also faced declines as economic sentiment wavered. Amidst these market pressures, Samsara's strategic advancements in fleet management and vehicle monitoring likely increased its long-term potential, though they were overshadowed by short-term market dynamics. Overall, while Samsara's strategic moves counter broader market challenges, fluctuations in investor sentiment driven by external economic influences held significant sway over its quarterly stock performance.

Click here and access our complete analysis report to understand the dynamics of Samsara.

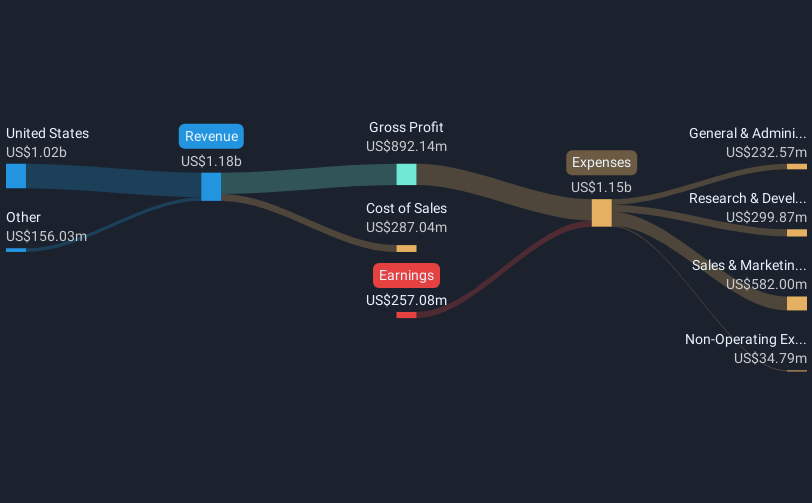

Over the past three years, Samsara (NYSE:IOT) achieved a total shareholder return of 143.46%, a significant performance that highlights its growth trajectory. Despite remaining unprofitable, Samsara consistently reduced its net loss, as evidenced by the net loss improvement from $286.73 million to $154.91 million by the year ending March 2025. Revenue surged notably from $937.39 million to $1.25 billion during the same period, reflecting the company's robust growth initiatives.

Several key developments bolstered Samsara's long-term appeal. Partnerships with major clients like USIC and Hyundai Translead enhanced its market position and broadened its service capabilities. The launch of the Samsara Intelligence suite in March 2025 marked a substantial step in leveraging AI to improve operational efficiency. However, over the past year, Samsara's returns fell short compared to the US software industry and the broader market, illustrating the impact of prevailing economic conditions and market sentiment on its recent performance.

- See whether Samsara's current market price aligns with its intrinsic value in our detailed report

- Discover the key vulnerabilities in Samsara's business with our detailed risk assessment.

- Is Samsara part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IOT

Samsara

Provides solutions that connects physical operations data to its connected operations cloud in the United States and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives