- United States

- /

- Software

- /

- NasdaqCM:PGY

Pagaya Technologies (NasdaqCM:PGY) Posts US$238M Net Loss Leading To 7% Decline Over Last Quarter

Reviewed by Simply Wall St

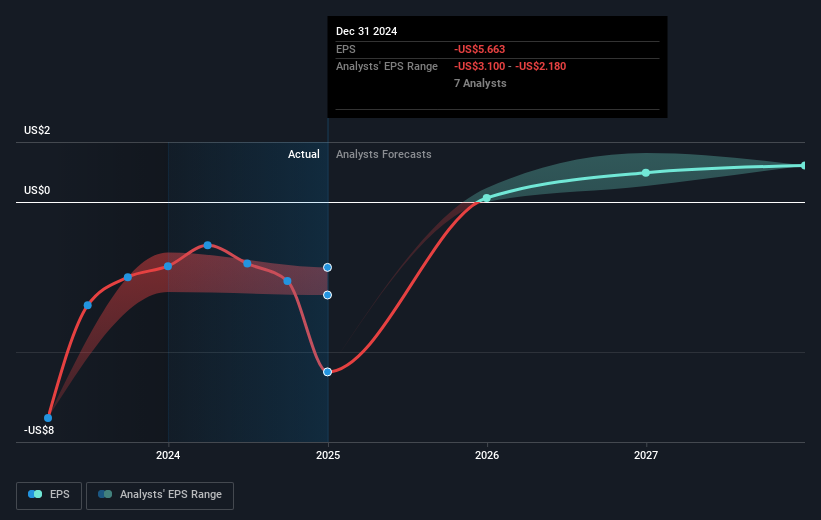

Pagaya Technologies (NasdaqCM:PGY) reported a quarterly net loss of $238 million despite a revenue increase to $279 million, contributing to the share price decline of 7% over the last quarter. The company's guidance indicates potential profitability in the upcoming quarters, yet the recent earnings report reflects uncertainty in achieving it soon. This decline aligns with broader market turmoil, as the Dow Jones and Nasdaq Composite indices experienced significant drops, driven by trade tariffs and economic concerns. Weak performance from other tech stocks and market apprehension also reflect challenges in the current financial landscape, impacting investor confidence in Pagaya's future.

Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

Pagaya Technologies has seen its total shareholder return dip by 6.63% over the past year, falling behind the broader US market, which achieved a 3.3% return during the same period. Despite revenue growth across various quarters, losses have amplified, with the full year 2024 recording a net loss increase to US$401.41 million. A significant decrease in net profit margin and heightened losses per share have contributed to the pressure on its share price.

Contributing to the volatility was a wave of executive changes, including the appointment of new directors and a Chief Accounting Officer in late 2024. Furthermore, substantial insider selling over recent months raised concerns among investors. Meanwhile, the company's valuation, underpinned by a Price-To-Sales Ratio of 0.7 compared to industry peers, suggests potential undervaluation, which may attract investor interest looking for value opportunities within the sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Pagaya Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PGY

Pagaya Technologies

A product-focused technology company, deploys data science and proprietary artificial intelligence-powered technology for financial institutions and investors in the United States, Israel, the Cayman Islands, and internationally.

Undervalued with high growth potential.

Market Insights

Community Narratives