- United States

- /

- Software

- /

- NYSE:DT

Edge Delta's Integration With Dynatrace (NYSE:DT) Enhances Data Clarity and Reduces Costs

Reviewed by Simply Wall St

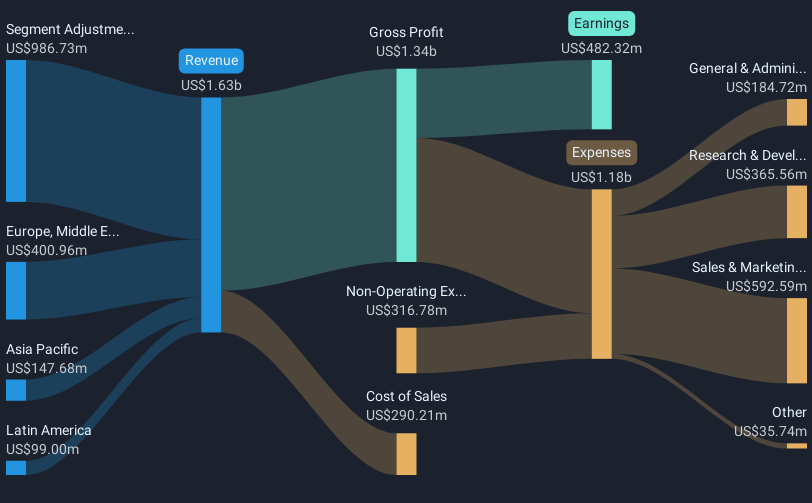

Dynatrace (NYSE:DT) recently saw the integration of its advanced Grail technology with Edge Delta, boosting data clarity and reducing costs for users. Despite this, the stock dropped 4% in the last quarter. During this period, Dynatrace reported strong Q3 earnings, with significant revenue and net income growth, and announced an increase in revenue guidance. However, the company's performance was likely impacted by broader market sell-offs in tech stocks, aggravated by tariff uncertainties under the Trump administration. The market sentiment was further strained by concerns about global economic growth and high valuations, causing a 1.9% drop overall. These factors, alongside positive news like their ongoing share buyback program and product enhancements, contextualize Dynatrace's quarterly performance. Despite strong company fundamentals and strategic initiatives, external market pressures contributed to its stock price decline amidst the turbulent tech sector landscape.

Get an in-depth perspective on Dynatrace's performance by reading our analysis here.

Over the last five years, Dynatrace shares have achieved a total return of 131.83%, reflecting considerable shareholder value. Contributing to this performance was the company's remarkable 65.2% average annual earnings growth, which underscores Dynatrace's ability to increase profitability steadily. Notably, its earnings growth significantly outpaced the software industry average, demonstrating the company's competitive edge. Furthermore, initiatives such as the integration of AI capabilities and strategic partnerships, like the collaboration with AWS in late 2022, have bolstered Dynatrace’s market positioning and technological advancement.

In assessing Dynatrace's performance against recent market trends, the company exceeded both the US Market's 13.1% return and the US Software industry's 6.1% one-year return. Concurrently, the initiation of a share repurchase program in 2024 emphasized the company’s commitment to enhancing shareholder value. The recent enhancement in net profit margins also signals an improved operational efficiency, strengthening Dynatrace’s long-term financial outlook and resilience amidst external market pressures.

- See whether Dynatrace's current market price aligns with its intrinsic value in our detailed report

- Gain insight into the risks facing Dynatrace and how they might influence its performance—click here to read more.

- Got skin in the game with Dynatrace? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Dynatrace, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DT

Dynatrace

Provides a security platform for multicloud environments in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives