- United States

- /

- Software

- /

- NYSE:FICO

Will FICO’s (FICO) Direct Licensing Shift Redefine Its Competitive Edge in Mortgage Credit Scoring?

Reviewed by Sasha Jovanovic

- Earlier this month, Fair Isaac (FICO) introduced its FICO® Mortgage Direct License Program, allowing tri-merge resellers to deliver FICO Scores directly to mortgage industry participants, bypassing the three nationwide credit bureaus and unveiling new performance-based and traditional pricing options targeted at increasing cost transparency and reducing lender expenses.

- This marks a major shift in how credit scores reach mortgage lenders and has prompted immediate competitive responses, with Equifax slashing prices and offering free VantageScore reports to blunt FICO’s expanded distribution model.

- We’ll explore how the direct-to-reseller move and Equifax’s aggressive price cuts are reshaping FICO’s investment narrative and future growth outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Fair Isaac Investment Narrative Recap

To be comfortable as a Fair Isaac (FICO) shareholder, you need confidence in its entrenched position as the industry standard for credit risk analytics and mortgage underwriting. The launch of the FICO Mortgage Direct License Program and Equifax’s counter-moves heighten near-term competitive pressure, but the most critical short-term catalyst, broad adoption of FICO’s direct distribution model, remains intact. Key risks, particularly faster switching to VantageScore or regulatory shifts favoring alternatives, may increase but the overall impact is still playing out.

Among recent product launches, the introduction of FICO® Score 10 BNPL in June stands out. This product expands FICO’s capabilities into alternative credit data, enhancing score relevance for lenders at a time when market competition and regulatory scrutiny around data inclusion are on the rise.

In contrast, investors should also be mindful of heightened regulatory risk, especially as FHFA guidance and credit scoring standards evolve...

Read the full narrative on Fair Isaac (it's free!)

Fair Isaac's narrative projects $2.9 billion revenue and $1.1 billion earnings by 2028. This requires 14.3% yearly revenue growth and a $467.4 million earnings increase from $632.6 million currently.

Uncover how Fair Isaac's forecasts yield a $1913 fair value, a 15% upside to its current price.

Exploring Other Perspectives

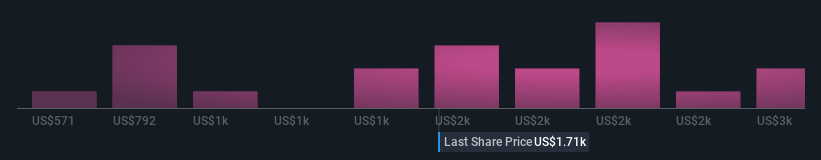

Simply Wall St Community members value FICO anywhere from US$1,005 to US$2,628, with 21 unique views reflecting substantial valuation gaps. With industry competition escalating, especially after recent direct licensing changes, it is clear you should examine a range of market opinions before forming your own outlook.

Explore 21 other fair value estimates on Fair Isaac - why the stock might be worth 40% less than the current price!

Build Your Own Fair Isaac Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fair Isaac research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fair Isaac research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fair Isaac's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Develops software with analytics and digital decisioning technologies that enable businesses to automate, enhance, and connect decisions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives