- United States

- /

- Consumer Finance

- /

- NasdaqGS:LX

3 Penny Stocks With At Least $100M Market Cap

Reviewed by Simply Wall St

Major stock indexes in the United States have started the holiday-shortened week on a positive note, with technology shares continuing to drive gains. While the term "penny stock" might seem outdated, it still holds significance for investors seeking opportunities in smaller or newer companies. These stocks can offer potential growth at lower price points, especially when they are backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.54 | $544.33M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.95 | $705.24M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.931 | $159.22M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.30 | $555.27M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.27 | $1.37B | ✅ 4 ⚠️ 1 View Analysis > |

| Global Self Storage (SELF) | $4.96 | $56.24M | ✅ 3 ⚠️ 3 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| VAALCO Energy (EGY) | $3.43 | $357.61M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.89015 | $6.47M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.71 | $84.05M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 343 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Cardiff Oncology (CRDF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cardiff Oncology, Inc. is a clinical-stage biotechnology company focused on developing novel therapies for cancer treatment, with a market cap of $173.12 million.

Operations: The company's revenue is primarily derived from its efforts in developing innovative cancer therapies, totaling $0.50 million.

Market Cap: $173.12M

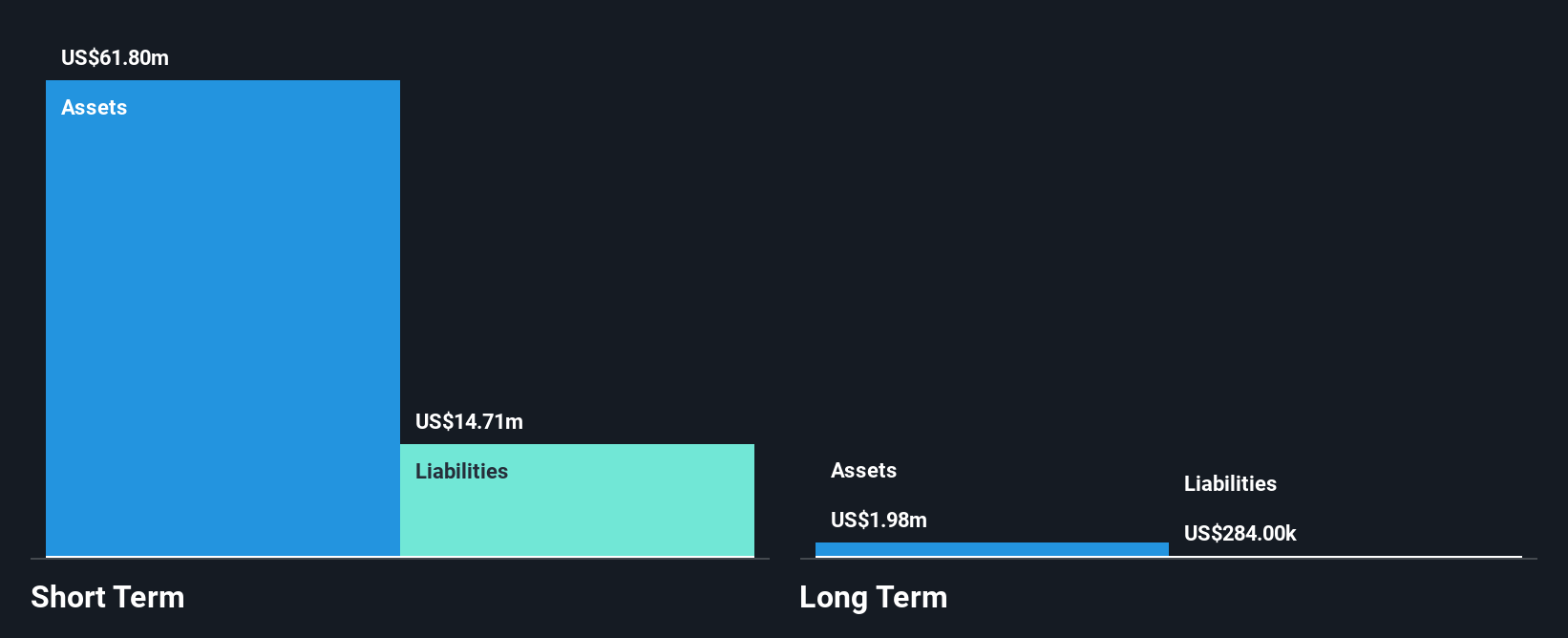

Cardiff Oncology operates as a pre-revenue biotech firm with a market cap of US$173.12 million, focusing on innovative cancer therapies. Recent clinical data presented at the ASH Annual Meeting highlighted promising results for its drug candidate, onvansertib, in chronic myelomonocytic leukemia. Despite these developments, Cardiff remains unprofitable and is forecasted to continue this trend over the next three years. The company has no debt and maintains sufficient cash runway for over a year but faces declining earnings projections. Its management team is experienced with an average tenure of 3.9 years, providing stability amidst its financial challenges.

- Get an in-depth perspective on Cardiff Oncology's performance by reading our balance sheet health report here.

- Explore Cardiff Oncology's analyst forecasts in our growth report.

LexinFintech Holdings (LX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LexinFintech Holdings Ltd. operates in the People’s Republic of China, providing online direct sales and consumer finance services, with a market cap of approximately $555.27 million.

Operations: The company's revenue is primarily generated from online retailers, amounting to CN¥13.77 billion.

Market Cap: $555.27M

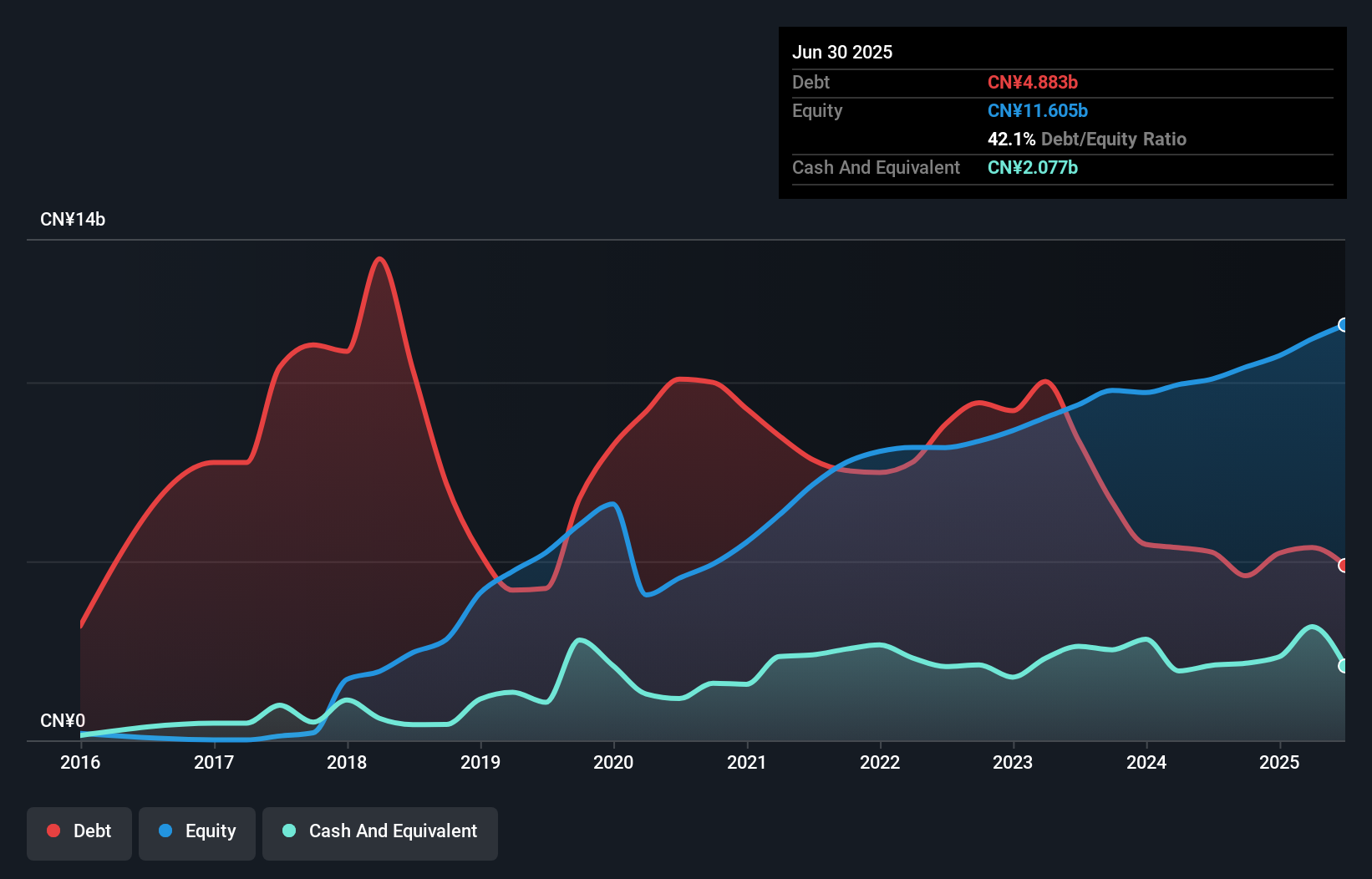

LexinFintech Holdings, with a market cap of approximately $555.27 million, demonstrates financial stability and growth potential within the consumer finance sector. The company boasts strong earnings growth over the past year, significantly outpacing industry averages. Its net profit margins have improved from 5.3% to 13.3%, reflecting enhanced operational efficiency. Despite revenue decline to CN¥10.11 billion for nine months ending September 2025, net income rose substantially to CN¥1,462.99 million due to effective cost management and high-quality earnings. The company's debt is well-covered by operating cash flow and interest payments are comfortably managed by EBIT, indicating sound financial health amidst market volatility.

- Unlock comprehensive insights into our analysis of LexinFintech Holdings stock in this financial health report.

- Evaluate LexinFintech Holdings' prospects by accessing our earnings growth report.

Blend Labs (BLND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Blend Labs, Inc. offers a cloud-based software platform for financial services firms in the United States and has a market cap of approximately $802.62 million.

Operations: The company generates revenue primarily through its Blend Platform, which accounts for $121.28 million, with an additional segment adjustment of $46.26 million.

Market Cap: $802.62M

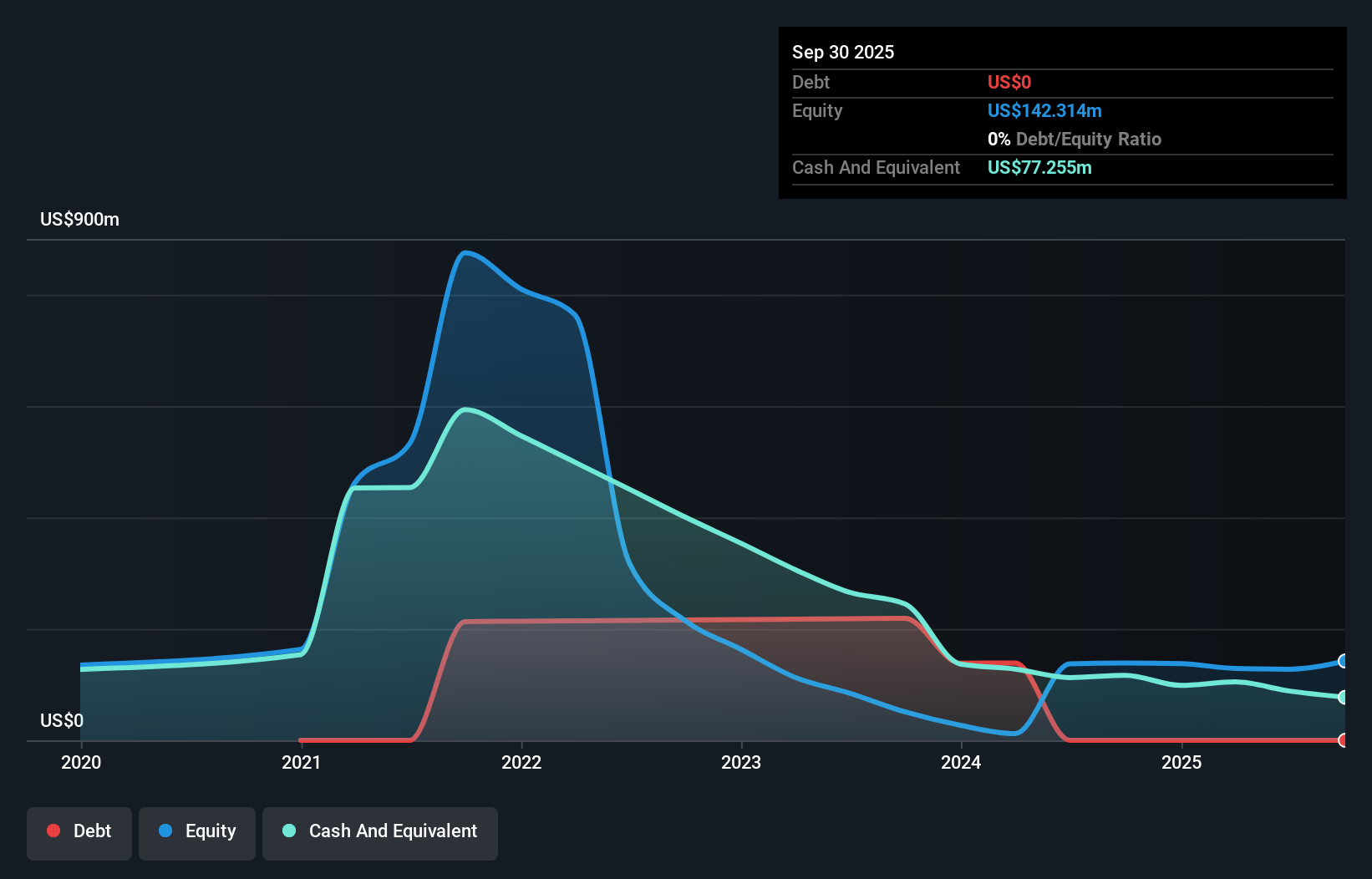

Blend Labs, Inc., with a market cap of approximately US$802.62 million, has shown progress in reducing losses and improving its financial standing despite being unprofitable. The company reported third-quarter revenue of US$32.86 million and net income of US$12.53 million, a significant turnaround from a net loss last year. Its recent AI-powered Intelligent Origination system aims to transform lending processes by integrating AI into core operations, potentially lowering costs and cycle times for lenders. Blend's debt-free status and sufficient cash runway for over three years provide some financial stability amidst ongoing operational challenges.

- Take a closer look at Blend Labs' potential here in our financial health report.

- Gain insights into Blend Labs' outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Navigate through the entire inventory of 343 US Penny Stocks here.

- Seeking Other Investments? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LX

LexinFintech Holdings

Offers online direct sales and online consumer finance services in the People’s Republic of China.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion