- United States

- /

- Software

- /

- NYSE:FICO

Is FICO’s Recent 33% Slide Creating Opportunity After Q2 Earnings Miss?

Reviewed by Simply Wall St

Thinking about what to do next with Fair Isaac stock? You are not alone. Whether you have held FICO through its impressive run over the past five years or you are eyeing the recent pullback and wondering if it is time to act, the outlook feels less certain these days. The stock soared more than 200% over the last five years, outpacing broader markets by a wide margin, but recently, momentum has cooled. In the last 90 days, FICO slid about 21%, and year-to-date, shares are down roughly 33%. With this kind of volatility, many investors are questioning whether the perception of risk has changed or if there is real growth still waiting to be unlocked.

The core business, which still reports steady double-digit revenue and profit growth, appears fundamentally resilient. Yet as valuation becomes a hot topic, investors want to know whether Fair Isaac is actually undervalued after this substantial reset. Using a standard six-point checklist, FICO earns a value score of 2. This means it is considered undervalued in just two out of six traditional valuation checks. While some might see this as a mixed review, it suggests there could be hidden value if viewed from the right perspective.

Next, we will break down the different valuation methods analysts use so you can see exactly how Fair Isaac compares. And just when it seems like you have the answer, we will explore a different, possibly more revealing, way to gauge the company’s true worth.

Fair Isaac delivered -23.3% returns over the last year. See how this stacks up to the rest of the Software industry.Approach 1: Fair Isaac Cash Flows

A Discounted Cash Flow (DCF) model works by estimating a company's future cash flows and then discounting those projections back to today’s value. This process gives investors a sense of what the business is truly worth right now.

Fair Isaac currently generates a Free Cash Flow of $772 million, which analysts expect to grow steadily in the coming years. Projections suggest that by 2029, annual Free Cash Flow could reach about $1.62 billion, reflecting a strong growth trend for the company’s core business.

