- United States

- /

- Software

- /

- NYSE:HUBS

A Fresh Look at HubSpot (HUBS) Valuation as AI Upgrades Boost Growth and Customer Engagement

Reviewed by Simply Wall St

HubSpot (HUBS) just posted quarterly results that have people talking, with new highs in user engagement and a strong boost in customer sign-ups. The real eye-catcher is the surge in subscription revenues, up 19% year over year. This indicates that its AI-driven features are resonating with businesses. Growth was not just about more users either, as core products like Sales Hub and Service Hub saw waves of upgrades thanks to clever AI integrations.

This pickup comes after a year where HubSpot’s share price has been through some ups and downs. Despite steady expansion of its customer base, now 18% higher than this time last year, the stock is down roughly 3% over the past year and off about 31% year-to-date. Compared to its multi-year returns, momentum clearly is not what it was, even as business performance and innovation appear to be hitting their stride.

With the company firing on all cylinders operationally but the stock trailing, some may be considering whether HubSpot is shaping up as a promising value play or if the market is already banking on years of future growth.

Most Popular Narrative: 30.5% Undervalued

According to the community narrative, HubSpot’s shares are viewed as notably undervalued. Analysts see a sharp disconnect between current market pricing and future growth expectations.

The company's quick pivot to adapt to shifting buyer behavior, such as declining traditional SEO and the rise of AI-powered search, positions HubSpot to capture new sources of lead generation (YouTube, social, newsletters, LLM citations). This supports customer growth and improves the durability of top-line expansion.

How did HubSpot arrive at this bullish price target? The real revelation lies in the significant forecasted jump in both revenue and profitability, backed by some ambitious assumptions about its AI-driven strategy. Interested in the growth rates and margin targets behind this valuation? The projected climb for this CRM innovator may be steeper than expected.

Result: Fair Value of $695.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifting buyer habits, along with declining SEO or setbacks in monetizing new AI features, could quickly challenge the bullish outlook for HubSpot.

Find out about the key risks to this HubSpot narrative.Another View: Sizing Up Value with Multiples

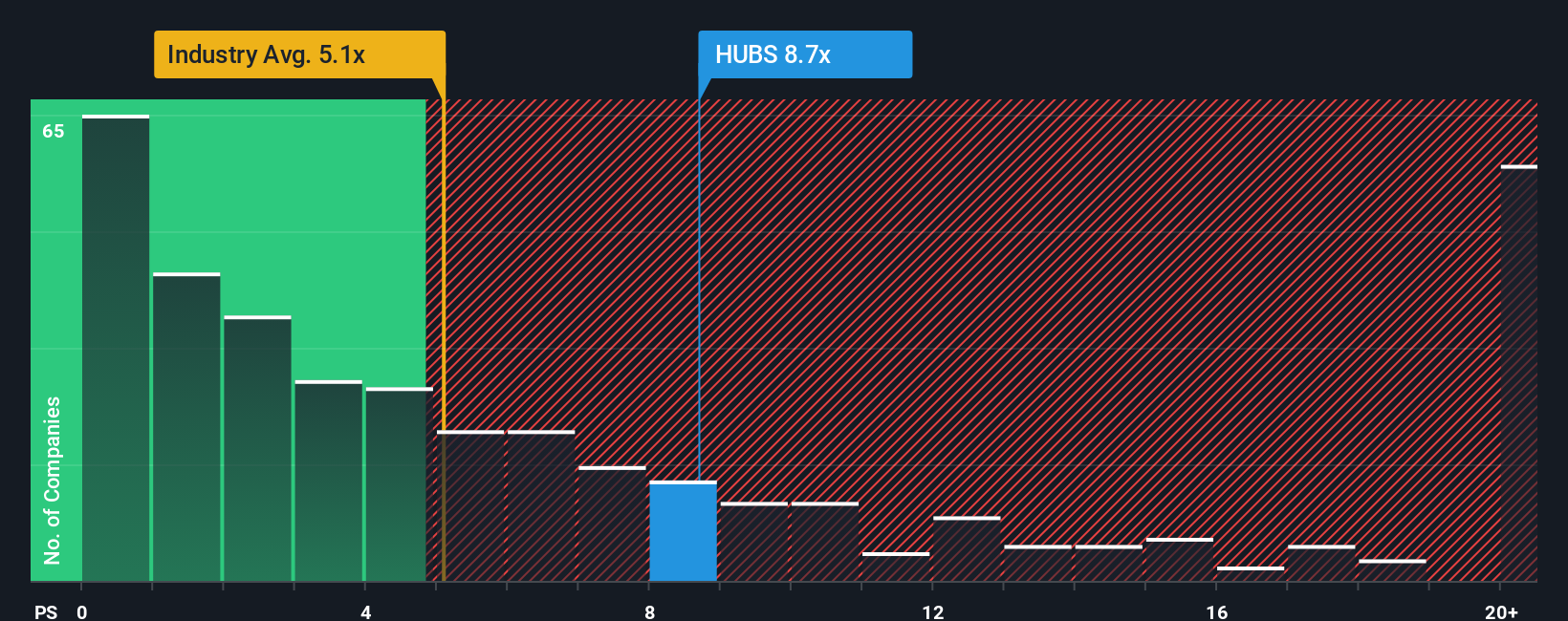

Looking from a different angle, valuation based on sales ratios tells a more cautious story. By this method, HubSpot is actually priced above the industry average. Could this market premium be justified, or is it a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own HubSpot Narrative

If you want to dig into the details and see where your own conclusions land, you can shape your own story with just a few clicks. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding HubSpot.

Looking for More Smart Investment Opportunities?

Don’t settle for searching alone when you could be ahead of the curve. Let Simply Wall Street’s powerful screeners help you uncover strategies that match your ambitions and risk appetite. Here are a few routes to spot promising companies before everyone is talking about them:

- Capture potential growth early by targeting up-and-coming businesses with strong financials using our penny stocks with strong financials.

- Capitalize on innovation as revolutionary startups push healthcare forward with AI. Check out the possibilities with healthcare AI stocks.

- Maximize your returns by identifying stocks the market may have overlooked, all thanks to our focus on undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if HubSpot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:HUBS

HubSpot

Provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)