- United States

- /

- Packaging

- /

- NYSE:PACK

Blend Labs Leads The Pack With These 3 Penny Stocks

Reviewed by Simply Wall St

The United States market has experienced a positive trend, rising 4.1% over the last week and 7.9% over the past year, with earnings projected to grow by 14% annually. In this context, identifying a good stock involves looking beyond traditional metrics to find smaller or less-established companies that offer value through robust financials and clear growth potential. While "penny stocks" may seem like an outdated term, they continue to represent significant opportunities for investors willing to explore these often-overlooked areas of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.36 | $349.13M | ✅ 3 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.25 | $1.3B | ✅ 3 ⚠️ 3 View Analysis > |

| Smith Micro Software (NasdaqCM:SMSI) | $1.06 | $18.48M | ✅ 4 ⚠️ 4 View Analysis > |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.20 | $9.36M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $3.829 | $48.19M | ✅ 4 ⚠️ 2 View Analysis > |

| TETRA Technologies (NYSE:TTI) | $2.62 | $327.01M | ✅ 5 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.8099 | $5.81M | ✅ 2 ⚠️ 3 View Analysis > |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $263.74M | ✅ 3 ⚠️ 2 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.71 | $82.45M | ✅ 3 ⚠️ 2 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.74 | $65.3M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 762 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Blend Labs (NYSE:BLND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Blend Labs, Inc. operates a cloud-based software platform catering to financial services firms in the United States, with a market capitalization of approximately $828.32 million.

Operations: The company's revenue is divided into two segments: Title, generating $46.26 million, and Blend Platform, contributing $115.76 million.

Market Cap: $828.32M

Blend Labs, Inc. is making strides in the financial technology sector with recent strategic partnerships and product enhancements aimed at improving its cloud-based software platform for financial services firms. The company has expanded collaborations with CrossCountry Mortgage and Alloy to enhance mortgage banking solutions and integrate advanced identity verification, respectively. Despite being unprofitable, Blend's short-term assets significantly exceed its liabilities, providing a solid financial footing. Recent innovations like Rapid Home Lending aim to streamline lending processes amid market challenges. With a market cap of US$828.32 million, Blend continues to focus on scalable technology that supports growth in an evolving industry landscape.

- Unlock comprehensive insights into our analysis of Blend Labs stock in this financial health report.

- Understand Blend Labs' earnings outlook by examining our growth report.

Ranpak Holdings (NYSE:PACK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ranpak Holdings Corp. offers product protection and end-of-line automation solutions for e-commerce and industrial supply chains across North America, Europe, and Asia, with a market cap of approximately $324.26 million.

Operations: The company's revenue segment is reported as $368.9 million.

Market Cap: $324.26M

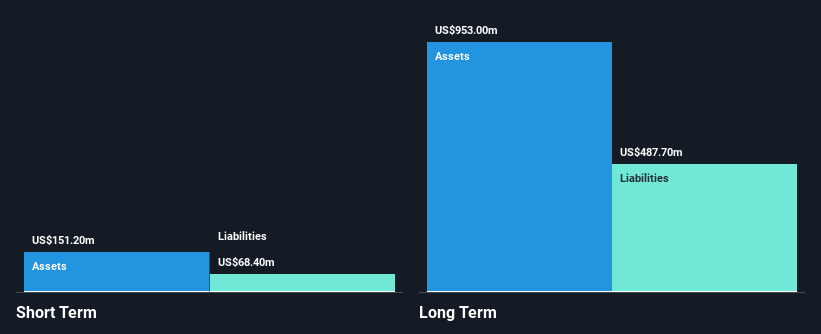

Ranpak Holdings Corp. is navigating the packaging industry with innovative solutions like Print'it!, PaperWrap, and Rabot, which enhance sustainability and operational efficiency. Despite being unprofitable with a negative return on equity of -3.92%, Ranpak maintains a strong cash runway exceeding three years, supported by positive free cash flow. The company's short-term assets ($151.2M) cover its liabilities but long-term liabilities remain uncovered at $487.7M. Recent product launches at ProMat 2025 highlight its commitment to eco-friendly packaging solutions, while earnings guidance suggests modest revenue growth between 5%–11% for 2025 amidst ongoing financial challenges.

- Navigate through the intricacies of Ranpak Holdings with our comprehensive balance sheet health report here.

- Evaluate Ranpak Holdings' prospects by accessing our earnings growth report.

Riskified (NYSE:RSKD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Riskified Ltd. operates an e-commerce risk intelligence platform that helps online merchants build trusted consumer relationships across various regions worldwide, with a market cap of approximately $732.43 million.

Operations: The company's revenue is derived entirely from its Security Software & Services segment, totaling $327.52 million.

Market Cap: $732.43M

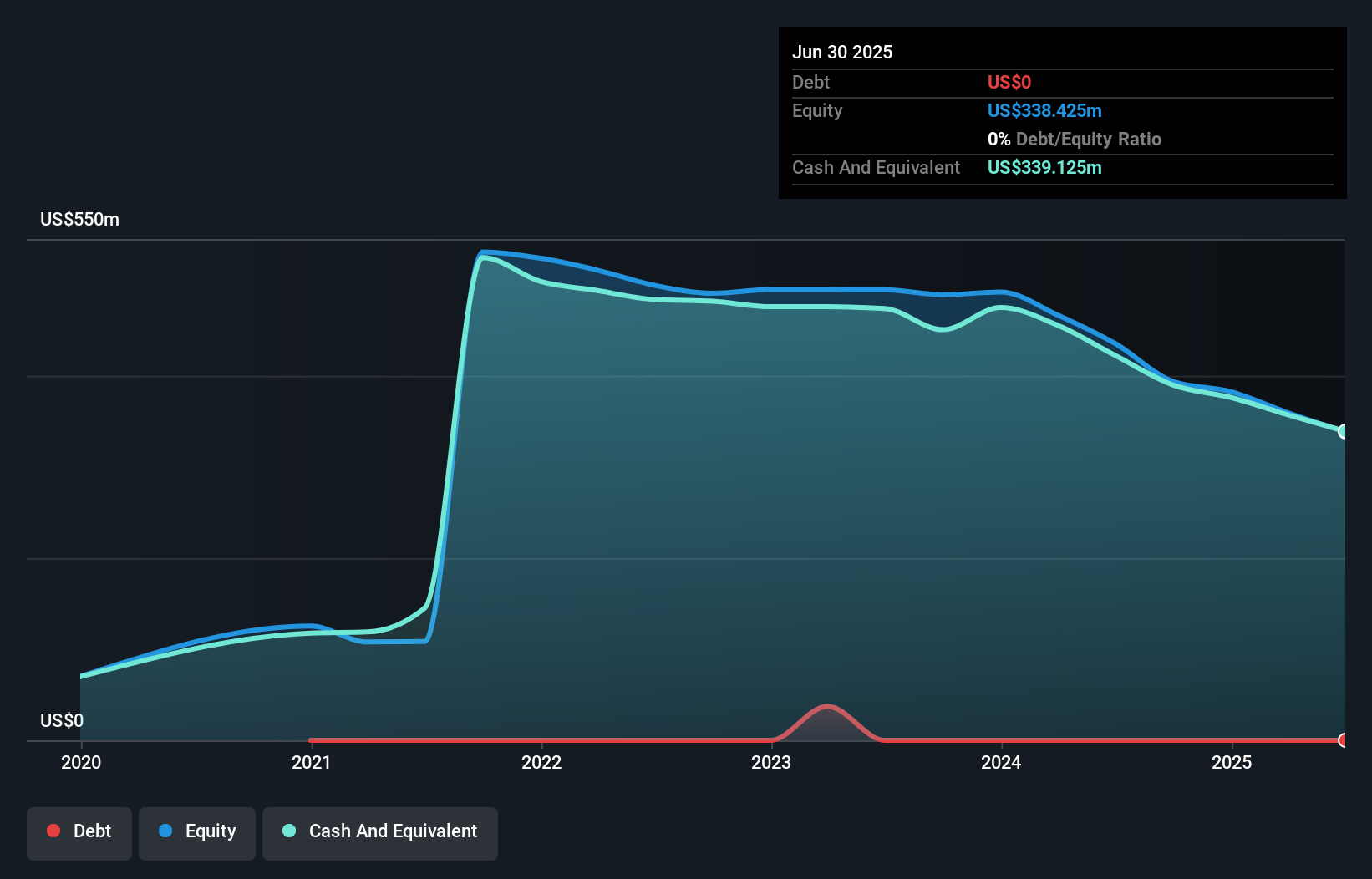

Riskified Ltd., with a market cap of US$732.43 million, operates an e-commerce risk intelligence platform and has shown resilience despite being unprofitable. The company has reduced its losses over the past five years by 7% annually and maintains a cash runway exceeding three years due to positive free cash flow growth. Riskified's short-term assets of US$433.7 million comfortably cover both short-term and long-term liabilities, while it remains debt-free. Recent developments include the launch of Adaptive Checkout to enhance fraud prevention, alongside strategic buybacks totaling 8.48% of shares for US$75 million, reflecting confidence in its business model amidst takeover interest discussions.

- Click to explore a detailed breakdown of our findings in Riskified's financial health report.

- Gain insights into Riskified's future direction by reviewing our growth report.

Seize The Opportunity

- Unlock our comprehensive list of 762 US Penny Stocks by clicking here.

- Seeking Other Investments? Explore 21 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Ranpak Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PACK

Ranpak Holdings

Provides product protection solutions and end-of-line automation solutions for e-commerce and industrial supply chains in North America, Europe, and Asia.

Adequate balance sheet very low.

Similar Companies

Market Insights

Community Narratives