- United States

- /

- Software

- /

- NasdaqGS:NCNO

High Growth Tech Stocks to Watch in January 2025

Reviewed by Simply Wall St

The United States market has shown a flat performance over the last week, yet it impressively rose by 24% in the past year with earnings expected to grow by 15% annually. In this context of robust growth potential, identifying high-growth tech stocks involves focusing on companies that demonstrate strong innovation and adaptability to capitalize on these favorable market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.36% | 24.28% | ★★★★★★ |

| Ardelyx | 21.46% | 54.72% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| TG Therapeutics | 29.87% | 43.91% | ★★★★★★ |

| Bitdeer Technologies Group | 51.06% | 122.94% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.37% | 56.70% | ★★★★★★ |

| Blueprint Medicines | 23.25% | 55.27% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.13% | ★★★★★★ |

Click here to see the full list of 233 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

nCino (NasdaqGS:NCNO)

Simply Wall St Growth Rating: ★★★★☆☆

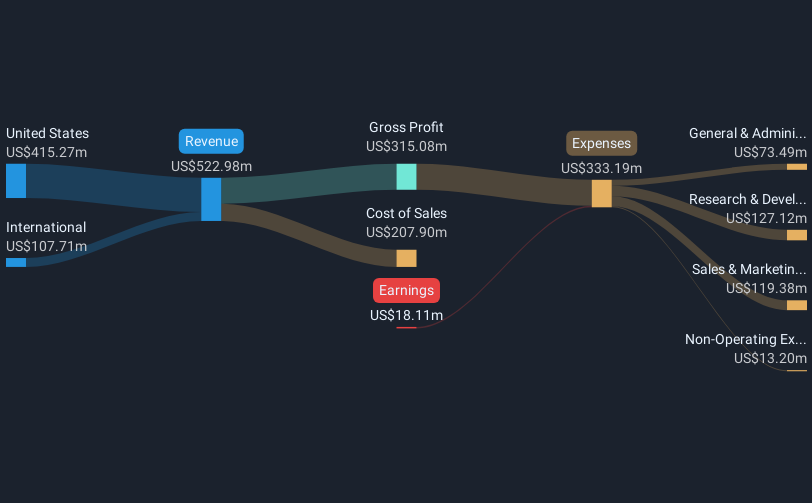

Overview: nCino, Inc. is a software-as-a-service company that offers cloud-based software applications to financial institutions globally, with a market cap of $3.91 billion.

Operations: The company generates revenue primarily from its software and programming segment, amounting to $522.98 million. As a cloud-based service provider for financial institutions, it focuses on delivering scalable solutions internationally.

Amidst a challenging landscape, nCino has demonstrated resilience with its recent earnings results showing a reduction in net loss to $5.25 million from $16.38 million year-over-year, alongside a revenue increase to $138.8 million from $121.94 million in the same period. This performance is underpinned by robust subscription growth, expected between $122.5 million and $124.5 million for the upcoming quarter, reflecting nCino's strong foothold in the financial technology sector despite its current unprofitability. The company's strategic focus on mergers and acquisitions as articulated by CFO Gregory Orenstein underscores an aggressive expansion strategy aimed at enhancing product offerings and market share, which could be pivotal as it navigates towards profitability forecasted within three years with an impressive annual earnings growth rate of 121%.

- Click here to discover the nuances of nCino with our detailed analytical health report.

Review our historical performance report to gain insights into nCino's's past performance.

PTC (NasdaqGS:PTC)

Simply Wall St Growth Rating: ★★★★☆☆

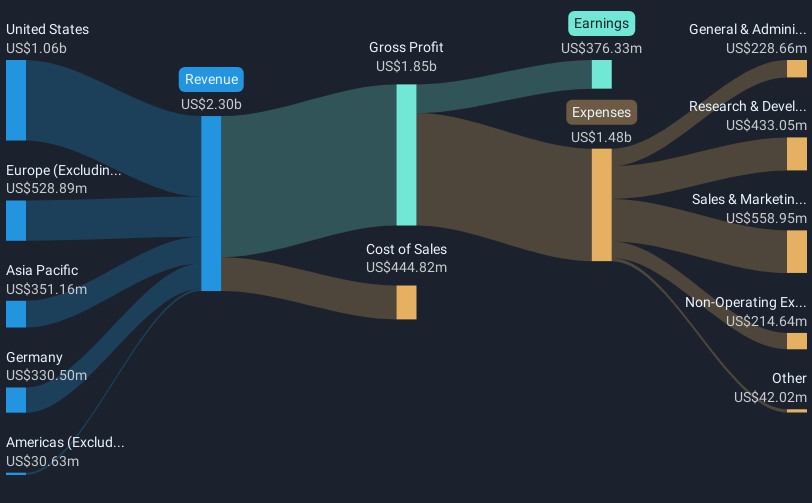

Overview: PTC Inc. is a software company with operations across the Americas, Europe, and the Asia Pacific, and has a market cap of approximately $22.68 billion.

Operations: The company generates revenue primarily from its CAD/CAM software segment, which accounts for approximately $2.30 billion.

PTC has showcased a robust trajectory in the tech landscape, marking a significant 53.3% earnings growth over the past year, outpacing the software industry's 27.6%. This growth is supported by strategic initiatives like the recent partnership with Microsoft and Volkswagen to innovate in AI-enhanced software development tools, reflecting PTC's commitment to maintaining a competitive edge through innovation. Additionally, with R&D expenses consistently high at $600 million annually—about 20% of their revenue—the company not only prioritizes but effectively invests in future capabilities and technologies. These efforts are complemented by an aggressive share repurchase program announced recently, planning to buy back $2 billion worth of stock by 2027, underscoring confidence in their financial health and future prospects.

- Click here and access our complete health analysis report to understand the dynamics of PTC.

Examine PTC's past performance report to understand how it has performed in the past.

RingCentral (NYSE:RNG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RingCentral, Inc. offers cloud-based communications, video meetings, collaboration, and contact center software solutions globally with a market cap of approximately $3.14 billion.

Operations: RingCentral generates revenue primarily from its Internet Software & Services segment, amounting to approximately $2.36 billion. The company's business model focuses on providing software-as-a-service solutions for communications and collaboration needs worldwide.

RingCentral is navigating the high-growth tech landscape with strategic enhancements like its improved Zendesk integration, which embeds voice capabilities directly into customer support platforms. This move not only streamlines workflows but also leverages AI to enrich customer interactions, a critical advantage in today's digital economy. Despite a forecasted revenue growth of 6.9% per year—slightly below the US market average—the company is expected to pivot to profitability within three years, showcasing potential for substantial earnings growth at an annual rate of 61.2%. Moreover, RingCentral's commitment to innovation is evident from its R&D expenditure, maintaining robust investment levels that support future tech advancements and market competitiveness.

- Take a closer look at RingCentral's potential here in our health report.

Gain insights into RingCentral's historical performance by reviewing our past performance report.

Make It Happen

- Take a closer look at our US High Growth Tech and AI Stocks list of 233 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NCNO

nCino

A software-as-a-service company, provides software solutions to financial institutions in the United States, the United Kingdom, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives