- United States

- /

- Software

- /

- NYSE:CRM

The Bull Case For Salesforce (CRM) Could Change Following New Perficient Partnership Focused on AI Transformation

Reviewed by Sasha Jovanovic

- Perficient recently announced a partnership with Salesforce to advance AI-powered enterprise transformation, emphasizing joint initiatives to help businesses modernize customer and employee experiences using Salesforce's Agentforce and Data Cloud platforms.

- This collaboration underlines Salesforce's expanding AI ecosystem and focus on agent-based solutions, positioning its technology at the core of next-generation enterprise automation and productivity enhancements.

- With this renewed AI partnership at the forefront, we'll consider how Salesforce's deepening AI integration could shift its long-term investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Salesforce Investment Narrative Recap

To be a Salesforce shareholder today, you have to believe in the company's ability to maintain its technology leadership with AI-powered CRM and agent-based automation, translating recent momentum into sustained revenue and margin growth. The new Perficient partnership reinforces Salesforce's AI ecosystem and broadens client use cases, but it does not materially alter the company’s main short-term catalyst: accelerating adoption of native AI solutions driving higher contract values from the existing customer base. The most important risk, intensifying competition from large technology vendors bundling CRM and AI, remains in focus, with the latest news unlikely to change the near-term balance of risk and reward.

Among recent innovations, the launch of Agentforce 3 stands out as particularly relevant to the Perficient collaboration. This release introduced advanced observability and industry-specific features, supporting the broader AI partnership narrative while directly underpinning Salesforce’s push to deepen enterprise automation, a key performance driver in the current environment.

But looking ahead, investors should be attuned to the risk as hyperscalers and IT giants increase their investments in CRM and AI, pressuring Salesforce’s margins and market share...

Read the full narrative on Salesforce (it's free!)

Salesforce’s outlook anticipates $51.9 billion in revenue and $10.3 billion in earnings by 2028. This implies a 9.6% annual revenue growth rate and a $3.6 billion increase in earnings from the current level of $6.7 billion.

Uncover how Salesforce's forecasts yield a $334.68 fair value, a 39% upside to its current price.

Exploring Other Perspectives

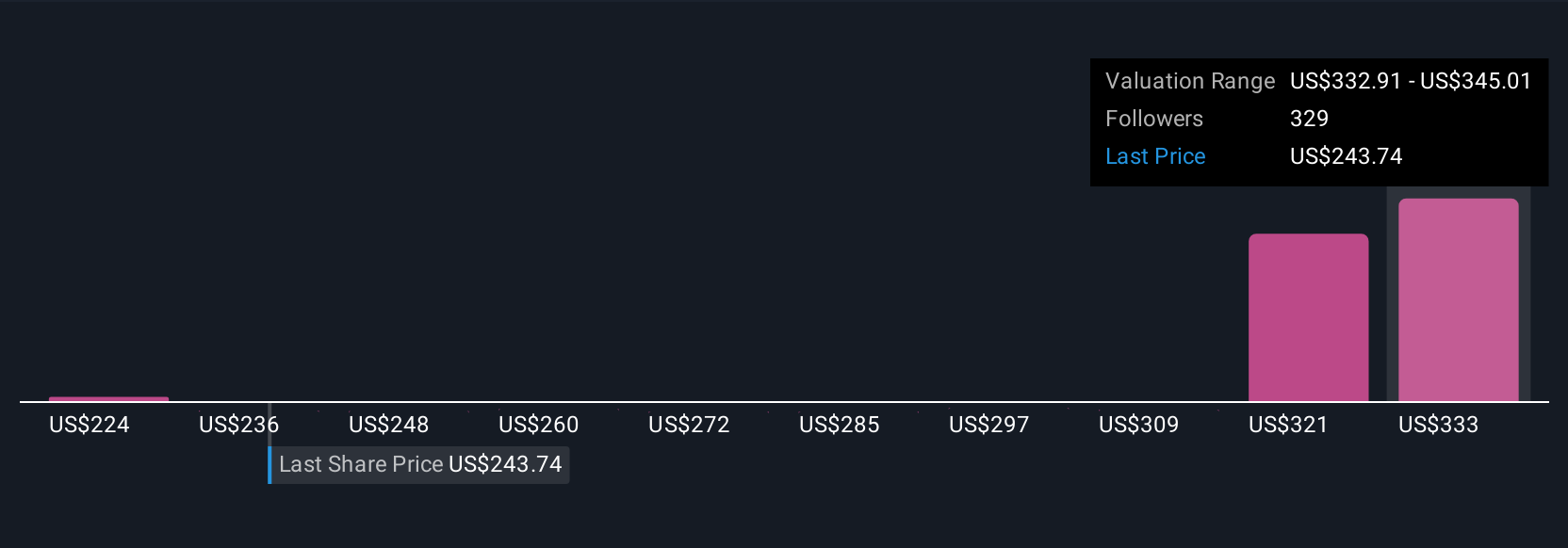

Simply Wall St Community members submitted 43 independent fair value estimates for Salesforce, ranging from US$223.99 to US$349.99 per share. As competition heats up in enterprise AI and bundled CRM offerings, these contrasting outlooks remind you to examine a wide variety of perspectives before making your own call.

Explore 43 other fair value estimates on Salesforce - why the stock might be worth 7% less than the current price!

Build Your Own Salesforce Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Salesforce research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Salesforce research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Salesforce's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 34 stocks are leading the charge.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRM

Salesforce

Provides customer relationship management technology that connects companies and customers together worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)