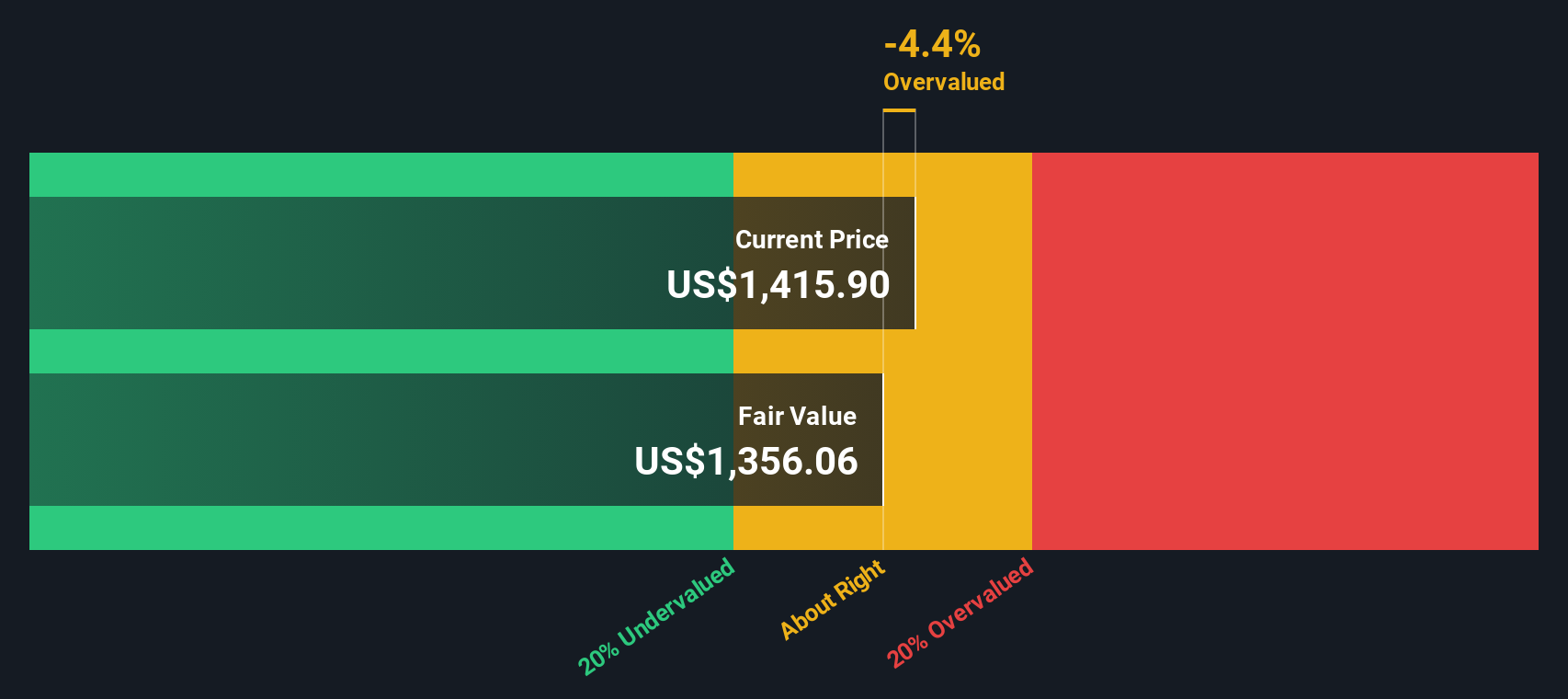

Using a two-stage model that factors in this acceleration and then tapers growth, the estimated intrinsic value for Fair Isaac lands at $1,356 per share. Compared to the current stock price, this implies the stock is just 0.9% undervalued.

This DCF analysis signals that Fair Isaac shares are trading very close to their calculated intrinsic worth. The stock does not appear significantly underpriced or overpriced.

Result: ABOUT RIGHT

Approach 2: Fair Isaac Price vs Earnings

The Price-to-Earnings (PE) ratio is a preferred metric for valuing profitable companies like Fair Isaac. This ratio helps investors understand how much the market is willing to pay for each dollar of the company’s earnings. For businesses delivering strong profits, the PE ratio provides a straightforward snapshot of valuation.

Investors often accept a higher PE ratio for companies with robust growth expectations or lower perceived risk. In contrast, if risk is elevated or growth is slowing, a lower PE typically signals a fairer price. What is considered a “normal” or reasonable PE ratio ultimately depends on how quickly a company’s earnings are expected to rise and how confident investors are in those projections.

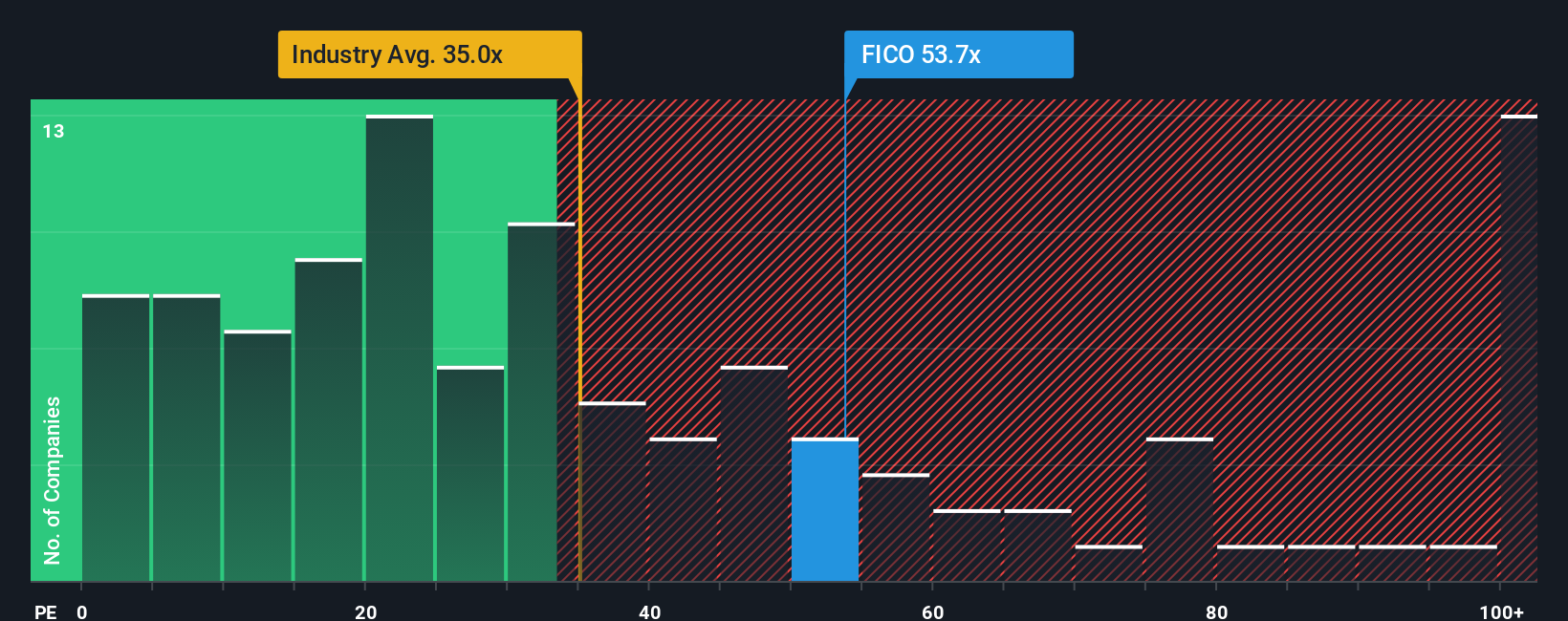

Currently, Fair Isaac trades at a PE ratio of 51x. This is noticeably higher than the software industry average of 37x and the company’s peer average of 47x. To put this in context, Simply Wall St calculates a custom Fair Ratio for Fair Isaac based on several factors including earnings growth, profit margins, and industry risk. For FICO, this Fair Ratio is 39x. Comparing the actual PE to this Fair Ratio, the stock appears to be trading at a premium, suggesting it could be somewhat overvalued on this metric alone.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Fair Isaac Narrative

Instead of relying solely on traditional numbers, investors can use Narratives to create a story about how they see Fair Isaac’s future. This approach links their view of the business to projections for growth, profitability, and ultimately an estimate of fair value.

A Narrative is simply your perspective on a company, expressed by setting your own assumptions for key metrics like revenue, earnings, and margins. This process effectively connects the story you believe in to the financial outlook you expect.

Narratives make valuation accessible to everyone. On Simply Wall St, millions of investors share and update their Fair Isaac Narratives, helping the community see how different scenarios could play out as news and earnings are released.

By tracking Narratives, you can quickly see how changes in the company’s story, whether it is a new regulatory threat or a breakthrough international deal, instantly flow through to fair value calculations. This allows you to judge for yourself whether Fair Isaac’s current price presents a buying opportunity or suggests it may be better to wait.

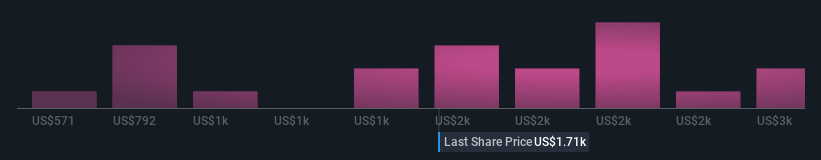

For example, some investors currently see Fair Isaac’s fair value as low as $1,230, reflecting concerns about competition and slowing software growth. Others are more optimistic and forecast a fair value as high as $2,300, citing the global cloud strategy and market expansion.

Do you think there's more to the story for Fair Isaac? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Develops software with analytics and digital decisioning technologies that enable businesses to automate, enhance, and connect decisions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives