- United States

- /

- Software

- /

- NYSE:FICO

Fair Isaac (NYSE:FICO) Surges 11% After Posting Robust Q1 Earnings Results

Reviewed by Simply Wall St

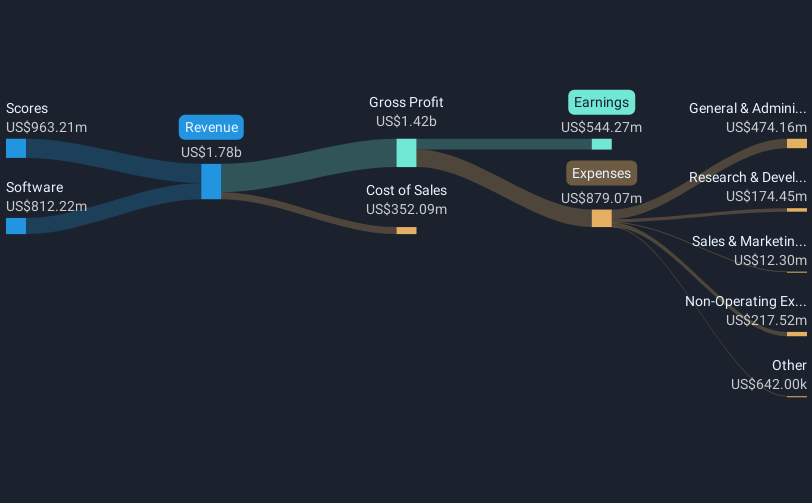

Last week, Fair Isaac (NYSE:FICO) announced a partnership with TransUnion Kenya to launch new credit risk solutions to enhance financial accessibility. The news underscored the company’s forward momentum following its robust Q1 earnings results revealing a significant revenue and earnings per share increase compared to the previous year. Coupled with the company's recent update of its share repurchase activities and optimistic fiscal year guidance, this news likely amplified investor enthusiasm, contributing to the 11.09% stock price increase over the week. Amidst an otherwise cautious market environment, buoyed by benign inflation data lifting stocks modestly towards week's end, Fair Isaac's developments set it apart from broader market movements. While major indexes experienced mixed performances, with weekly gains and monthly losses, Fair Isaac's updates and strategic initiatives appeared to resonate positively with investors, reflecting confidence in its growth trajectory and market positioning.

Get an in-depth perspective on Fair Isaac's performance by reading our analysis here.

Over the past five years, Fair Isaac's stock delivered a total return of 427.02%, marking a significant appreciation. This remarkable performance outpaced the broader market and highlighted investors' long-term confidence. Several developments contributed to this growth. The company's consistent earnings growth, with a notable increase of 16.1% yearly, underscored its strong operational execution. The strategic initiatives, including the AI partnership with Belvo in 2020, and the recent launch of the FICO® Score Mortgage Simulator in late 2024, showcased the company's focus on innovation and market expansion.

Additionally, Fair Isaac's buyback activities, such as the completion of a US$401.69 million repurchase in early 2025, likely supported share price appreciation by reducing the supply of outstanding shares. The company's robust guidance, frequently revised upwards, further cemented investor confidence in future growth prospects. Despite its relatively high Price-To-Earnings Ratio, the company's earnings growth rate and the exceeded market returns illustrate its strong positioning within the industry. Collectively, these factors have played pivotal roles in FICO's impressive stock performance.

- Unlock the insights behind Fair Isaac's valuation and discover its true investment potential

- Understand the uncertainties surrounding Fair Isaac's market positioning with our detailed risk analysis report.

- Are you invested in Fair Isaac already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Develops software with analytics and digital decisioning technologies that enable businesses to automate, enhance, and connect decisions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives