- United States

- /

- Software

- /

- NasdaqGS:OTEX

Open Text Independent Director Deborah Weinstein Sells 100% Of Holding

Some Open Text Corporation (NASDAQ:OTEX) shareholders may be a little concerned to see that the Independent Director, Deborah Weinstein, recently sold a substantial US$545k worth of stock at a price of US$27.23 per share. That diminished their holding by a very significant 100%, which arguably implies a strong desire to reallocate capital.

Our free stock report includes 3 warning signs investors should be aware of before investing in Open Text. Read for free now.The Last 12 Months Of Insider Transactions At Open Text

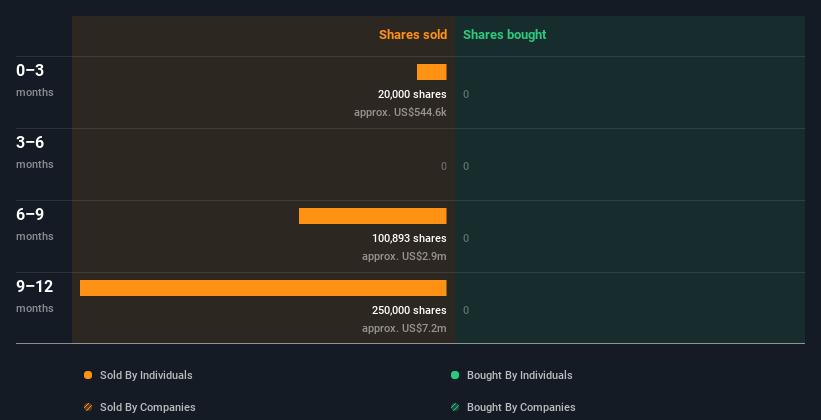

The insider, Michael Slaunwhite, made the biggest insider sale in the last 12 months. That single transaction was for US$7.2m worth of shares at a price of US$28.82 each. That means that an insider was selling shares at around the current price of US$27.14. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. We note that this sale took place at around the current price, so it isn't a major concern, though it's hardly a good sign.

Open Text insiders didn't buy any shares over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

See our latest analysis for Open Text

If you are like me, then you will not want to miss this free list of small cap stocks that are not only being bought by insiders but also have attractive valuations.

Insider Ownership Of Open Text

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Open Text insiders own about US$137m worth of shares (which is 2.0% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Does This Data Suggest About Open Text Insiders?

An insider sold stock recently, but they haven't been buying. And there weren't any purchases to give us comfort, over the last year. But it is good to see that Open Text is growing earnings. The company boasts high insider ownership, but we're a little hesitant, given the history of share sales. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Open Text. At Simply Wall St, we've found that Open Text has 3 warning signs (1 is potentially serious!) that deserve your attention before going any further with your analysis.

Of course Open Text may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:OTEX

Open Text

Designs, develops, markets, and sells information management software and solutions in North, Central, and South America, Europe, the Middle East, Africa, Australia, Japan, Singapore, India, and China.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)