- United States

- /

- Software

- /

- NYSE:FICO

Fair Isaac (FICO) Valuation in Focus After Launch of Specialized AI Tools for Financial Services

Reviewed by Kshitija Bhandaru

If you’ve been watching Fair Isaac (FICO) lately, there’s a fresh reason to pay attention. The company has just launched a new suite of domain-specific AI models, targeting some of the biggest pain points in financial services: accuracy, auditability, and regulatory compliance. By introducing the Focused Foundation Model for Financial Services and its specialized components, FICO is making the case that the industry does not need to settle for black-box AI. Instead, these products promise outputs financial institutions can trust, with less risk of surprise outcomes and much lower operating costs.

The rollout of these custom AI tools comes at a turning point for Fair Isaac. Over the past year, shares have struggled, with longer-term investors still sitting on impressive multi-year gains, but more recent momentum has been negative. The market’s cool response to prior innovations, along with regulatory headwinds and shifting client demands, makes this launch particularly interesting. FICO’s stock is down year to date and over the past year, though the multi-year view remains very strong, and recent product news like the Swisscard partnership hints at emerging opportunities.

After this wave of innovation and mixed price action, some investors may be wondering whether the market is already pricing in future growth for Fair Isaac or if there is potential for further developments to influence the stock.

Most Popular Narrative: 18.1% Undervalued

According to the most widely followed narrative, Fair Isaac appears materially undervalued, trading below the consensus analyst fair value despite recent price volatility and regulatory challenges.

Momentum in international expansion, combined with new partnerships (for example, AWS) and growing platform adoption, positions FICO to benefit from global financial services digitization. This opens up significant new addressable markets that could fuel multi-year top-line growth.

Want to know the secret formula driving this bold opportunity call? The heart of the narrative points to ambitious growth forecasts and market-defying profitability assumptions. Discover which financial levers set the stage for a future valuation few investors are expecting.

Result: Fair Value of $1,874.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, increased regulatory uncertainty and rising competition, including the possible adoption of alternative credit scoring models, could present challenges to Fair Isaac's future growth story.

Find out about the key risks to this Fair Isaac narrative.Another View: Market-Based Valuation Challenges

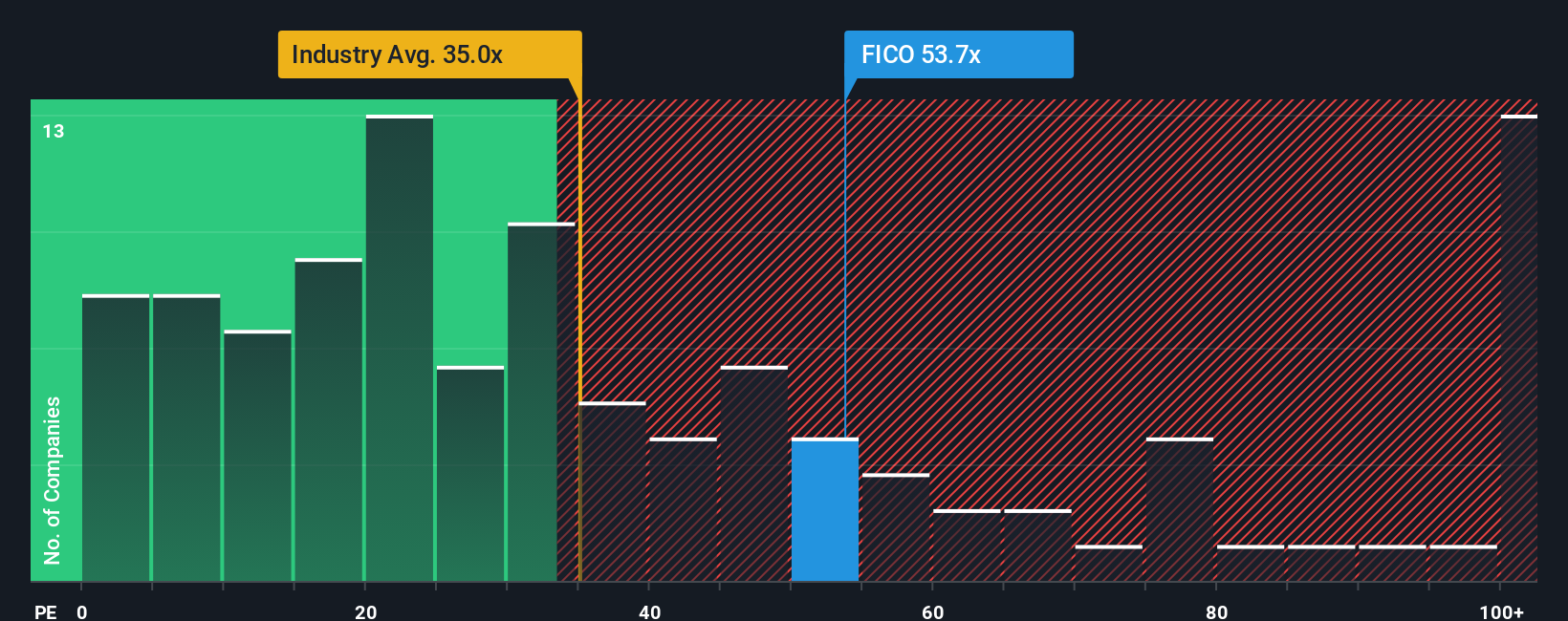

While analyst models suggest Fair Isaac is undervalued, a quick check against how the company is priced in relation to other US software firms presents a contrasting view and indicates a higher valuation. Does the market have insights that the models might miss?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fair Isaac Narrative

If this outlook does not align with your perspective or you prefer hands-on analysis, you can easily shape your own view in just a few minutes. Do it your way

A great starting point for your Fair Isaac research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

There is no better time to broaden your investment horizons. Skip the noise and get a jump on standout opportunities hiding in plain sight with these handpicked screens:

- Unlock growth by tracking real-world businesses powering the explosion in digital money, secure transactions, and blockchain solutions via cryptocurrency and blockchain stocks.

- Capture potential in companies bringing healthcare into the automated era. See which cutting-edge firms are reshaping medicine with next-level artificial intelligence using healthcare AI stocks.

- Supercharge your watchlist with top-rated companies trading for less than they may be worth and primed for tomorrow’s upside through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Develops software with analytics and digital decisioning technologies that enable businesses to automate, enhance, and connect decisions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives