- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

High Growth Tech Stocks To Watch In December 2024

Reviewed by Simply Wall St

The United States market has recently experienced a notable upswing, climbing by 2.8% over the past week and achieving a 24% increase over the past year, with every sector contributing to this growth. In this context of robust market performance and anticipated earnings growth of 15% per annum in the coming years, identifying high-growth tech stocks becomes crucial for investors seeking to capitalize on innovation-driven opportunities within this dynamic sector.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.13% | 24.28% | ★★★★★★ |

| Ardelyx | 25.47% | 69.63% | ★★★★★★ |

| Sarepta Therapeutics | 24.07% | 42.97% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Clene | 77.61% | 59.19% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 238 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Vertex Pharmaceuticals (NasdaqGS:VRTX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vertex Pharmaceuticals Incorporated is a biotechnology company focused on developing and commercializing therapies for cystic fibrosis, with a market capitalization of approximately $105.12 billion.

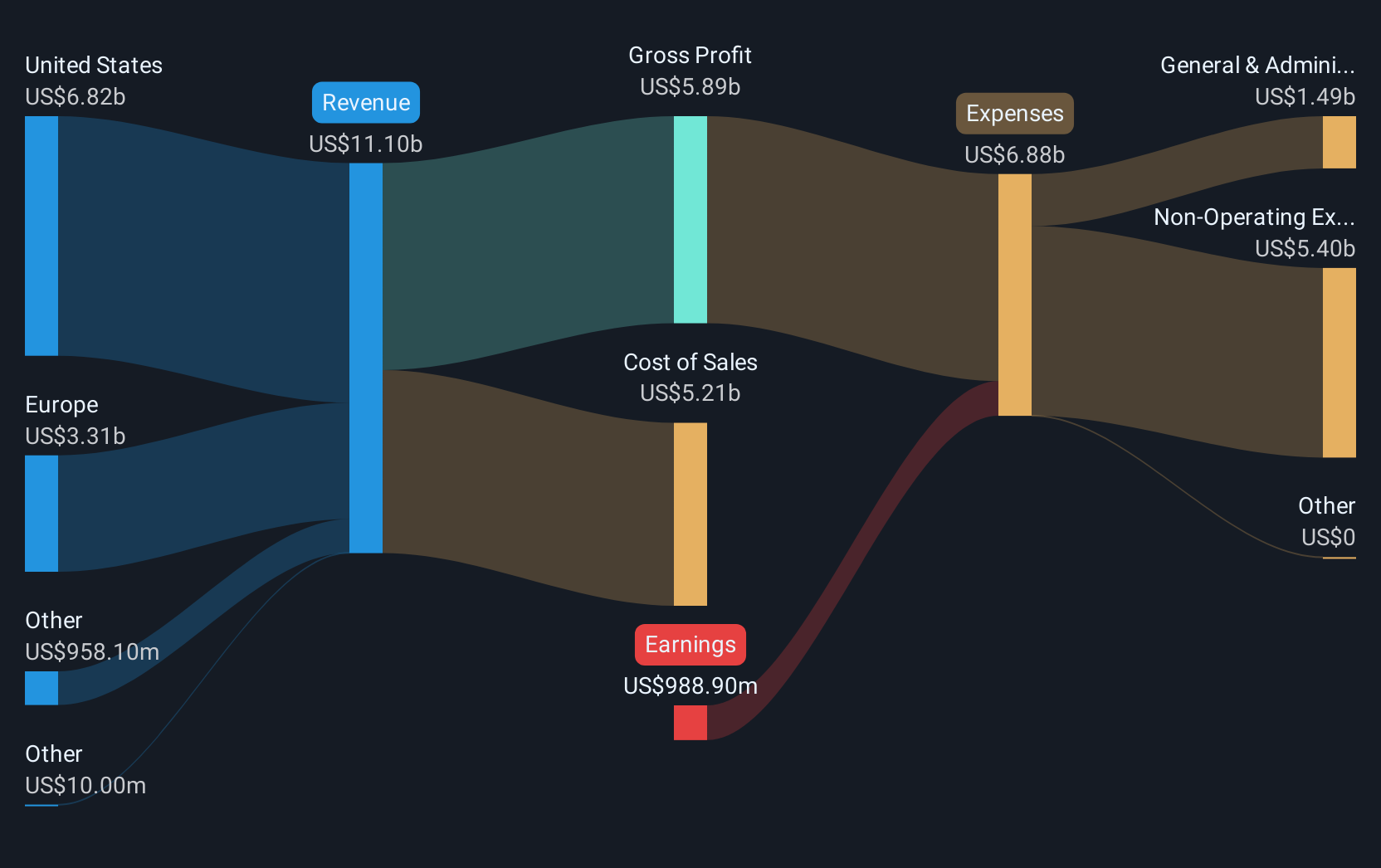

Operations: Vertex Pharmaceuticals generates revenue primarily from its pharmaceutical segment, amounting to $10.63 billion. The company's focus is on developing and commercializing therapies specifically for cystic fibrosis.

Vertex Pharmaceuticals stands out with its recent FDA approval of TRIKAFTA® for broader cystic fibrosis treatment, significantly expanding its market reach by including 300 more U.S. patients. This regulatory nod follows a robust R&D focus, where Vertex consistently allocates substantial resources; in 2024 alone, R&D expenses were notably high, underscoring their commitment to pioneering medical solutions. Moreover, the company's strategic share repurchases, totaling $1.19 billion since early 2023, reflect a strong confidence in its financial health and future prospects. These moves illustrate Vertex’s agility in enhancing shareholder value while pushing the boundaries of biotechnological innovation in healthcare.

- Navigate through the intricacies of Vertex Pharmaceuticals with our comprehensive health report here.

Understand Vertex Pharmaceuticals' track record by examining our Past report.

Zscaler (NasdaqGS:ZS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zscaler, Inc. is a global cloud security company with a market capitalization of approximately $28.73 billion.

