- United States

- /

- Software

- /

- NasdaqGS:SPNS

Does Sapiens International’s 65% Rally Continue After Strong Digital Insurance Momentum in 2025?

Reviewed by Simply Wall St

If you’re staring at Sapiens International’s stock chart and wondering whether it’s time to buy, hold, or move on, you’re in good company. After all, the past few years have seen Sapiens International deliver an eye-catching 125.0% return over three years, with gains of 64.8% in just the current year to date. Even if the last 30 days have been relatively quiet, up only 0.7%, that long-term upward climb is hard to ignore. Market watchers have noted that much of this momentum stems from new digital insurance adoption trends, which have played right into Sapiens International’s core strengths. These shifts have generally boosted investor confidence, translating into a more favorable risk perception.

But impressive returns are only half the story. If you’re truly looking to make an informed decision, it’s worth digging deeper into the valuation. Our latest analysis puts Sapiens International at a value score of 1 out of 6, meaning it’s currently undervalued in just one area on our checklist. What exactly does that mean for your investment thesis? In the next sections, I’ll walk you through how we arrived at this score using several time-tested valuation methods. Just as importantly, there may be an even smarter approach you haven’t considered yet.

Sapiens International scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Sapiens International Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates how much a company is worth by forecasting its future cash flows and then discounting those cash flows back to today's value. This helps investors gauge the true, or intrinsic, value of a stock beyond its current market price.

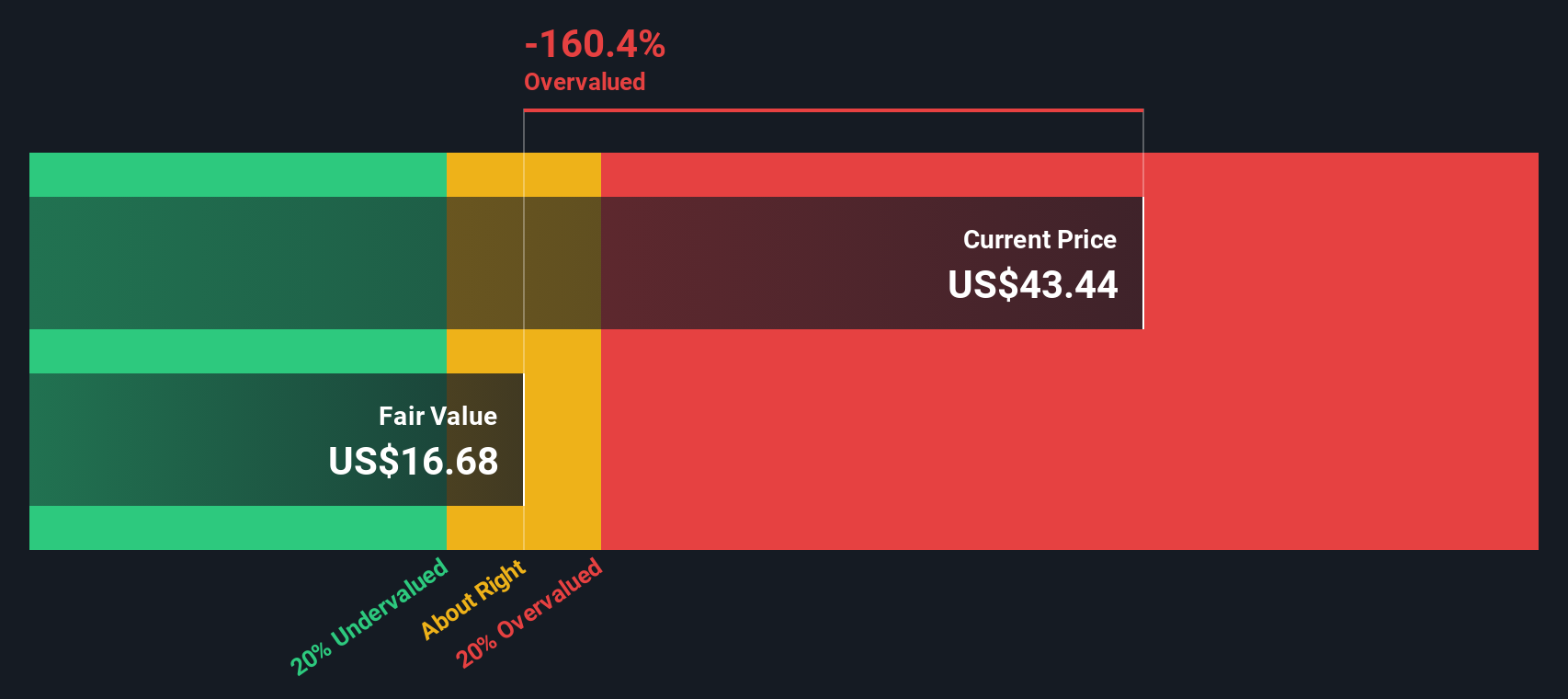

For Sapiens International, the DCF model looks at its Free Cash Flow (FCF), which currently stands at $72.4 million. Analysts have projected that the company’s FCF will increase to $100.3 million by 2026. For the years after that, Simply Wall St extrapolates continued growth, reaching an estimated $182.4 million by 2035. All projections and discounting are performed in US dollars.

Based on these projections and using the 2 Stage Free Cash Flow to Equity approach, the estimated intrinsic value of Sapiens International shares is $30.62. However, compared to the current share price, this DCF model suggests the stock is 40.4% overvalued. In other words, the market price is well above the company’s calculated fair value.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Sapiens International.

Approach 2: Sapiens International Price vs Earnings

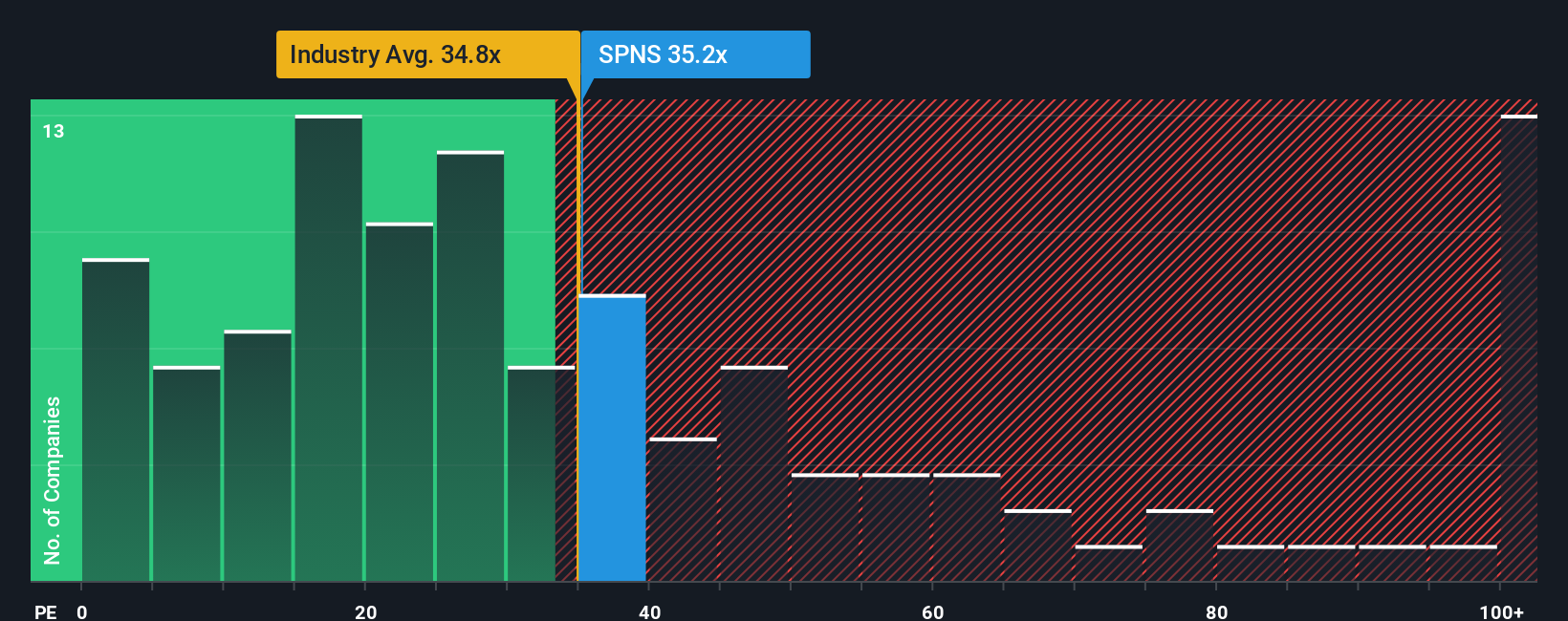

For profitable companies like Sapiens International, the Price-to-Earnings (PE) ratio is a go-to metric for investors because it tells you how much you’re paying for each dollar of earnings. Generally, companies with strong growth prospects or lower risk command a higher PE ratio, while those with slower growth or more uncertainty are valued at a lower PE. This is why the “right” PE isn’t a fixed number; it reflects growth expectations, industry conditions, and overall investor sentiment.

Currently, Sapiens International trades at a PE ratio of 35.2x. For context, the software industry average is roughly 35.2x, and the average among its peer companies sits higher at 52.8x. On its face, Sapiens International appears somewhere between fairly valued and conservative compared to both its peers and the overall sector.

To get a more precise picture, Simply Wall St calculates a “Fair Ratio.” This proprietary benchmark uses a blend of company-specific factors, such as earnings growth, profit margins, risks, market cap, and industry, to estimate what a reasonable PE should be for Sapiens International right now. Because it’s tailored, the Fair Ratio helps cut through market noise and looks past simple averages.

For Sapiens International, the Fair Ratio is 28.9x. Since the current PE ratio is only moderately higher than the Fair Ratio, the shares are trading a little above their tailored fair value, but not alarmingly so. This suggests the market may be factoring in slightly more optimistic growth or lower risk than our model.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Sapiens International Narrative

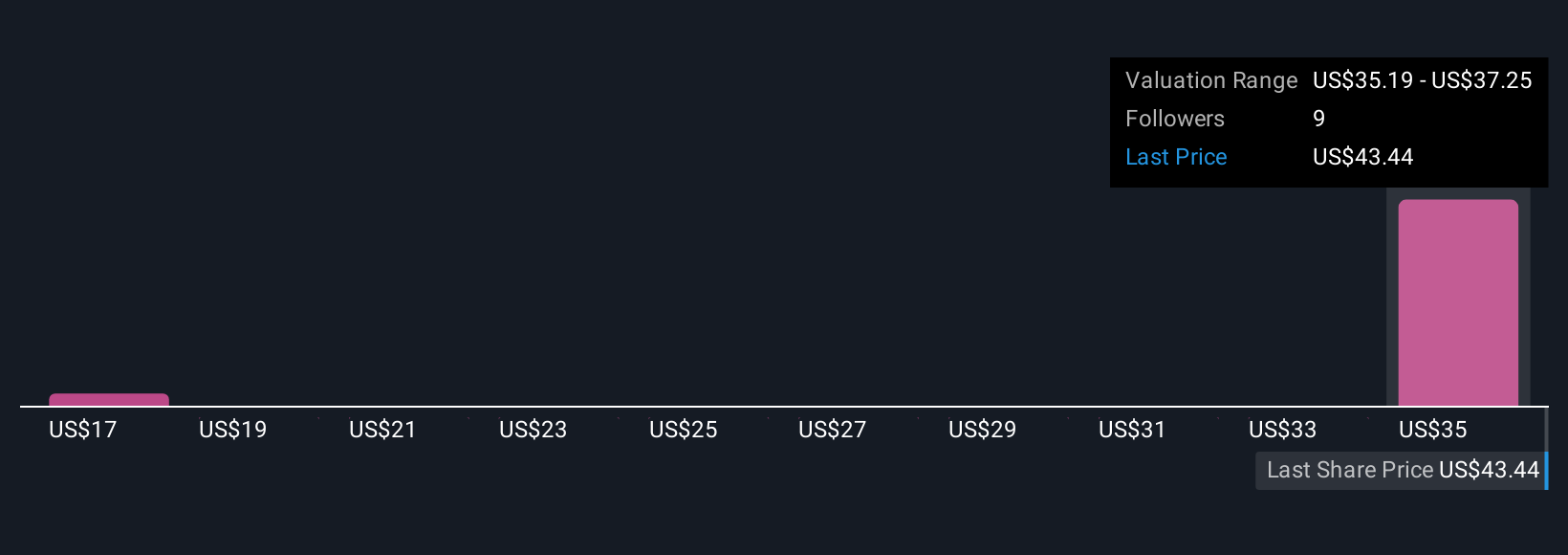

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is an investment story that connects your view of a company, like Sapiens International, to specific financial forecasts and a resulting fair value. This approach places your assumptions about future revenue, earnings, and margins at the center of the discussion.

Rather than focusing only on past numbers, Narratives let you explain why you believe Sapiens International’s performance could take a certain path and what that means for its value today. You can easily create your own Narrative or explore those from other investors directly on the Community page on Simply Wall St, where millions share ideas and scenarios.

Narratives empower you to compare your fair value to the current share price, making your decision on whether to buy, hold, or sell more grounded in your expectations and less about guessing market sentiment. Because Narratives update automatically with new events, earnings releases, or news, you can always see how fresh information changes the outlook and fair value.

For example, one investor might build a bullish Narrative for Sapiens International with a future fair value of $43.5 based on rapid SaaS adoption and strong AI-driven margin gains. A more cautious investor may set their fair value closer to $27, reflecting concerns over integration risks and slower growth.

Do you think there's more to the story for Sapiens International? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SPNS

Sapiens International

Provides software solutions for the insurance industry in North America, the United Kingdom, Europe and internationally.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)