- United States

- /

- Software

- /

- NYSE:CRM

Salesforce (NYSE:CRM) Sees 13% Stock Surge Over Past Week

Reviewed by Simply Wall St

Salesforce (NYSE:CRM) experienced a 13% increase in its stock price over the past week. While there are no headline-defining events for Salesforce within this period to directly correlate with its price movement, this increase contrasts with the broader market, which held steady despite losing ground in early trading. The overall market's modest retreat, as observed in the downticks of other tech giants like Nvidia and Tesla, didn't impact Salesforce similarly, suggesting that any underlying positive sentiment towards the company's long-term business prospects might have supported this divergent upward move. This performance highlights Salesforce's resilience amid a volatile tech sector landscape.

We've spotted 1 risk for Salesforce you should be aware of.

The recent 13% rise in Salesforce's stock price, as detailed in the introduction, suggests a positive sentiment that could bolster its narrative around AI-driven growth and operational efficiencies. Over the past five years, Salesforce shares have delivered a total return of 67.07%, highlighting its capacity to generate shareholder value. While Salesforce's 1-year performance has lagged behind the US market return of 7.5%, its robust five-year return demonstrates sustained long-term growth potential. The recent stock movement occurs amid a share price still significantly below the consensus analyst price target of approximately US$371.51, suggesting room for potential appreciation.

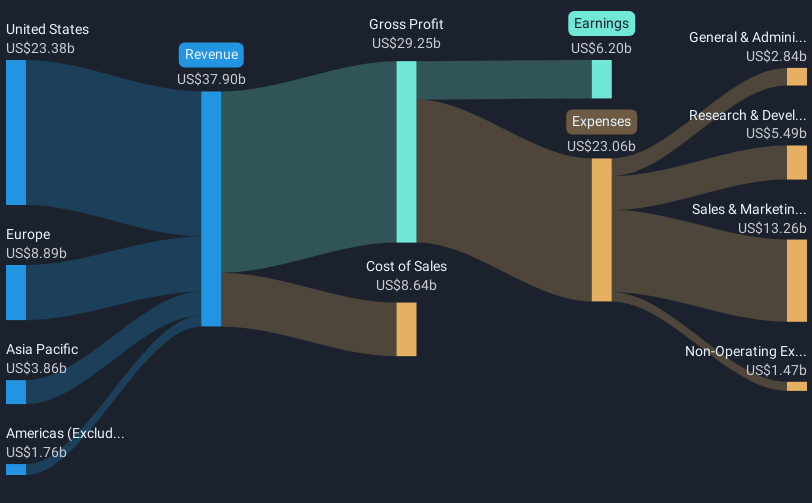

The proposed advancement stemming from Salesforce's investments in AI and data products like Data Cloud and Agentforce may positively influence revenue and earnings forecasts. Analysts project that these initiatives will contribute to substantial revenue growth, with expected annual earnings growth slightly below the US market average at 13.1%. This positive outlook encourages speculation that Salesforce may gain an advantage through its innovative consumption-based pricing models and strategic cloud partnerships. However, it's important to remain cautious given potential risks such as increasing competition and reliance on third-party partnerships. Investors will need to closely monitor how these factors evolve and how they might affect Salesforce's ability to meet or exceed expectations.

Take a closer look at Salesforce's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Salesforce, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRM

Salesforce

Provides customer relationship management (CRM) technology that connects companies and customers together worldwide.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives