- United States

- /

- Software

- /

- NYSE:FICO

Fair Isaac (NYSE:FICO) Powers Vitality's Digital Health Transformation With FICO Platform

Reviewed by Simply Wall St

Fair Isaac (NYSE:FICO) experienced a 15% price increase in the last quarter, likely influenced by the recent collaborations with companies such as Vitality and Entercard, which highlighted advancements in personalized services and fraud detection. The integration of FICO's technology in Vitality's Care Hub and Entercard's fraud prevention strategy showcases the company's innovative capabilities. Meanwhile, developments like iA Financial Group's automation project and Lloyds Banking Group's transformation exemplify further adoption of FICO solutions. This period of growth aligns with market optimism, despite broader economic concerns like rising Treasury yields and fluctuating major indices. Though these sectoral moves undoubtedly reflect broader market stability, FICO's initiatives may have added an additional layer of investor confidence.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Fair Isaac's recent collaborations with Vitality and Entercard, as mentioned in the introduction, could potentially bolster its reputation for innovation, thus enhancing revenue and earnings projections. The integration of FICO's technology in these projects is expected to increase demand for its solutions, which may support revenue growth beyond traditional finance sectors, particularly in the context of the company's strategic expansion into international markets.

Over the past three years, Fair Isaac's total return, including share price and dividends, was 418.63%. This substantial long-term growth contrasts with its recent short-term performance, where its share price saw a 15% increase in the last quarter. When comparing Fair Isaac's performance to the US Software industry and the broader US market over the past year, the company outperformed both, with a notable excess in returns relative to the market average of 11.1% and the industry average of 16.1%.

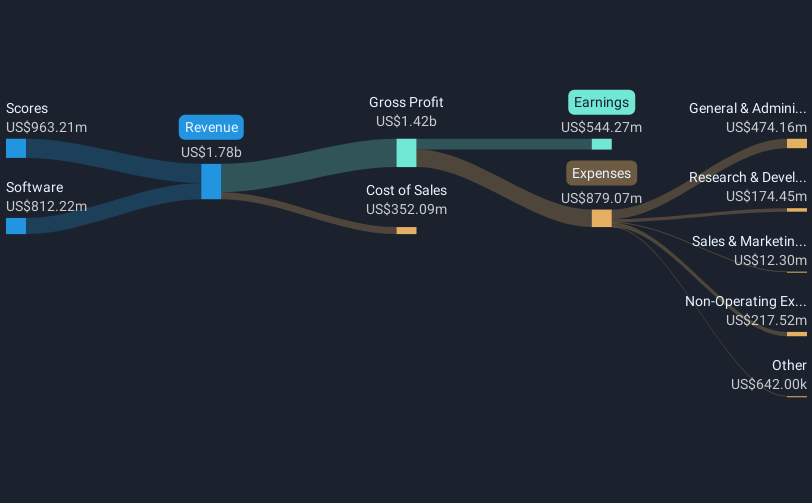

In terms of revenue and earnings forecasts, the news in the introduction could provide a positive impact. Analysts expect that by 2028, revenues and earnings could reach $2.8 billion and $1.1 billion, respectively. This aligns with FICO's ongoing initiatives to diversify its revenue base and leverage global partnerships. The share price of US$2,060.86 remains close to the consensus price target of US$2,116.96, indicating that current market valuations might reflect a relatively fair assessment of the company's future performance as projected by analysts. However, investors should carefully consider how evolving macroeconomic conditions could affect these projections.

The valuation report we've compiled suggests that Fair Isaac's current price could be inflated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Fair Isaac, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Develops software with analytics and digital decisioning technologies that enable businesses to automate, enhance, and connect decisions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives