- United States

- /

- Software

- /

- NasdaqGS:TENB

Possible Bearish Signals With Tenable Holdings Insiders Disposing Stock

Tenable Holdings, Inc. (NASDAQ:TENB) shareholders may have reason to be concerned, as several insiders sold their shares over the past year. When analyzing insider transactions, it is usually more valuable to know whether insiders are buying versus knowing if they are selling, as the latter sends an ambiguous message. However, when multiple insiders sell stock over a specific duration, shareholders should take notice as that could possibly be a red flag.

While we would never suggest that investors should base their decisions solely on what the directors of a company have been doing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

Tenable Holdings Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by the Co-CEO & Director, Stephen Vintz, for US$495k worth of shares, at about US$38.19 per share. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. The silver lining is that this sell-down took place above the latest price (US$26.52). So it is hard to draw any strong conclusion from it.

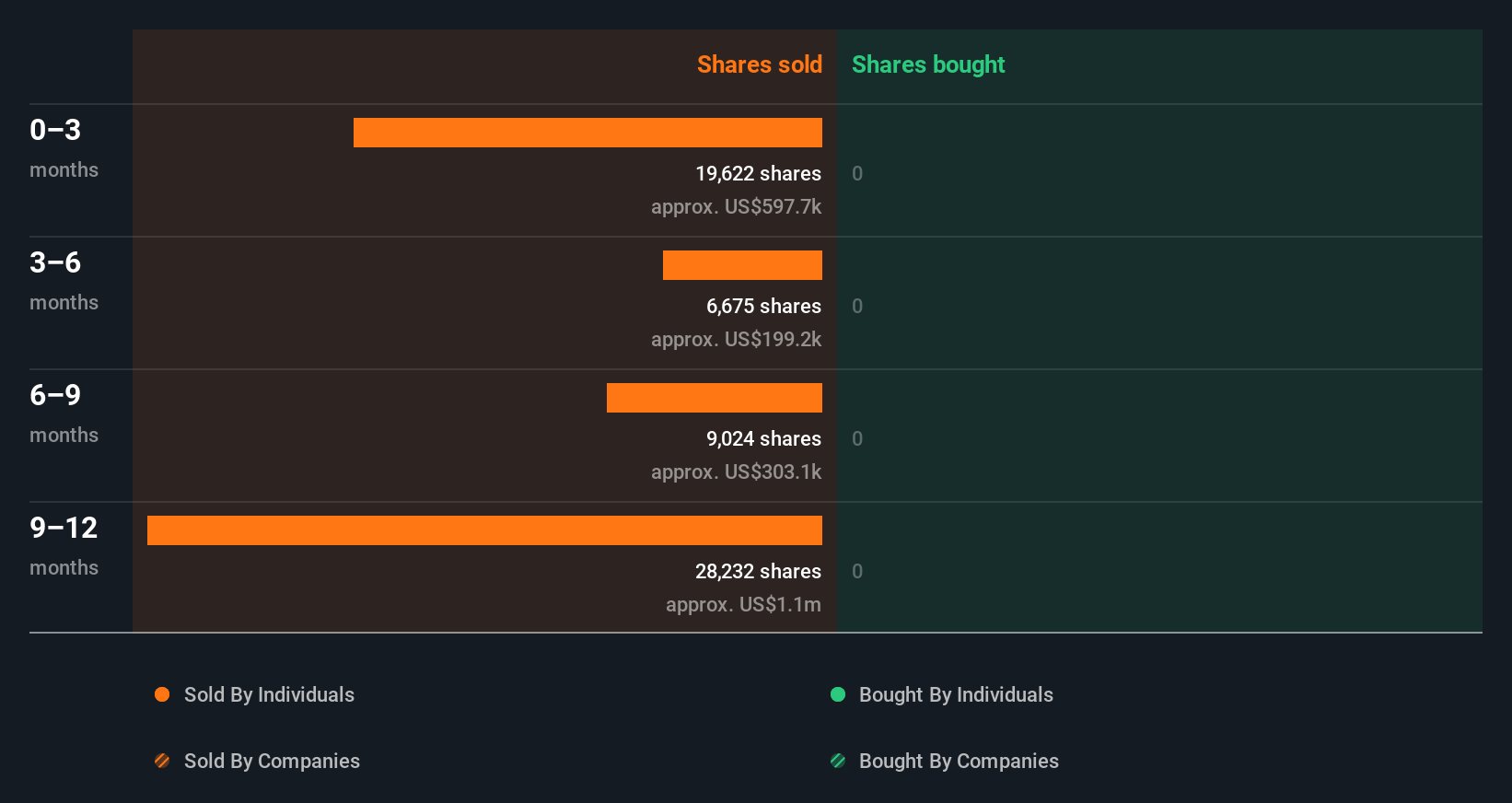

In the last year Tenable Holdings insiders didn't buy any company stock. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

Check out our latest analysis for Tenable Holdings

For those who like to find hidden gems this free list of small cap companies with recent insider purchasing, could be just the ticket.

Tenable Holdings Insiders Are Selling The Stock

The last quarter saw substantial insider selling of Tenable Holdings shares. In total, Independent Director A. Seawell sold US$601k worth of shares in that time, and we didn't record any purchases whatsoever. In light of this it's hard to argue that all the insiders think that the shares are a bargain.

Does Tenable Holdings Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. A high insider ownership often makes company leadership more mindful of shareholder interests. It appears that Tenable Holdings insiders own 1.0% of the company, worth about US$32m. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

So What Does This Data Suggest About Tenable Holdings Insiders?

An insider sold stock recently, but they haven't been buying. And even if we look at the last year, we didn't see any purchases. Insiders own shares, but we're still pretty cautious, given the history of sales. So we'd only buy after careful consideration. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. To assist with this, we've discovered 1 warning sign that you should run your eye over to get a better picture of Tenable Holdings.

But note: Tenable Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tenable Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TENB

Tenable Holdings

Provides cyber exposure management solutions in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026