- United States

- /

- Software

- /

- NasdaqGS:OPRA

Can Opera's (OPRA) AI-Powered Browser Redefine Its Competitive Edge in Premium Software?

Reviewed by Sasha Jovanovic

- Opera Limited recently began the rollout of Opera Neon, a premium, subscription-based browser featuring agentic AI that can automate tasks, manage projects, and execute user commands locally within the browser environment.

- This product launch marks a significant departure from conventional browsers by combining AI-driven productivity tools with privacy-centric workflow features, catering to professionals seeking advanced online capabilities.

- We'll explore how the introduction of Opera Neon and its agentic AI could influence Opera's long-term earnings growth outlook.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Opera Investment Narrative Recap

For Opera shareholders, the core belief centers on the company’s ability to successfully monetize innovation like Opera Neon while sustaining its position as a high-engagement alternative browser. The recent CEO transition from Mr. James Zhou to Mr. Lin Song is unlikely to materially affect the short-term catalyst, which remains the commercial adoption and revenue contribution from Neon, but the biggest risk continues to be Opera's dependence on third-party AI, which could affect costs and margins going forward.

The most relevant announcement here is the official rollout of Opera Neon to its first users, a substantial launch that reinforces the current earnings growth narrative and draws attention to Opera’s strategy to drive subscription and premium revenue growth. This is especially important as market share expansion remains a challenge against dominant ecosystem players, putting even greater pressure on new product monetization as an immediate catalyst for investors.

By contrast, investors should be aware that rising costs tied to third-party AI integration have the potential to pressure margins when...

Read the full narrative on Opera (it's free!)

Opera's outlook anticipates $813.6 million in revenue and $135.8 million in earnings by 2028. This projection is based on an expected annual revenue growth rate of 13.6%, and a $55.2 million increase in earnings from the current $80.6 million.

Uncover how Opera's forecasts yield a $25.50 fair value, a 58% upside to its current price.

Exploring Other Perspectives

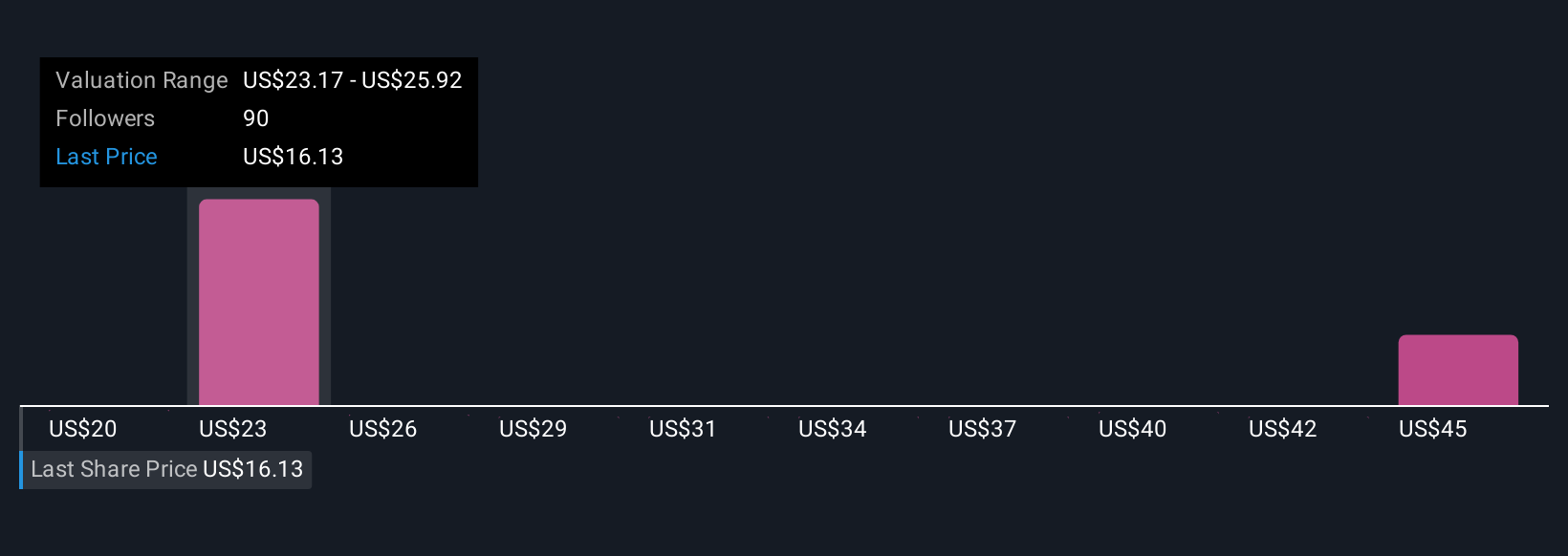

Seven individual fair value estimates from the Simply Wall St Community range widely between US$20.41 and US$47.98 per share. Against this backdrop, the need to prove sustainable premium pricing from Neon is front of mind for many participants, explore other perspectives and see why opinions vary.

Explore 7 other fair value estimates on Opera - why the stock might be worth just $20.41!

Build Your Own Opera Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Opera research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Opera research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Opera's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPRA

Opera

Provides mobile and PC web browsers and related products and services in Norway and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives