- United States

- /

- Software

- /

- NYSE:CWAN

A Fresh Look at Clearwater Analytics (CWAN) Valuation as M&A Ambitions Scale Up

Reviewed by Simply Wall St

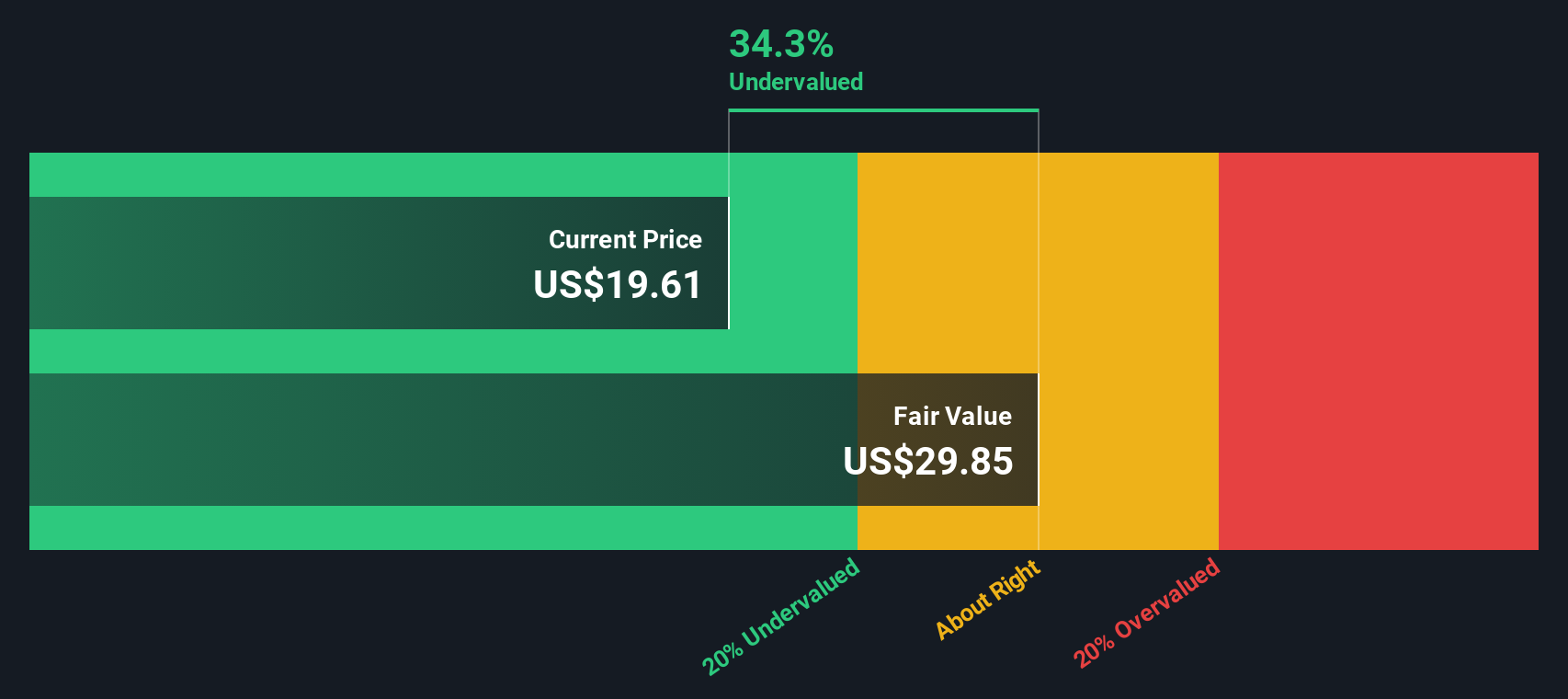

Most Popular Narrative: 33.7% Undervalued

Clearwater Analytics Holdings is seen as significantly undervalued, with current share prices estimated to be well below fair value, according to community narrative. The bullish view is built on strong operational catalysts and depends on several ambitious underlying assumptions.

Continuous product innovation, especially the integration of generative AI, the launch of proprietary data and risk platforms (such as Helios), and the buildout of a unified, front-to-back, multi-asset SaaS solution positions the company to increase cross-sell and upsell to its existing sticky client base. This should drive up net revenue retention and average revenue per customer.

What is fueling this aggressive price target? The narrative points to rapid business transformation, including new technology adoption, major international wins, and a daring financial roadmap. But what are the growth assumptions powering such ambitious value projections? Analysts have crunched some surprising numbers, challenging conventional expectations. Interested in the story behind this potential swing in fortunes? Find out what bold estimates are reshaping Clearwater’s fair value today.

Result: Fair Value of $30.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent integration challenges from recent acquisitions and reliance on ambitious cross-sell targets could undermine Clearwater’s projected growth trajectory and introduce renewed uncertainty.

Find out about the key risks to this Clearwater Analytics Holdings narrative.Another View: Our DCF Model Weighs In

Looking at Clearwater through the lens of our SWS DCF model, the numbers still suggest shares are undervalued. While this method uses future cash flow projections, the question remains whether expectations for growth will hold up.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Clearwater Analytics Holdings Narrative

If you want a different perspective or wish to conduct your own analysis, you can easily shape your own narrative and insights. Do it your way.

A great starting point for your Clearwater Analytics Holdings research is our analysis highlighting 5 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Want to stay ahead and seize more smart investment opportunities? Don’t limit your research to just Clearwater Analytics Holdings. Use Simply Wall Street’s powerful tools to spot stocks making waves in fascinating sectors. Here are three exciting ways to uncover your next winning idea:

- Unlock portfolio potential by tracking companies offering reliable income with dividend stocks with yields > 3%. These companies consistently pay out yields above 3%.

- Fuel your curiosity about the future by focusing on leading innovators in robotics and automation through AI penny stocks.

- Strengthen your strategy by considering stocks currently trading below their intrinsic value using undervalued stocks based on cash flows. These tools can help you identify fresh opportunities that others might miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:CWAN

Clearwater Analytics Holdings

Develops and provides a Software-as-a-Service (SaaS) solution for automated investment data aggregation, reconciliation, accounting, and reporting services to insurers, investment managers, corporations, institutional investors, and government entities in the United States and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)