- United States

- /

- Software

- /

- NasdaqGS:PANW

Exploring High Growth Tech Opportunities in US Markets

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it is up 11% over the past year with earnings forecasted to grow by 14% annually. In this environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and scalability potential to capitalize on these favorable conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 26.38% | 39.09% | ★★★★★★ |

| Mereo BioPharma Group | 53.63% | 66.57% | ★★★★★★ |

| Ardelyx | 20.78% | 59.46% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| AVITA Medical | 27.36% | 60.93% | ★★★★★★ |

| Blueprint Medicines | 21.12% | 60.77% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.63% | 60.71% | ★★★★★★ |

| Alkami Technology | 20.54% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.07% | 59.92% | ★★★★★★ |

| Lumentum Holdings | 22.99% | 103.97% | ★★★★★★ |

Click here to see the full list of 233 stocks from our US High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Palo Alto Networks (PANW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Palo Alto Networks, Inc. is a global provider of cybersecurity solutions with a market capitalization of $130.87 billion.

Operations: The company generates revenue primarily from its Security Software & Services segment, amounting to $8.87 billion.

Palo Alto Networks' strategic maneuvers, such as its recent partnership with Binary Defense, underscore its commitment to enhancing security operations through AI-driven platforms like Cortex XSIAM. This collaboration not only broadens the implementation and MDR services but also customizes support to fit diverse organizational needs, reflecting Palo Alto's adaptability in a high-stakes cybersecurity landscape. Moreover, their consistent R&D investment, which recently accounted for approximately 12.6% of their revenue, fuels innovations that keep them at the forefront of cybersecurity solutions. These efforts are pivotal as they navigate a competitive market where maintaining technological leadership is crucial for growth and client trust.

- Take a closer look at Palo Alto Networks' potential here in our health report.

Assess Palo Alto Networks' past performance with our detailed historical performance reports.

Take-Two Interactive Software (TTWO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Take-Two Interactive Software, Inc. is a global developer, publisher, and marketer of interactive entertainment solutions with a market cap of approximately $42.11 billion.

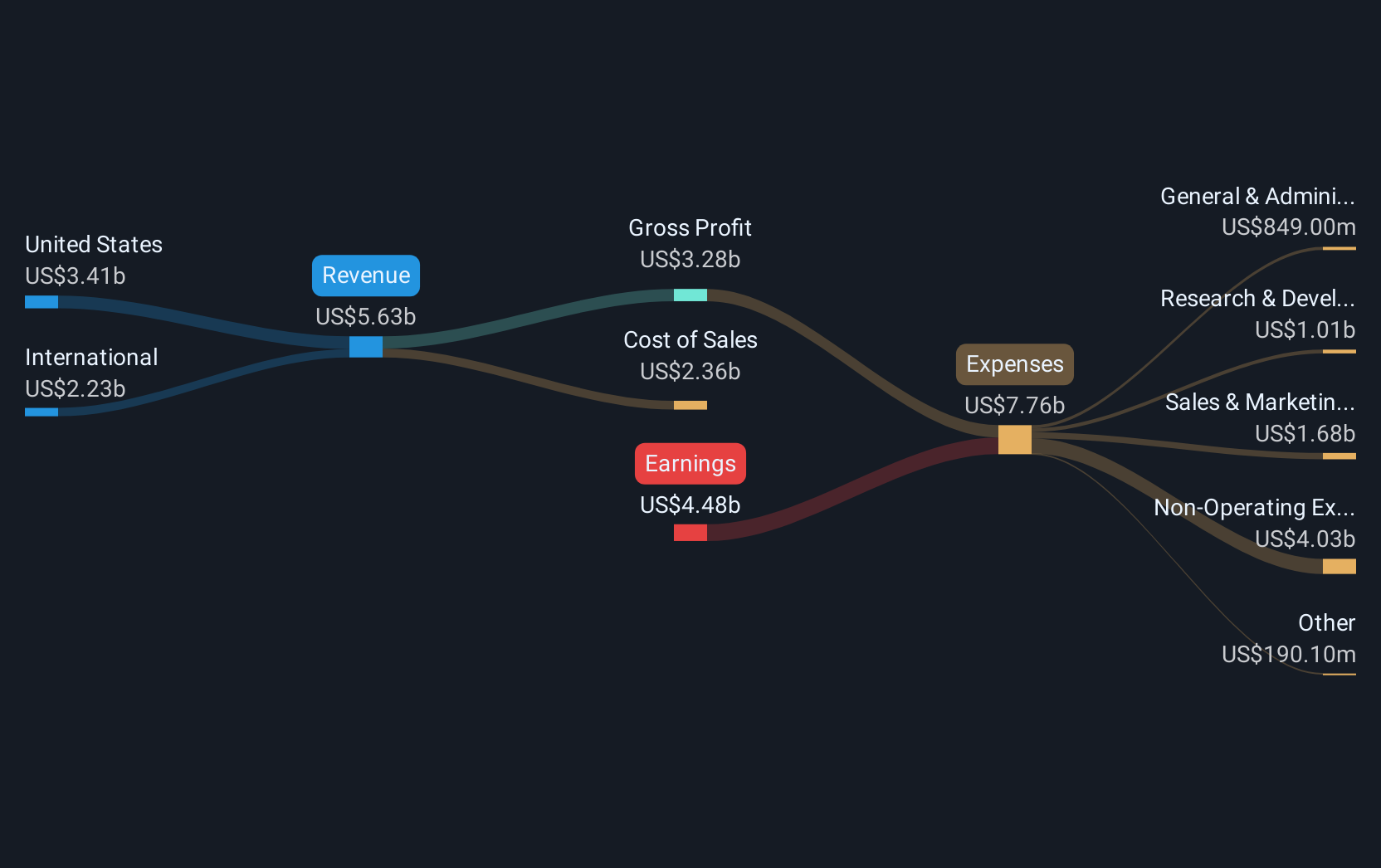

Operations: The company generates revenue primarily through its publishing segment, which accounts for $5.63 billion.

Take-Two Interactive Software has been actively expanding its financial and operational scope, as evidenced by recent strategic moves including a $1B public offering aimed at funding acquisitions and debt repayment. This aligns with their aggressive R&D investment strategy, crucial for fostering innovation in the highly competitive gaming sector. Despite reporting a net loss, Take-Two projects significant revenue growth ranging from $5.95B to $6.05B next fiscal year, underpinned by robust annualized revenue and earnings growth rates of 14.2% and 89.3%, respectively. These figures suggest a resilient adaptation to market demands and potential future profitability, positioning them well within the high-growth tech landscape despite current financial setbacks.

Spotify Technology (SPOT)

Simply Wall St Growth Rating: ★★★★★☆

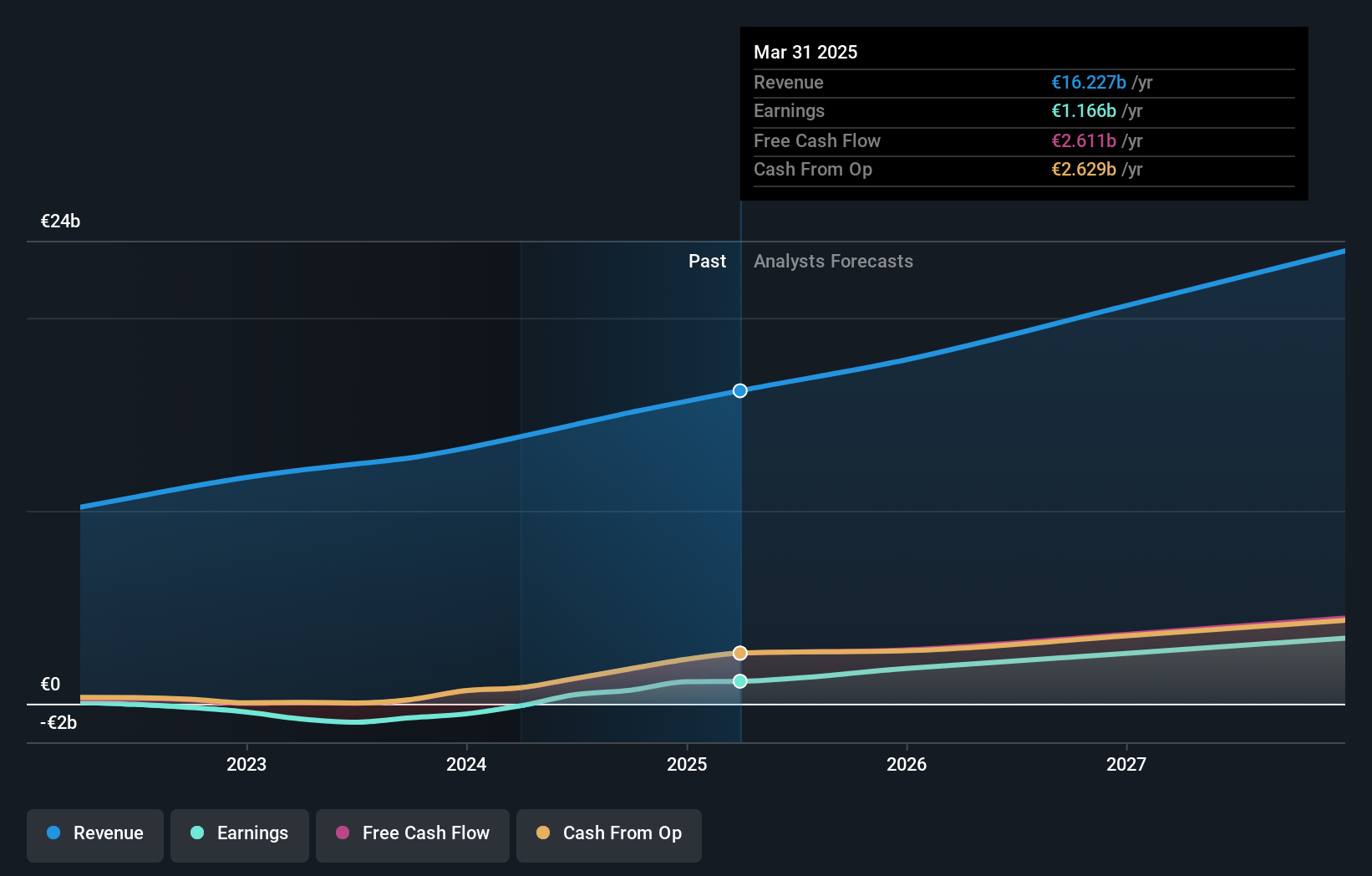

Overview: Spotify Technology S.A., along with its subsidiaries, offers audio streaming subscription services globally and has a market capitalization of approximately $145.76 billion.

Operations: Spotify generates revenue primarily through its Premium subscription service, which accounts for €14.34 billion, and its Ad-Supported segment, contributing €1.88 billion.

Spotify Technology has demonstrated robust financial performance, with a notable increase in sales from EUR 3.64 billion to EUR 4.19 billion year-over-year and an uplift in net income to EUR 225 million. This growth is underpinned by a strategic emphasis on R&D, crucial for sustaining innovation and competitiveness in the dynamic tech landscape; indeed, Spotify's R&D expenses have consistently aligned with its revenue growth, ensuring continuous product evolution and market relevance. Moreover, the company's forward-looking revenue projection of $4.3 billion underscores its operational optimism and potential for sustained expansion within the tech sector.

- Click here to discover the nuances of Spotify Technology with our detailed analytical health report.

Next Steps

- Explore the 233 names from our US High Growth Tech and AI Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PANW

Palo Alto Networks

Provides cybersecurity solutions the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives