- United States

- /

- Software

- /

- NasdaqGS:MSTR

Why MicroStrategy (MSTR) Is Down 15.3% After Trade War Fears Hit Bitcoin and Global Markets

Reviewed by Sasha Jovanovic

- In the past week, President Trump threatened to impose higher tariffs on Chinese goods after China restricted its exports of rare earth minerals, triggering widespread concern over a potential trade war and its impact on supply chains.

- A distinctive element of this event is the resulting sharp drop in Bitcoin and related stocks, highlighting Strategy’s exposure to macro risks tied to its large digital asset treasury.

- We’ll explore how this heightened sensitivity to global trade tensions influences Strategy’s investment narrative, particularly given its significant Bitcoin holdings.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Strategy's Investment Narrative?

To hold shares in Strategy Inc, I think you need to buy into the company's evolution from a software firm to a digital asset treasury with a massive Bitcoin reserve at its core, all while embracing new tech ventures like Strategy Mosaic. The big, near-term catalyst is typically the price action of Bitcoin itself and market adoption of digital asset-backed products, including those new perpetual preferred shares. However, with the fresh shock from U.S.-China trade tensions causing rapid selloffs in both Bitcoin and related stocks, it's clear that macro risk is front and center for the business right now, even more than before. While previous analysis highlighted earnings growth and product launches as the key upside, this news event brings heightened volatility and raises questions about the resilience of Bitcoin-focused business models during geopolitical stress, at least in the short run. For now, I think the main narrative is unchanged, but the risk profile feels more urgent, especially with recent price moves underscoring how quickly sentiment can shift.

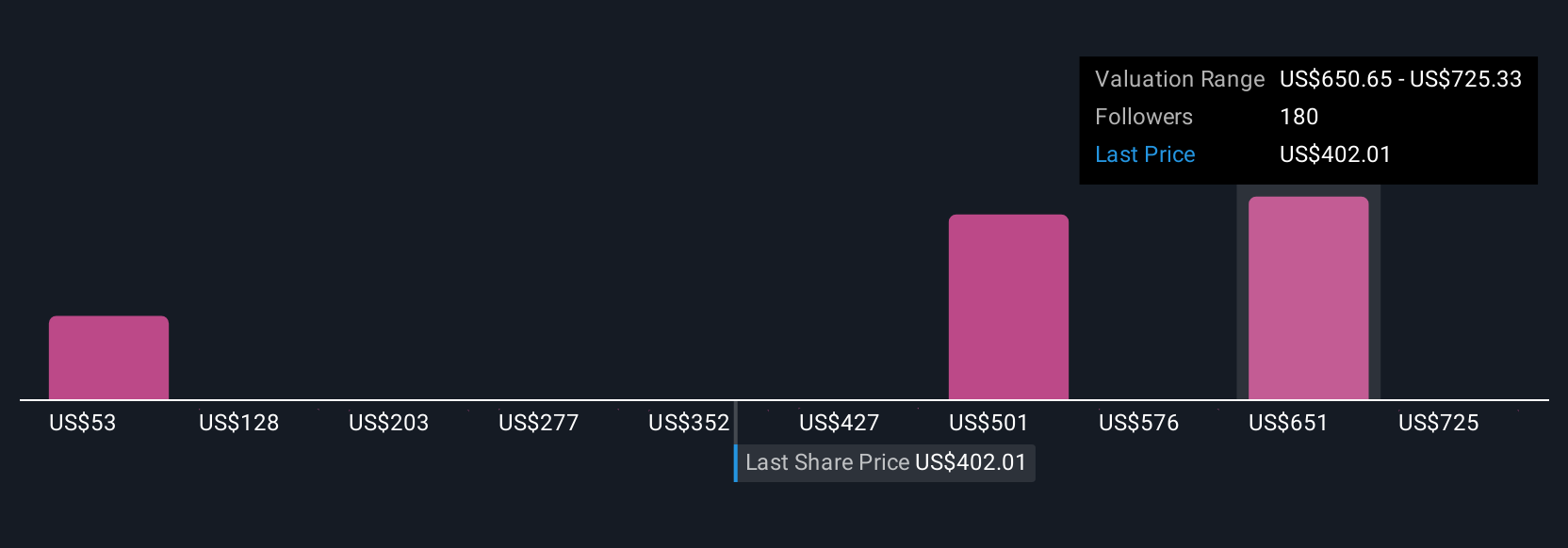

But with volatility ramping up, not everyone is prepared for new macro risks. Our comprehensive valuation report raises the possibility that Strategy is priced lower than what may be justified by its financials.Exploring Other Perspectives

Explore 17 other fair value estimates on Strategy - why the stock might be worth over 2x more than the current price!

Build Your Own Strategy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Strategy research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Strategy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Strategy's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSTR

Strategy

Operates as a bitcoin treasury company in the United States, Europe, the Middle East, Africa, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)