- United States

- /

- Software

- /

- NasdaqGS:MNDY

Evaluating monday.com (MNDY): How Spending and Slower Growth Are Shaping Its Current Valuation

Reviewed by Simply Wall St

If you have monday.com (MNDY) on your watchlist, the latest commentary around the company’s high spending and slowing customer growth might have caught your attention. After all, when a software name gets flagged for profitability pressures, it tends to prompt the question: how much risk are you really taking on at this price?

To put things in perspective, monday.com has seen its shares slip over the past year, underperforming with a 22% drop. The tone around its spending pace and customer momentum has only added to the caution, with the stock falling 23% in the past month alone. While annual revenue and net income are growing at double-digit rates, worry over operational efficiency now dominates the conversation and points to real shifts in investor sentiment this summer.

So, after a year of declining share price and mounting concerns, is monday.com a bargain waiting to be noticed, or is the market telling us to expect more pain before the story improves?

Most Popular Narrative: 32.5% Undervalued

According to the most widely followed narrative, monday.com is currently seen as significantly undervalued in the market, with its fair value estimated to be much higher than the recent share price.

Ongoing global shift toward digital transformation, remote/hybrid work, and rising SaaS adoption continues fueling strong demand for cloud-based productivity and collaboration platforms like monday.com, supporting high double-digit revenue growth and future ARR expansion. Rapid integration of generative AI and low-code/no-code capabilities (e.g., Monday Magic, Vibe, Sidekick) enable broader automation and workflow customization, strengthening platform differentiation and stickiness. These trends are likely to improve customer retention, ARPU, and net margins as monetization scales.

Curious what’s powering this bullish call? There’s a set of financial assumptions behind this price target that challenge the norm, including expectations for long-term profit expansion and revenue acceleration. Want to see how growth, margins, and future profit multiples shape the fair value story? The full narrative breaks down all the projections and tells you exactly what’s driving this valuation.

Result: Fair Value of $282.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as slower customer additions and rising marketing costs could quickly challenge the optimistic case for monday.com’s long-term upside.

Find out about the key risks to this monday.com narrative.Another View: Multiples Point to a Different Story

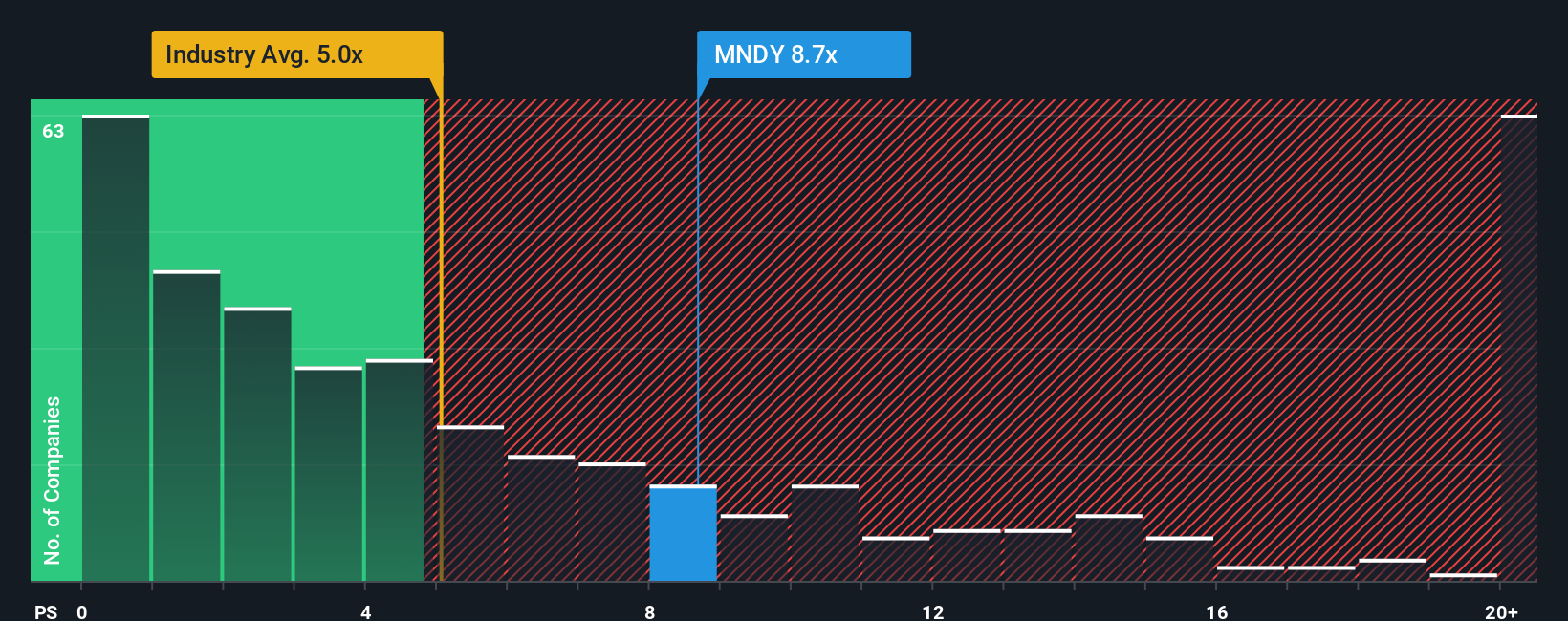

While some models call monday.com undervalued, looking at its pricing compared to the broader software sector presents a different perspective. A traditional comparison shows the stock is more expensive than its industry. Which perspective matters more?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding monday.com to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own monday.com Narrative

If you want to dive deeper or prefer a hands-on approach, building your own view takes just a few minutes and can reveal new insights. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding monday.com.

Ready for Your Next Smart Move?

Don’t let great opportunities slip by. With so many fast-moving markets, you can confidently spot new investment themes that could strengthen your portfolio and future gains.

- Uncover the most promising up-and-comers by zeroing in on penny stocks with solid financials and growth momentum using penny stocks with strong financials.

- Tap into the explosive world of artificial intelligence by finding standout innovators and tech disruptors with the smartest AI penny stocks picks.

- Boost your income strategy by locking onto companies that consistently deliver strong yields with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:MNDY

monday.com

Develops software applications in the United States, Europe, the Middle East, Africa, the United Kingdom, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)