- United States

- /

- Software

- /

- NasdaqCM:PRCH

High Growth Tech Stocks To Watch In The US May 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 1.2%, and over the past 12 months, it is up by 7.7%, with earnings forecasted to grow by 14% annually. In this context of steady growth, identifying high-growth tech stocks involves assessing their potential for innovation and scalability in a dynamic market landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 27.47% | 39.60% | ★★★★★★ |

| Ardelyx | 20.63% | 59.87% | ★★★★★★ |

| Travere Therapeutics | 28.83% | 64.80% | ★★★★★★ |

| Clene | 62.08% | 64.01% | ★★★★★★ |

| TG Therapeutics | 25.99% | 38.42% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.67% | 61.11% | ★★★★★★ |

| AVITA Medical | 27.81% | 55.17% | ★★★★★★ |

| Lumentum Holdings | 21.86% | 123.95% | ★★★★★★ |

| Alkami Technology | 22.46% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.16% | 60.26% | ★★★★★★ |

Click here to see the full list of 234 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Porch Group (NasdaqCM:PRCH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Porch Group, Inc. operates a vertical software and insurance platform in the United States with a market cap of $648.31 million.

Operations: The company provides a platform that integrates software solutions with insurance services, targeting the home services industry in the United States. Its business model involves generating revenue through software subscriptions and insurance premiums. The focus on these sectors allows it to cater to both service providers and consumers, enhancing operational efficiency and customer engagement within its niche market.

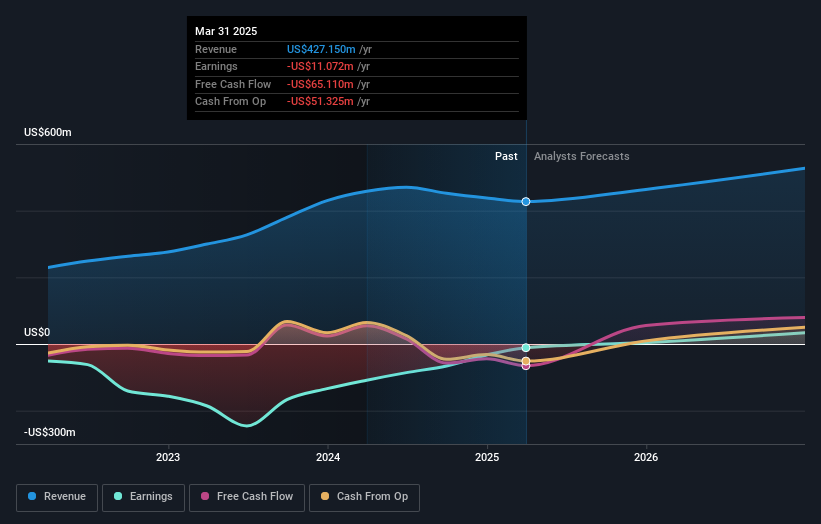

Porch Group, with a revenue growth forecast of 12.1% annually, is outpacing the US market average of 8.4%, signaling robust sector dynamics despite its current unprofitability. The firm recently transitioned into profitability, as evidenced by a net income of $3.74 million this quarter compared to a loss last year, and it has raised its full-year revenue guidance to between $400 million and $420 million. This upward revision follows significant leadership enhancements in sales and reinsurance, likely bolstering its strategic positioning in the competitive tech landscape where innovations and client-centric solutions often dictate market success.

- Click here and access our complete health analysis report to understand the dynamics of Porch Group.

Gain insights into Porch Group's historical performance by reviewing our past performance report.

Vericel (NasdaqGM:VCEL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vericel Corporation is a commercial-stage biopharmaceutical company focused on developing and distributing cellular therapies and specialty biologic products for sports medicine and severe burn care in North America, with a market cap of approximately $2.03 billion.

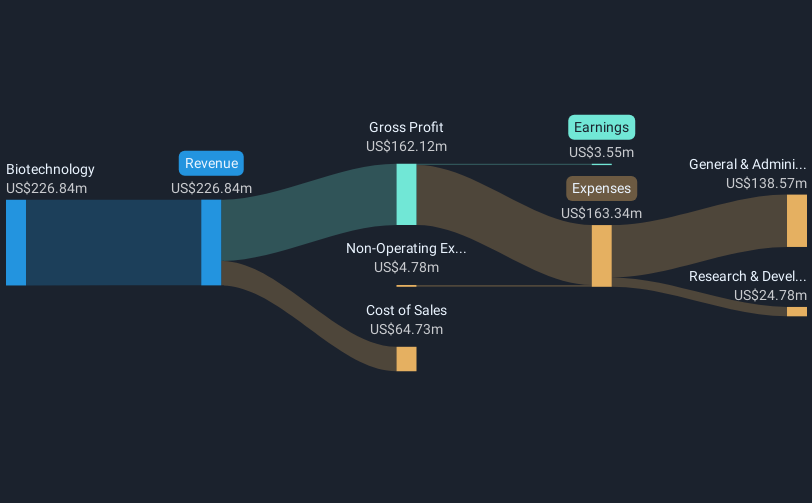

Operations: The company generates revenue primarily from its biotechnology segment, amounting to $237.22 million. It operates in the research, development, manufacture, and distribution of cellular therapies and specialty biologic products within North America.

Vericel stands out with a robust annual revenue growth of 20%, surpassing the US market average of 8.3%. This performance is complemented by an impressive earnings growth forecast of 39.7% per year, highlighting its competitive edge in the biotech sector. The company's commitment to innovation is evident from its R&D spending, which significantly contributes to its strategic positioning and future prospects in high-growth markets. Recent announcements include expected Q1 results that could further solidify Vericel's market stance, following a year where it transitioned from a net loss to reporting substantial profits—USD 10.36 million annually—underscoring its operational turnaround and enhanced financial health.

- Unlock comprehensive insights into our analysis of Vericel stock in this health report.

Understand Vericel's track record by examining our Past report.

Tripadvisor (NasdaqGS:TRIP)

Simply Wall St Growth Rating: ★★★★☆☆

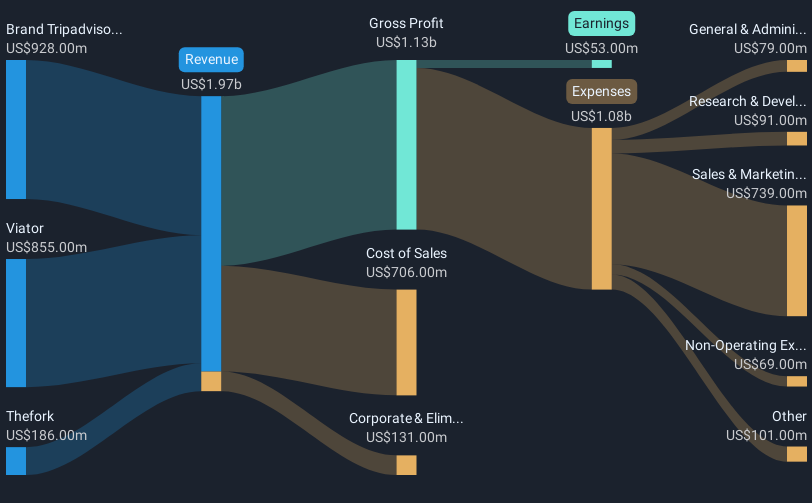

Overview: TripAdvisor, Inc. is an online travel company that offers travel guidance products and services globally, with a market cap of $1.70 billion.

Operations: TripAdvisor generates revenue primarily through advertising and subscription-based services, leveraging its platform to connect travelers with accommodations, attractions, and restaurants. The company focuses on monetizing user-generated content by offering targeted advertising solutions to travel-related businesses.

Tripadvisor's recent financials show a notable recovery, with Q1 2025 sales slightly up to $398 million from $395 million the previous year, and a reduced net loss of $11 million compared to $59 million. This improvement aligns with an earnings growth forecast of 21.8% annually, outpacing the US market's average of 13.9%. Despite these gains, revenue growth projections remain modest at 6.6% annually—below the broader market expectation of 8.3%. The company also completed a significant share repurchase program, buying back shares worth approximately $49.94 million by late 2024, which reflects a strategic initiative to enhance shareholder value amidst fluctuating market conditions.

- Get an in-depth perspective on Tripadvisor's performance by reading our health report here.

Evaluate Tripadvisor's historical performance by accessing our past performance report.

Where To Now?

- Click through to start exploring the rest of the 231 US High Growth Tech and AI Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PRCH

Porch Group

Operates a vertical software and insurance platform in the United States.

Good value with slight risk.

Market Insights

Community Narratives