- United States

- /

- Diversified Financial

- /

- NYSE:CPAY

Discover Advanced Micro Devices Among 3 Stocks Possibly Priced Below Intrinsic Value Estimates

Reviewed by Simply Wall St

As the U.S. market rebounds from a recent downturn, with major indices like the Dow Jones and S&P 500 showing signs of recovery, investors are eyeing opportunities amid ongoing economic uncertainties and policy developments. In this context, identifying stocks that may be undervalued can offer potential advantages, especially when considering companies like Advanced Micro Devices that could be trading below their intrinsic value estimates.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Dime Community Bancshares (NasdaqGS:DCOM) | $28.34 | $56.31 | 49.7% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | $31.29 | $61.41 | 49% |

| Berkshire Hills Bancorp (NYSE:BHLB) | $26.15 | $51.75 | 49.5% |

| Pure Storage (NYSE:PSTG) | $50.69 | $99.56 | 49.1% |

| KBR (NYSE:KBR) | $51.05 | $101.68 | 49.8% |

| Datadog (NasdaqGS:DDOG) | $103.97 | $206.31 | 49.6% |

| Similarweb (NYSE:SMWB) | $9.30 | $18.51 | 49.7% |

| Alaska Air Group (NYSE:ALK) | $55.15 | $109.03 | 49.4% |

| Gold Royalty (NYSEAM:GROY) | $1.56 | $3.08 | 49.4% |

| Driven Brands Holdings (NasdaqGS:DRVN) | $17.48 | $34.44 | 49.2% |

Let's take a closer look at a couple of our picks from the screened companies.

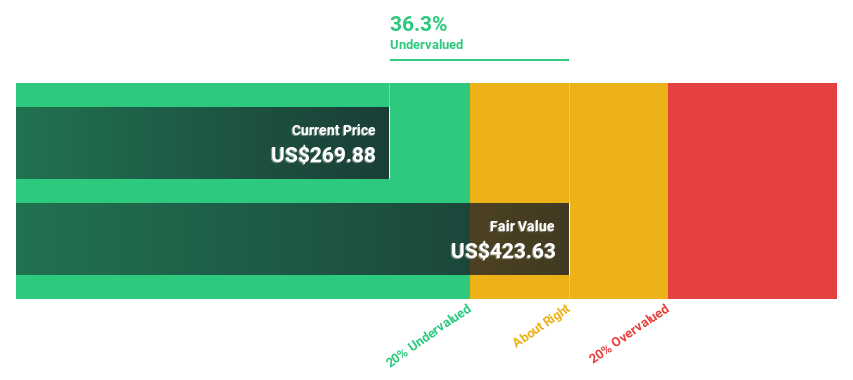

Advanced Micro Devices (NasdaqGS:AMD)

Overview: Advanced Micro Devices, Inc. is a global semiconductor company with a market capitalization of approximately $163.62 billion.

Operations: Advanced Micro Devices generates revenue from several segments, including Client at $7.05 billion, Gaming at $2.60 billion, Embedded at $3.56 billion, and Data Center at $12.58 billion.

Estimated Discount To Fair Value: 48.7%

Advanced Micro Devices (AMD) appears undervalued based on discounted cash flow analysis, trading at US$104.59, significantly below the estimated fair value of US$203.69. Despite a recent fixed-income offering of $1.5 billion to strengthen its financial position, AMD's earnings are expected to grow 32% annually, outpacing the broader US market growth rate of 13.9%. The company's strategic product expansions and collaborations further enhance its potential for robust cash flow generation in competitive markets.

- Our expertly prepared growth report on Advanced Micro Devices implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Advanced Micro Devices with our comprehensive financial health report here.

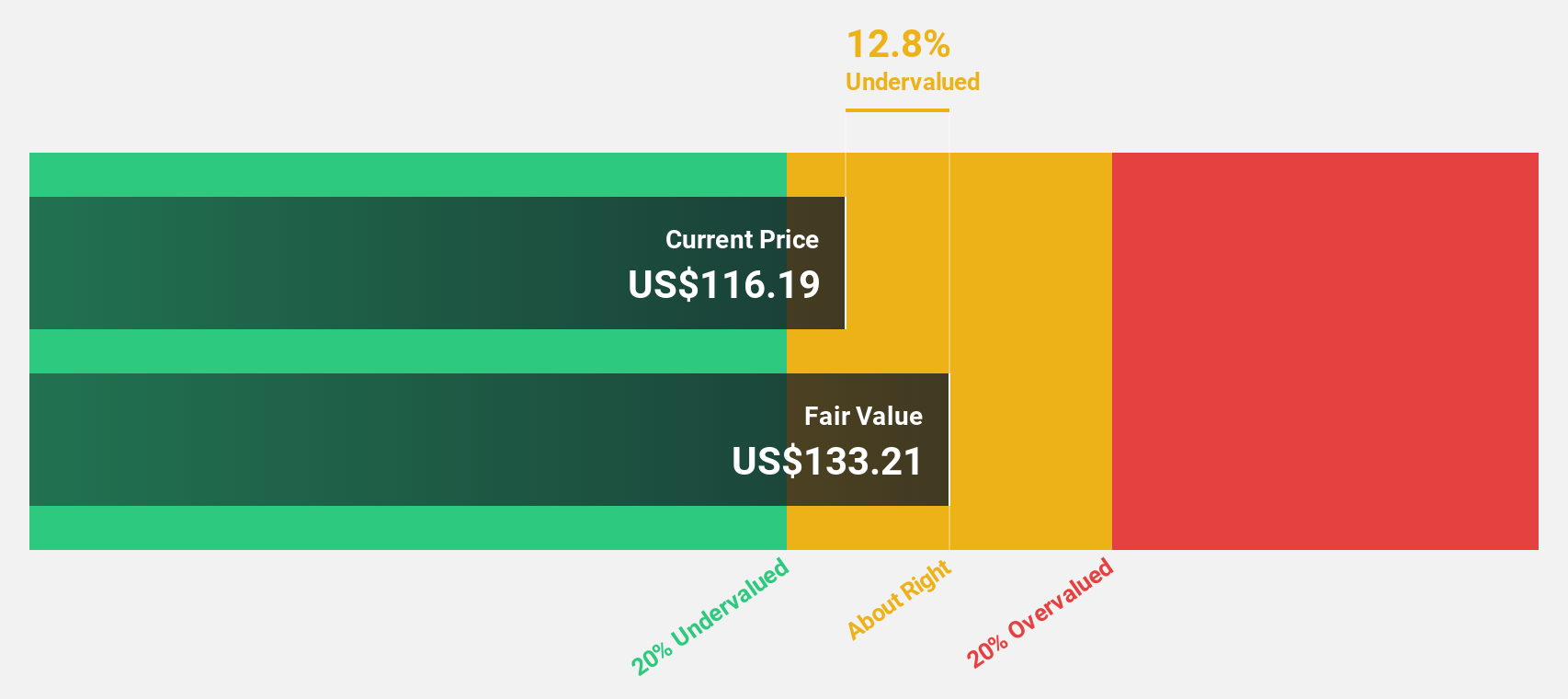

Workday (NasdaqGS:WDAY)

Overview: Workday, Inc. offers enterprise cloud applications globally, with a market capitalization of approximately $65.04 billion.

Operations: The company's revenue is primarily derived from its cloud applications segment, which generated $8.45 billion.

Estimated Discount To Fair Value: 36.5%

Workday is trading at US$250.62, significantly below its estimated fair value of US$394.47, suggesting it is undervalued based on discounted cash flow analysis. The company's earnings are projected to grow 27.7% annually, surpassing the US market's growth rate of 13.9%. Recent strategic partnerships and product integrations enhance Workday's offerings in AI-driven workforce solutions, potentially boosting its cash flow generation capabilities despite recent profit margin declines.

- Our growth report here indicates Workday may be poised for an improving outlook.

- Dive into the specifics of Workday here with our thorough financial health report.

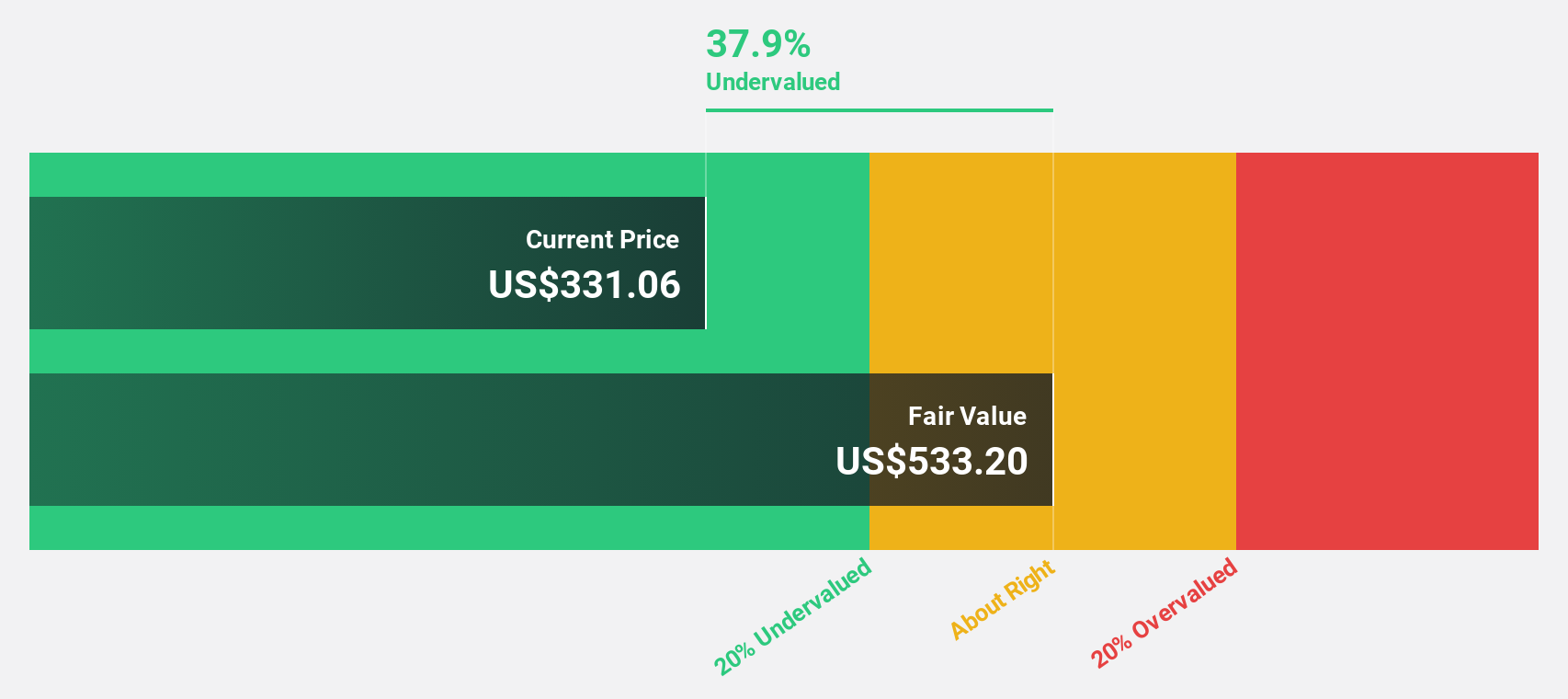

Corpay (NYSE:CPAY)

Overview: Corpay, Inc. is a payments company that facilitates the management of vehicle-related expenses, lodging expenses, and corporate payments for businesses and consumers across the United States, Brazil, the United Kingdom, and internationally; it has a market cap of $23.73 billion.

Operations: Corpay's revenue is primarily derived from vehicle payments ($2.01 billion), corporate payments ($1.22 billion), and lodging payments ($488.59 million).

Estimated Discount To Fair Value: 35.1%

Corpay, trading at US$347.31, is significantly undervalued compared to its fair value estimate of US$535.19 based on discounted cash flow analysis. The company's earnings are forecast to grow 15.6% annually, outpacing the broader US market's growth rate of 13.9%. Recent strategic partnerships with SK Slavia Praha and the Federation Internationale de Gymnastique enhance its cross-border solutions, potentially strengthening cash flow despite a high debt level and moderate revenue growth projections.

- Insights from our recent growth report point to a promising forecast for Corpay's business outlook.

- Click to explore a detailed breakdown of our findings in Corpay's balance sheet health report.

Next Steps

- Click this link to deep-dive into the 199 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPAY

Corpay

Operates as a payments company that helps businesses and consumers manage vehicle-related expenses, lodging expenses, and corporate payments in the United States, Brazil, the United Kingdom, and internationally.

Reasonable growth potential and fair value.