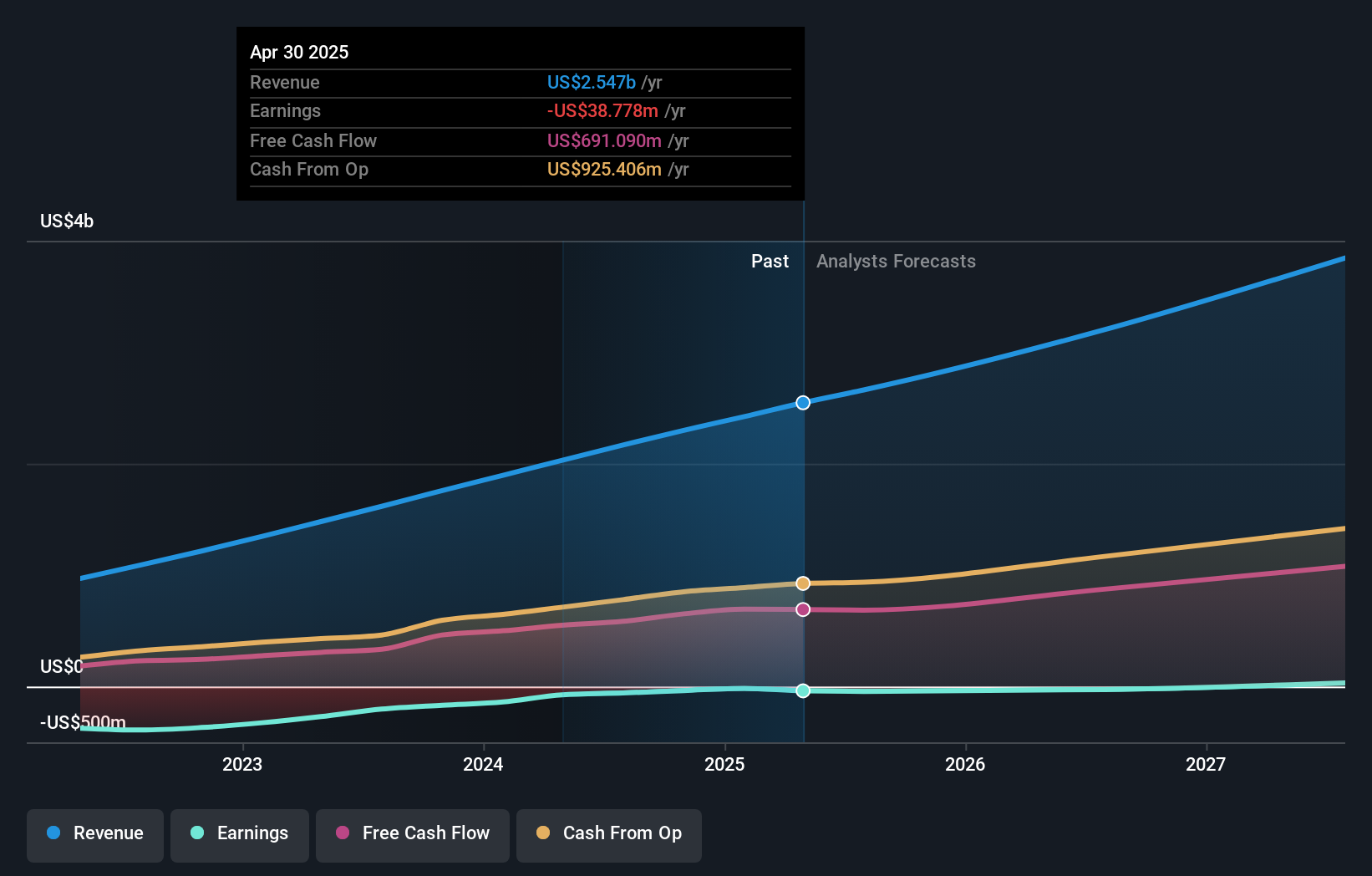

Operations: Zscaler generates revenue primarily through the sale of subscription services to its cloud platform and related support services, amounting to $2.30 billion. The company focuses on providing comprehensive cloud security solutions worldwide.

Zscaler's strategic positioning in the cybersecurity landscape is underscored by a robust 16.3% annual revenue growth and an impressive turnaround in net losses, reducing from $33.48 million to $12.05 million year-over-year as of Q1 2025. The company's commitment to innovation is evident from its R&D focus, with substantial investments aimed at advancing its Zero Trust Exchange platform—a key factor in securing high-profile clients like Nokia and Cognizant. These partnerships not only enhance Zscaler's service offerings but also solidify its role in transforming enterprise security architectures, positioning it well for sustained growth amidst escalating cyber threats.

- Delve into the full analysis health report here for a deeper understanding of Zscaler.

Examine Zscaler's past performance report to understand how it has performed in the past.

HubSpot (NYSE:HUBS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: HubSpot, Inc. offers a cloud-based customer relationship management platform for businesses across the Americas, Europe, and Asia Pacific with a market capitalization of $37.24 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, totaling $2.51 billion. It provides a comprehensive CRM platform designed to support businesses globally.

HubSpot's integration with ZINFI Technologies enhances its CRM capabilities, positioning it strongly in the SaaS market, a move that aligns with industry shifts toward subscription-based revenue models. This strategic partnership is timely as HubSpot reported a significant revenue jump to $669.72 million in Q3 2024 from $557.56 million the previous year, marking an impressive growth trajectory. Additionally, the company turned a net profit of $8.15 million compared to a loss last year, reflecting robust operational improvements and effective cost management strategies. These developments suggest HubSpot is effectively leveraging technological innovations and partnerships to sustain its growth momentum in the competitive tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of HubSpot.

Evaluate HubSpot's historical performance by accessing our past performance report.

Summing It All Up

- Click here to access our complete index of 238 US High Growth Tech and AI Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet and good value.