- United States

- /

- IT

- /

- NasdaqGS:VRSN

VeriSign (NasdaqGS:VRSN) Announces Increased Earnings And $0.77 Dividend

Reviewed by Simply Wall St

VeriSign (NasdaqGS:VRSN) has demonstrated strong shareholder returns with a 20% increase over the past quarter, bolstered by significant financial achievements. The company's declaration of a quarterly cash dividend signals confidence in its financial stability, contributing positively to investor sentiment. The first-quarter earnings report showcased a rise in sales and net income, likely reinforcing market confidence. These developments come during a period when broader market indices experienced gains, including a 4% weekly climb, making VeriSign's moves largely consistent with overall market trends. This alignment suggests that recent company actions supported broader market positive momentum.

The recent announcement of VeriSign's quarterly cash dividend and positive financial results contributes to the company's perception of stability, which may enhance investor confidence. Over the extended period of the past year, VeriSign's total shareholder return, including share price and dividends, was 38.3%. This performance surpasses the US IT industry average, which achieved an 11.8% return over the same timeframe. Furthermore, amidst the backdrop of rising broader market indices, VeriSign's 20% increase over the past quarter aligns with this momentum, reflecting its resilience in the current market conditions.

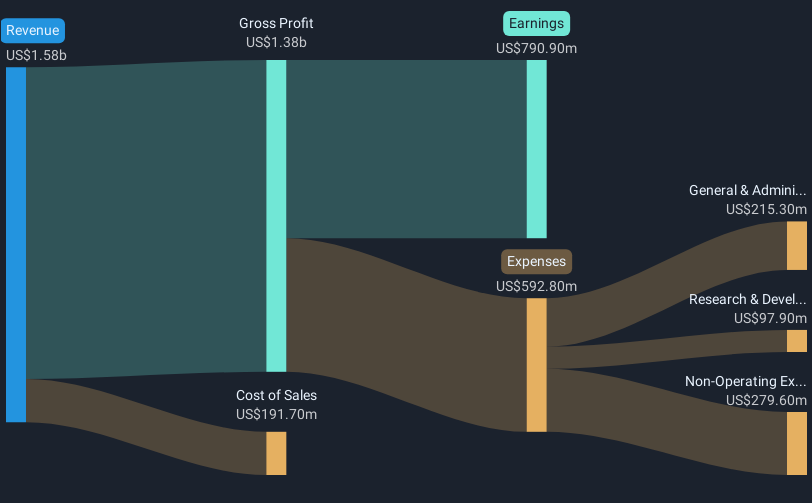

The latest developments, such as enhanced marketing strategies, may positively influence VeriSign's future revenue and earnings forecasts. Analysts project revenue to grow 4.7% annually over the next three years, while earnings are expected to increase to US$899 million by 2028. This narrative presupposes the successful re-engagement of registrars and domain stabilization efforts. However, the reality of market challenges, including declines in domain registrations, could pressure these forecasts. The current share price of US$248.08 remains slightly above the consensus analyst price target of US$235.28, suggesting a 5.4% share price premium. This disparity reinforces the importance of aligning individual investment expectations with market projections.

The valuation report we've compiled suggests that VeriSign's current price could be quite moderate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade VeriSign, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRSN

VeriSign

Provides internet infrastructure and domain name registry services that enables internet navigation for various recognized domain names worldwide.

Fair value low.

Similar Companies

Market Insights

Community Narratives