- United States

- /

- Software

- /

- NYSE:BLND

Discovering 3 Promising Penny Stocks With Over $200M Market Cap

Reviewed by Simply Wall St

As the U.S. stock market rebounds from a recent sell-off, driven by tech sector gains, investors are once again exploring opportunities that lie beyond the traditional blue-chip stocks. The term 'penny stocks' might feel like a relic of past market eras, but the potential they represent is as real as ever. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.68 | $600.36M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.9432 | $155.13M | ✅ 4 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.645 | $20.89M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $90.04M | ✅ 3 ⚠️ 2 View Analysis > |

| Cricut (CRCT) | $4.72 | $982.65M | ✅ 2 ⚠️ 1 View Analysis > |

| Riverview Bancorp (RVSB) | $4.86 | $101.11M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (BABB) | $0.8925 | $6.46M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.17 | $95.71M | ✅ 3 ⚠️ 3 View Analysis > |

| Resources Connection (RGP) | $4.65 | $159.36M | ✅ 3 ⚠️ 1 View Analysis > |

| TETRA Technologies (TTI) | $3.98 | $513.66M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 419 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Mercurity Fintech Holding (MFH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mercurity Fintech Holding Inc. is a digital fintech company offering AI-powered infrastructure, blockchain, and digital asset services in the United States, with a market cap of $262.71 million.

Operations: The company's revenue is derived entirely from its B2B online e-commerce platform, generating $1.01 million.

Market Cap: $262.71M

Mercurity Fintech Holding Inc., a digital fintech company, is navigating the penny stock landscape with a market cap of US$262.71 million and revenues under US$1 million, indicating its pre-revenue status. Recent strategic moves include a partnership with Franklin Templeton to integrate blockchain technology into traditional financial products and a share repurchase program worth up to US$10 million. Despite having more cash than debt and sufficient short-term assets to cover liabilities, the company faces challenges such as high volatility in its share price and increasing losses over five years at 23% annually.

- Take a closer look at Mercurity Fintech Holding's potential here in our financial health report.

- Gain insights into Mercurity Fintech Holding's historical outcomes by reviewing our past performance report.

Opendoor Technologies (OPEN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Opendoor Technologies Inc. operates a digital platform facilitating residential real estate transactions in the United States, with a market cap of approximately $1.53 billion.

Operations: The company generates revenue from its Real Estate Brokers segment, amounting to $5.13 billion.

