- United States

- /

- Capital Markets

- /

- NYSE:BRDG

US Growth Companies With High Insider Ownership In September 2024

Reviewed by Simply Wall St

In September 2024, the U.S. stock market has seen a mix of record highs and subsequent pullbacks, largely driven by the Federal Reserve's aggressive rate cuts aimed at bolstering a cooling labor market. Amid this backdrop of volatility and opportunity, growth companies with high insider ownership stand out as potentially strong investments due to their alignment of interests between management and shareholders. In such an environment, stocks where insiders hold significant shares can be particularly appealing because they suggest confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 23.2% |

| GigaCloud Technology (NasdaqGM:GCT) | 25.7% | 24.3% |

| Victory Capital Holdings (NasdaqGS:VCTR) | 10.2% | 32.3% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Super Micro Computer (NasdaqGS:SMCI) | 25.7% | 28.0% |

| Hims & Hers Health (NYSE:HIMS) | 13.7% | 40.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| BBB Foods (NYSE:TBBB) | 22.9% | 51.2% |

| Carlyle Group (NasdaqGS:CG) | 29.5% | 22% |

We're going to check out a few of the best picks from our screener tool.

Silvaco Group (NasdaqGS:SVCO)

Simply Wall St Growth Rating: ★★★★☆☆

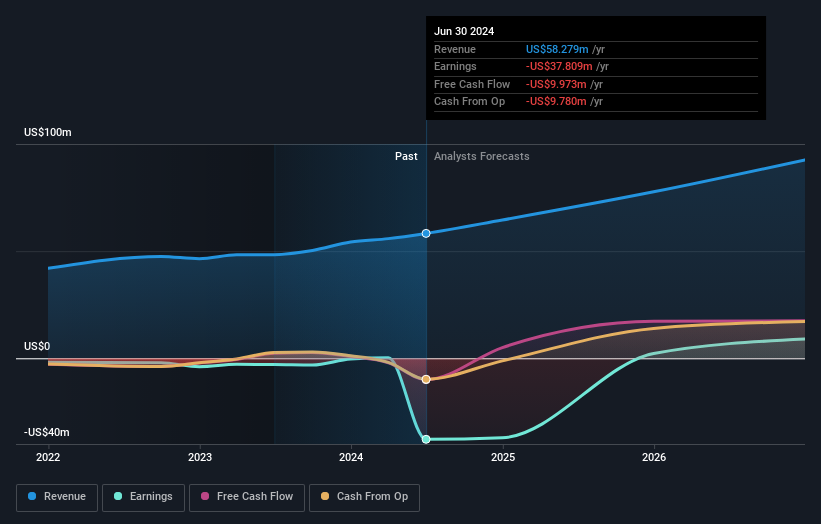

Overview: Silvaco Group, Inc. specializes in TCAD software, EDA software, and SIP solutions with a market cap of approximately $394.68 million.

Operations: The company's revenue segments include Software & Programming, generating $58.28 million.

Insider Ownership: 37.2%

Earnings Growth Forecast: 92.3% p.a.

Silvaco Group, Inc. shows strong growth potential with high insider ownership, expected to become profitable within three years and forecasted earnings growth of 92.26% annually. Despite a recent net loss of US$38.39 million for Q2 2024, revenue increased to US$14.96 million from US$12.53 million year-over-year. Analysts predict a 61% stock price rise, and the company maintains its full-year revenue guidance of up to US$66 million, indicating robust future performance expectations.

- Take a closer look at Silvaco Group's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Silvaco Group shares in the market.

Bridge Investment Group Holdings (NYSE:BRDG)

Simply Wall St Growth Rating: ★★★★★★

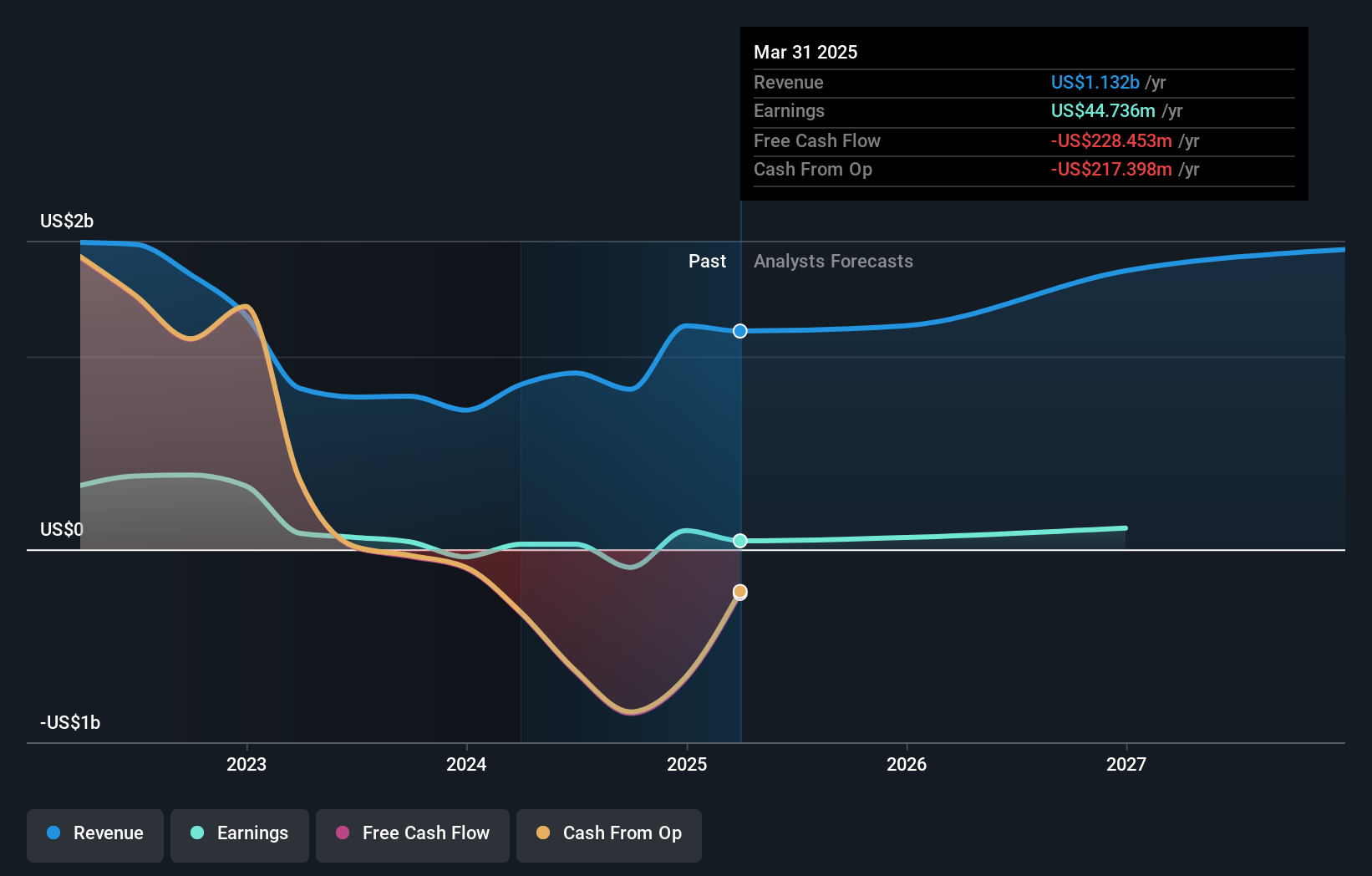

Overview: Bridge Investment Group Holdings Inc. operates in the real estate investment management sector in the United States with a market cap of $1.10 billion.

Operations: Bridge Investment Group Holdings generates $368.47 million from its fully integrated real estate investment management operations in the United States.

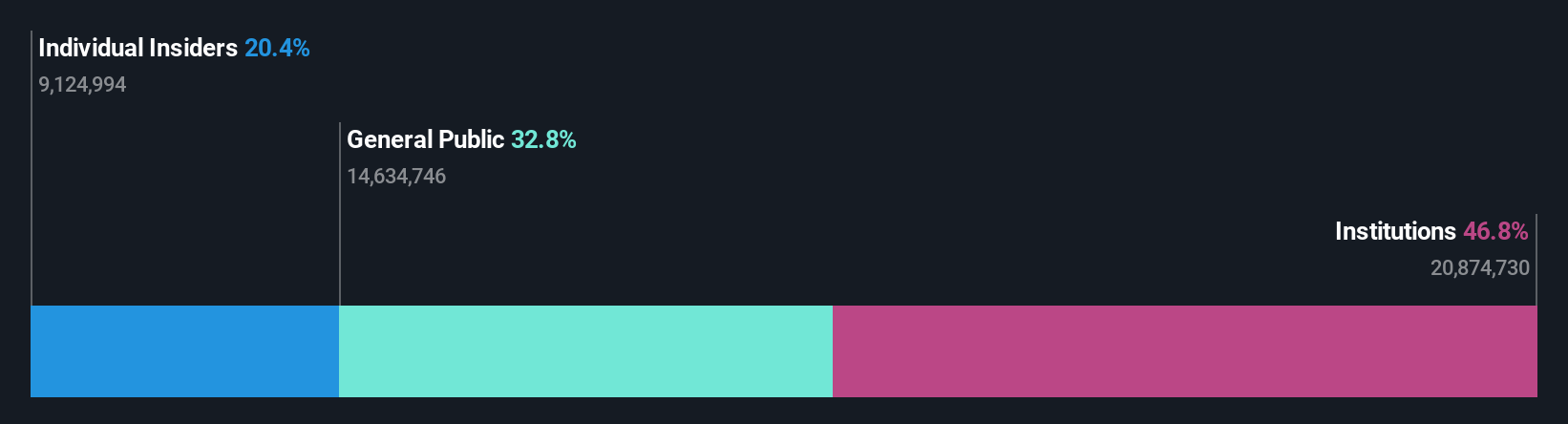

Insider Ownership: 11.3%

Earnings Growth Forecast: 102.3% p.a.

Bridge Investment Group Holdings demonstrates strong growth potential with high insider ownership. The company reported Q2 2024 revenue of US$104.76 million, up from US$98.8 million a year ago, and net income rose significantly to US$13.67 million from US$1.43 million. Despite past shareholder dilution and substantial insider selling over the last quarter, BRDG is forecasted to grow earnings by 102% annually and achieve profitability within three years, outpacing market expectations.

- Unlock comprehensive insights into our analysis of Bridge Investment Group Holdings stock in this growth report.

- The analysis detailed in our Bridge Investment Group Holdings valuation report hints at an deflated share price compared to its estimated value.

Guild Holdings (NYSE:GHLD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guild Holdings Company originates, sells, and services residential mortgage loans in the United States, with a market cap of $1.03 billion.

Operations: Guild Holdings generates revenue from two primary segments: Servicing ($173.23 million) and Origination ($623.64 million).

Insider Ownership: 11.5%

Earnings Growth Forecast: 32.8% p.a.

Guild Holdings shows potential as a growth company with high insider ownership. Earnings are forecasted to grow 32.84% annually, outpacing the US market's 15.2%. Despite lower profit margins (3%) compared to last year (7.9%), Q2 revenue increased to US$285.69 million from US$236.81 million a year ago, with net income rising slightly to US$37.58 million from US$36.94 million. Recent initiatives include an AI system, GuildGPT, enhancing operational efficiency and customer service for its mortgage professionals.

- Navigate through the intricacies of Guild Holdings with our comprehensive analyst estimates report here.

- The analysis detailed in our Guild Holdings valuation report hints at an inflated share price compared to its estimated value.

Turning Ideas Into Actions

- Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 178 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Bridge Investment Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRDG

Bridge Investment Group Holdings

Engages in the real estate investment management business in the United States.

High growth potential slight.