- United States

- /

- Software

- /

- NasdaqGM:RPD

A Fresh Look at Rapid7 (RPD) Valuation Following Prolonged Share Price Decline

Reviewed by Simply Wall St

See our latest analysis for Rapid7.

Rapid7’s share price continues to lose steam, with a 1-day decline of 1.3% and a year-to-date plunge of nearly 52%. Despite a small uptick last week, momentum remains negative, and the total shareholder return over the past year has dropped just over 51%, deepening longer-term losses. At current levels, investors appear to be reassessing growth prospects and risk across cybersecurity firms.

If you’re looking to discover opportunities outside of the current cybersecurity shakeup, now is a good time to broaden your search and explore fast growing stocks with high insider ownership

With Rapid7 trading at a significant discount to analyst price targets, investors are left wondering whether the recent slide is an opportunity to buy in at a bargain or if the market is simply pricing in muted future growth.

Most Popular Narrative: 23.3% Undervalued

Rapid7’s most widely followed valuation narrative places its fair value comfortably above the last close. This suggests analysts see potential for a substantial rebound. The current gap between market sentiment and this projection creates an interesting discussion about growth drivers the market may be underestimating.

Rapid7's unified Command platform and MDR-led solutions are increasingly winning larger, strategic consolidation deals as enterprises seek to reduce fragmentation and simplify compliance in complex, highly regulated environments. This points to an expanding addressable market, higher average revenue per customer, and sustained revenue growth opportunity.

Curious what’s fueling this optimistic outlook? The narrative hinges on bold assumptions for margin expansion, recurring SaaS revenue, and the long-term payoff from AI-infused platform plays. Only the full breakdown reveals which forecasts tip the scales so sharply. Don’t miss the details analysts are betting on.

Result: Fair Value of $24.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, longer deal cycles and persistent challenges in legacy product growth could undermine analysts' optimism and limit Rapid7’s ability to deliver consistent upside.

Find out about the key risks to this Rapid7 narrative.

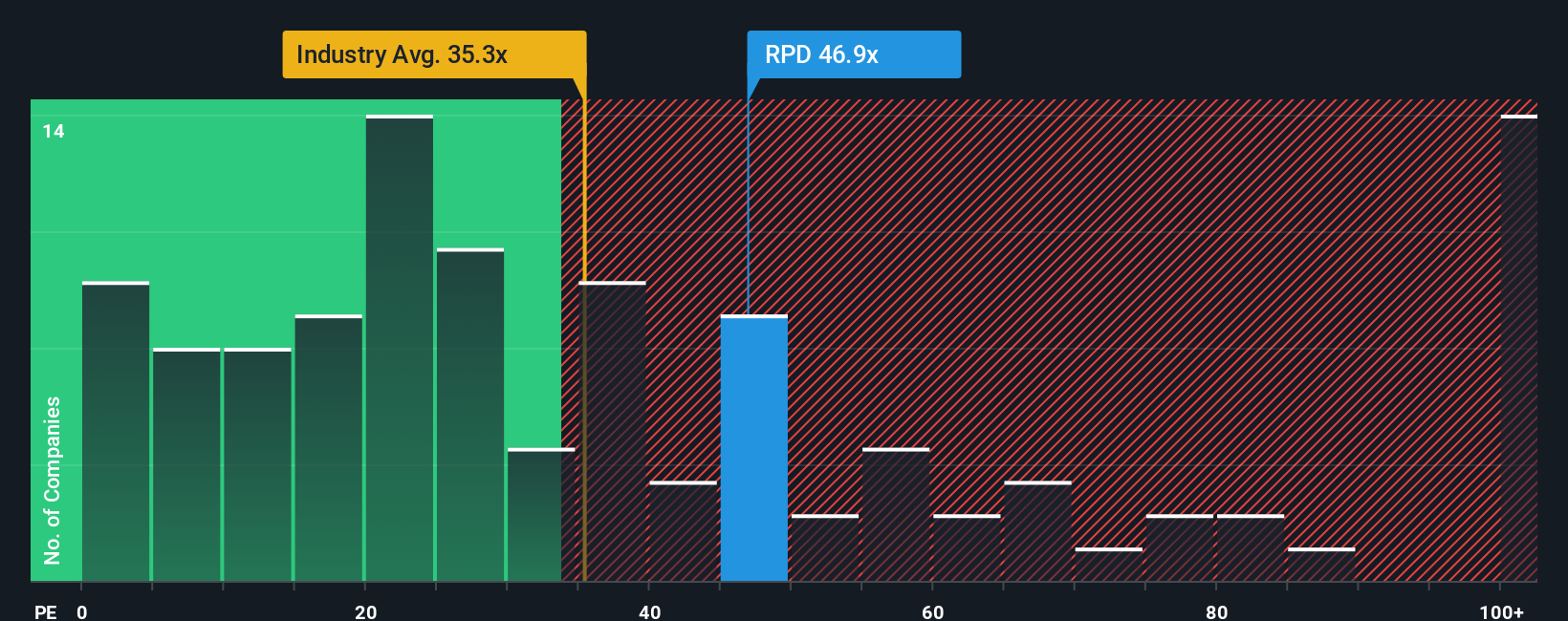

Another View: High Earnings Multiple Sets a Challenge

On the other hand, Rapid7 trades at a price-to-earnings ratio of 43.7x, which is above both its industry average (34.3x), the peer group average (41.6x), and the fair ratio indicated by market analysis (35.3x). This premium suggests investors are baking in higher growth or margin improvements than the market expects. Can actual results justify the lofty valuation, or is there a risk the multiple will need to come down?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rapid7 Narrative

If you’d rather take a hands-on approach or question the current outlook, you can easily analyze the numbers yourself and shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Rapid7 research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Make your next move count and seize tomorrow’s winners today. Don’t let unique opportunities pass you by. Maximize your potential with these top picks right now:

- Capitalize on technology’s explosive growth by targeting the innovators shaping AI. Start with these 27 AI penny stocks to find standout performers in this red-hot sector.

- Tap into robust, long-term income streams by checking out these 17 dividend stocks with yields > 3%, featuring companies offering yields above 3% to strengthen your portfolio.

- Ride the wave of digital finance evolution by reviewing these 80 cryptocurrency and blockchain stocks and uncover stocks at the forefront of cryptocurrency and blockchain trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RPD

Rapid7

Provides cybersecurity software and services under the Rapid7, Nexpose, and Metasploit brand names.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)