Market Cap: $1.53B

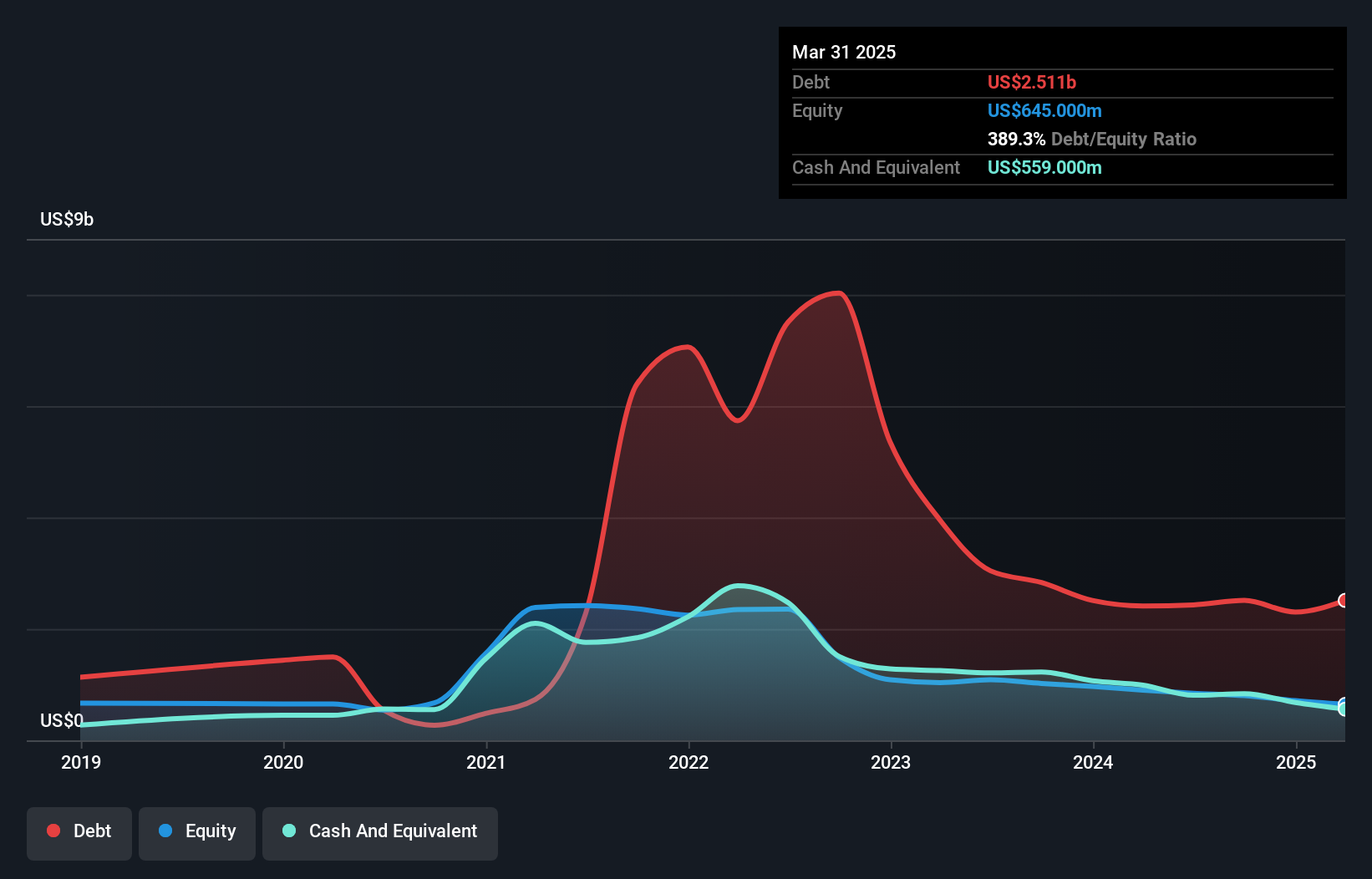

Opendoor Technologies, with a market cap of US$1.53 billion, is actively expanding its product offerings and agent network to strengthen its position in the real estate market. Recent launches like Cash Plus and the Opendoor Key Agent app aim to enhance transaction efficiency and seller flexibility. Despite these advancements, the company faces challenges such as high volatility in share price and potential delisting from Nasdaq due to non-compliance with minimum bid price requirements. Financially, Opendoor remains unprofitable with increasing debt levels; however, it has sufficient short-term assets to cover both short- and long-term liabilities.

- Dive into the specifics of Opendoor Technologies here with our thorough balance sheet health report.

- Understand Opendoor Technologies' earnings outlook by examining our growth report.

Blend Labs (BLND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Blend Labs, Inc. offers a cloud-based software platform tailored for financial services firms in the United States and has a market cap of approximately $920.34 million.

Operations: The company's revenue is derived from its Blend Platform, generating $118.69 million, with a segment adjustment of $46.26 million.

Market Cap: $920.34M

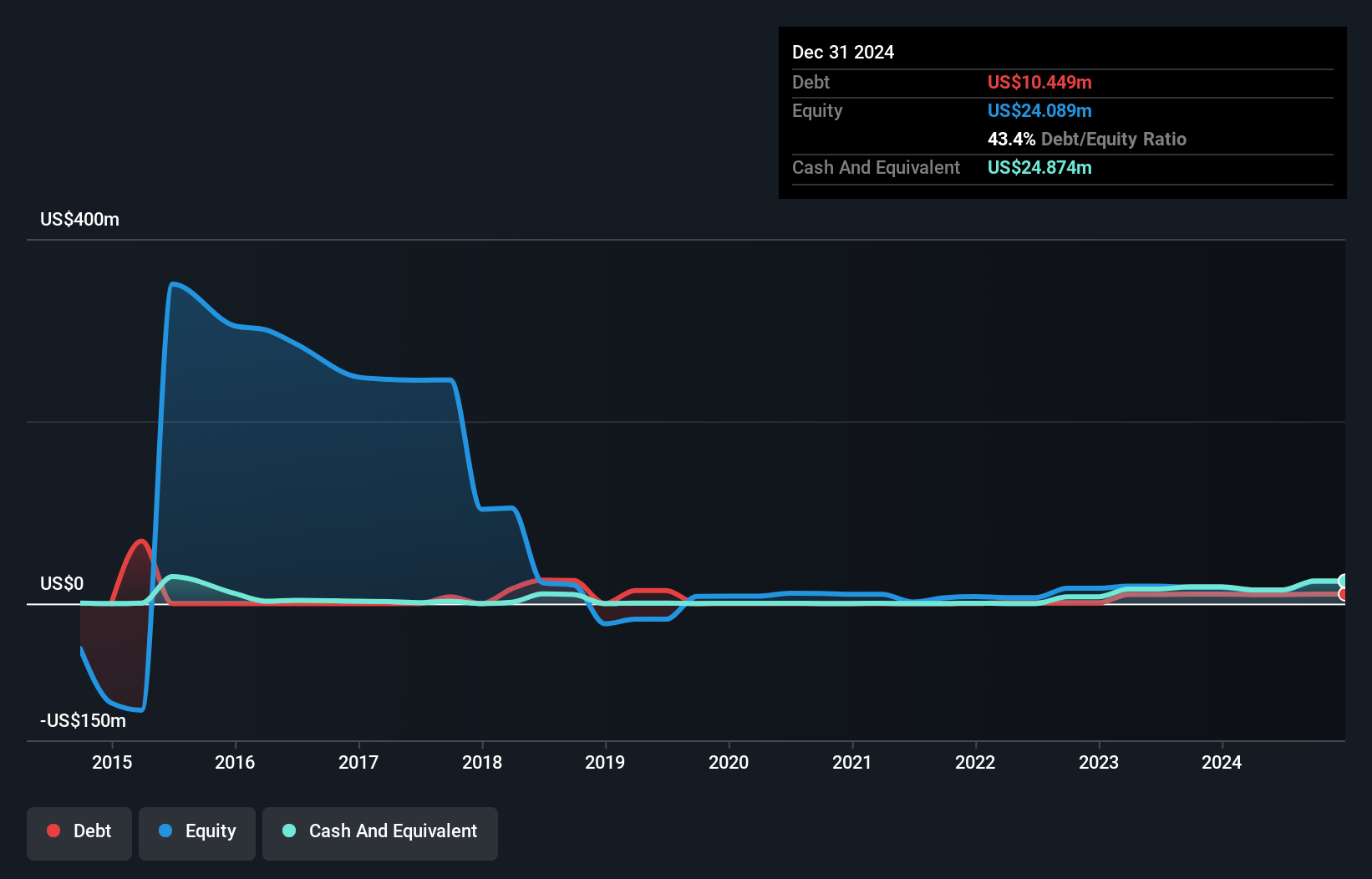

Blend Labs, Inc., with a market cap of approximately US$920.34 million, is navigating the penny stock landscape by focusing on strategic partnerships and product innovations. Recent collaborations with Doma Technology and PHH Mortgage aim to enhance its digital lending platform's efficiency and borrower experience. Despite being unprofitable, Blend has reduced losses over the past five years and maintains sufficient short-term assets to cover liabilities. The company has no debt, providing financial flexibility as it expands offerings like its Business Deposit Account Opening solution. However, significant insider selling could indicate potential concerns about future performance or strategy execution.

- Click here to discover the nuances of Blend Labs with our detailed analytical financial health report.

- Gain insights into Blend Labs' future direction by reviewing our growth report.

Seize The Opportunity

- Embark on your investment journey to our 419 US Penny Stocks selection here.

- Looking For Alternative Opportunities? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Blend Labs might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLND

Blend Labs

Provides a cloud-based software platform for financial services firms in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)