- United States

- /

- Software

- /

- NasdaqGS:CORZ

High Growth Tech Stocks To Watch In The US March 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 1.3%, yet in the past year it has risen by 15%, with earnings forecasted to grow by 14% annually. In this dynamic environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability to capitalize on evolving market trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 25.26% | 29.10% | ★★★★★★ |

| AsiaFIN Holdings | 51.75% | 82.69% | ★★★★★★ |

| Travere Therapeutics | 28.43% | 65.01% | ★★★★★★ |

| Alkami Technology | 20.94% | 85.17% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.90% | 58.64% | ★★★★★★ |

| Zai Lab | 28.84% | 67.49% | ★★★★★★ |

| Lumentum Holdings | 21.24% | 119.37% | ★★★★★★ |

Click here to see the full list of 236 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Core Scientific (NasdaqGS:CORZ)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Core Scientific, Inc. is a North American company specializing in digital asset mining services with a market capitalization of approximately $3.28 billion.

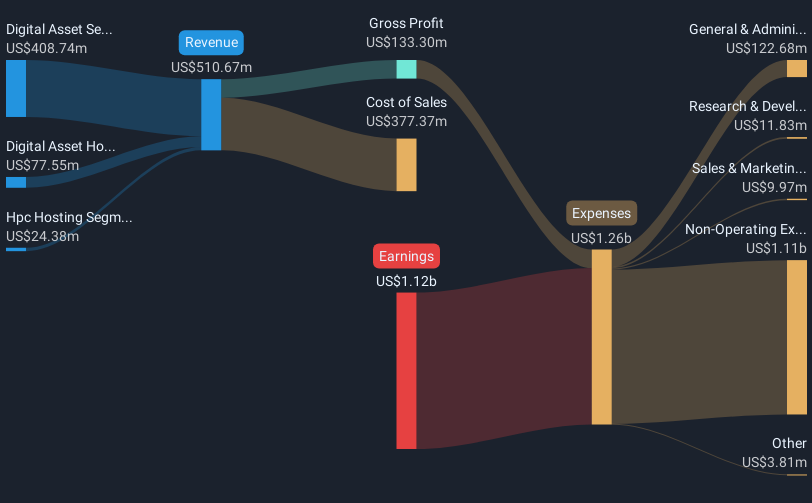

Operations: Core Scientific generates revenue primarily from its Digital Asset Self-Mining Segment, contributing $408.74 million, and its Digital Asset Hosted Mining Segment, which brings in $77.55 million. The HPC Hosting Segment adds $24.38 million to the overall revenue stream.

Core Scientific's strategic expansion into high-performance computing (HPC) data centers, exemplified by a recent $1.2 billion revenue contract with CoreWeave, underscores its pivotal role in the tech industry. This move not only boosts its contracted power to 1.3 gigawatts but also diversifies its operations beyond bitcoin mining, which currently utilizes 400 MW of power. Despite reporting a substantial net loss of $265.54 million in Q4 2024, the company's aggressive growth strategy is evident from its forecasted revenue and earnings growth rates of 25% and 112.72% per year respectively, positioning it well above average market projections. These developments suggest Core Scientific is adapting robustly to meet escalating demands for specialized data center solutions, marking significant steps toward profitability and industry leadership in energy-dense sectors.

Elastic (NYSE:ESTC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Elastic N.V. is a search artificial intelligence company that provides hosted and managed solutions for hybrid, public or private clouds, and multi-cloud environments globally, with a market cap of $12.15 billion.

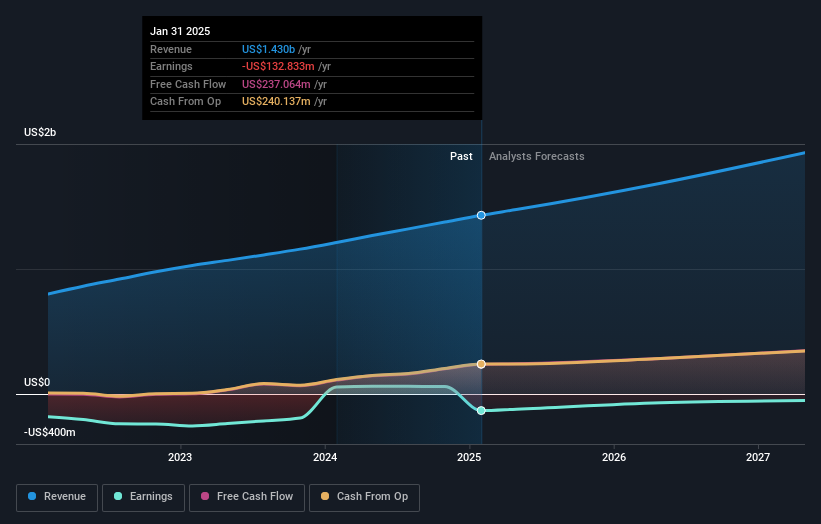

Operations: Elastic N.V. generates revenue primarily from its Software & Programming segment, amounting to $1.43 billion. The company specializes in delivering hosted and managed solutions for various cloud environments worldwide.

Elastic N.V. is navigating a complex landscape with recent financial performances and strategic integrations indicating both challenges and advancements. Despite a net loss of $91.73 million over nine months, the company's revenue growth remains robust, forecasting an increase to between $1.474 billion and $1.476 billion for the fiscal year, up approximately 16% year-over-year at the midpoint. This growth is complemented by Elastic's innovative strides in AI integration through its Elasticsearch Open Inference API, now supporting Jina AI’s advanced embedding models which enhance semantic search capabilities significantly—demonstrating Elastic’s commitment to evolving with high-demand tech trends in information retrieval and AI applications.

- Delve into the full analysis health report here for a deeper understanding of Elastic.

Gain insights into Elastic's historical performance by reviewing our past performance report.

Ubiquiti (NYSE:UI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ubiquiti Inc. develops networking technology for service providers, enterprises, and consumers, with a market cap of approximately $20.67 billion.

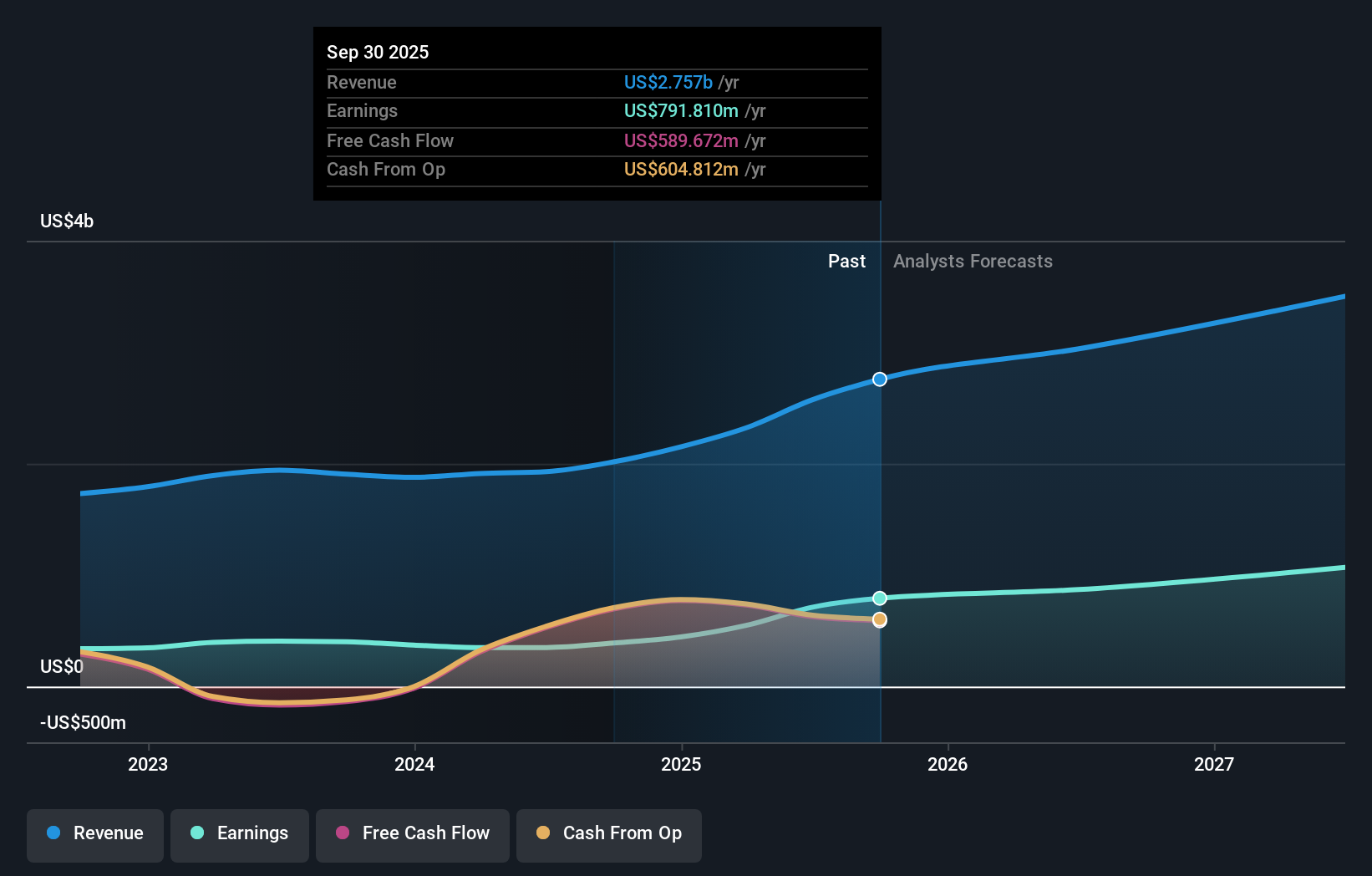

Operations: The company generates revenue primarily from its Wireless Communications Equipment segment, amounting to $2.15 billion.

Ubiquiti Inc. recently showcased robust financial results, with second-quarter sales surging to $599.88 million, a notable increase from $464.95 million the previous year, and net income climbing to $136.8 million from $82.12 million. This performance underscores a significant annual revenue growth of 13% and an impressive earnings growth forecast at 27% per year, signaling strong market traction and operational efficiency in the tech sector. Moreover, the company's commitment to shareholder returns was evident through a declared dividend of $0.60 per share, reinforcing its financial stability amidst dynamic market conditions.

- Click here to discover the nuances of Ubiquiti with our detailed analytical health report.

Review our historical performance report to gain insights into Ubiquiti's's past performance.

Make It Happen

- Unlock more gems! Our US High Growth Tech and AI Stocks screener has unearthed 233 more companies for you to explore.Click here to unveil our expertly curated list of 236 US High Growth Tech and AI Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CORZ

High growth potential slight.

Similar Companies

Market Insights

Community Narratives