- United States

- /

- IT

- /

- NYSE:IBM

International Business Machines (NYSE:IBM) Reports Q1 Revenue Growth But Decline In Net Income

Reviewed by Simply Wall St

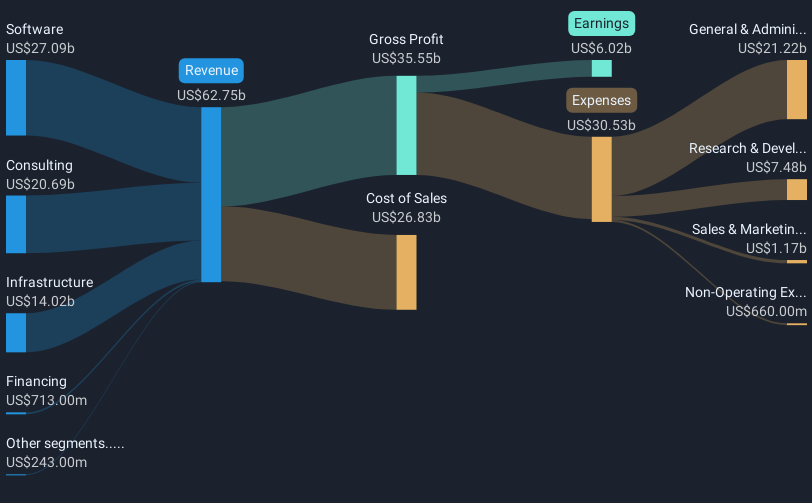

International Business Machines (NYSE:IBM) experienced a share price increase of 8.60% over the last quarter, against the backdrop of the company's announcement of its Q1 2025 earnings. The earnings revealed a modest revenue increase of 0.55%, but a significant decline in net income and EPS, which some might have seen as a signal of challenges in maintaining profitability. The market, buoyed by a general upswing in major indices, saw the Dow Jones and Nasdaq rise notably, suggesting optimism stemming from broader economic conditions. IBM's various initiatives, including efforts in quantum computing and partnerships, may have provided additional weight to these broader market movements.

You should learn about the 4 weaknesses we've spotted with International Business Machines.

The recent uptick in IBM's share price by 8.60% over the last quarter, coinciding with its Q1 2025 earnings announcement, highlights investor optimism despite challenges in net income and EPS. Over a longer five-year timeframe, IBM recorded a total return of 151.06%, suggesting a strong long-term performance. However, when comparing IBM's one-year return with the broader US market and IT industry, IBM's return was more favorable, surpassing both the US market and IT industry benchmarks.

The company's strategic thrust in quantum computing and AI investments might bolster revenue and earnings forecasts if these initiatives deliver as anticipated. However, geopolitical tensions and supply chain disruptions remain potential hurdles that could dampen these prospects. IBM's anticipated 2.9% annual revenue growth and increased profit margins may need to accelerate to align with investor expectations expressed in the recent price movement.

With the current share price of approximately US$245.48, IBM trades below the consensus price target of US$255.49, but above the more conservative estimates of US$216.47 by the bearish analyst cohort. This indicates that while there is confidence in IBM's strategy, there is also caution regarding the potential risks outlined. Therefore, while the market optimism following the earnings announcement is evident, keeping pace with analyst forecasts and addressing macroeconomic challenges will be key for IBM's continued share price appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IBM

International Business Machines

Provides integrated solutions and services in the United States, Europe, the Middle East, Africa, Asia Pacific, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives