- United States

- /

- Software

- /

- NasdaqGS:MNDY

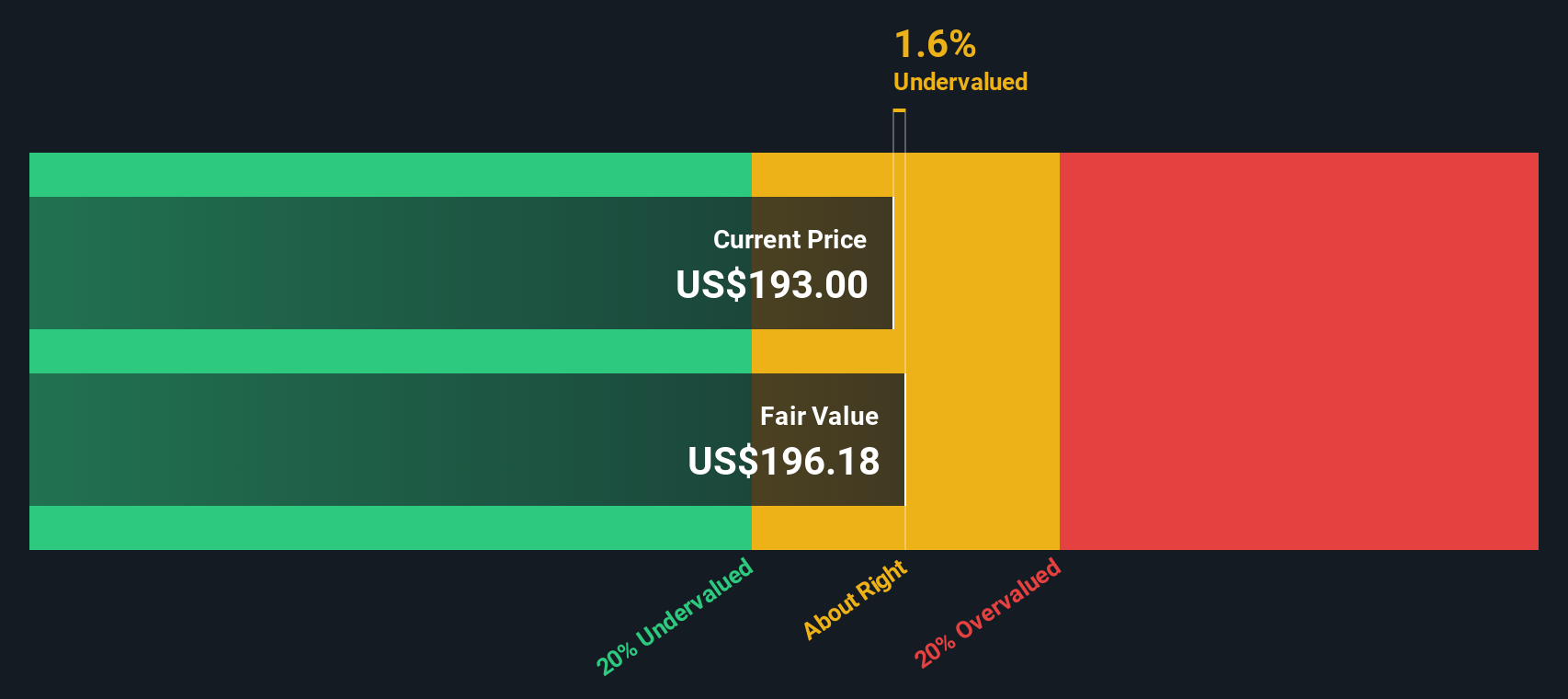

A Closer Look at monday.com (MNDY) Valuation After Bullish Analyst Report and Upbeat Revenue Guidance

Reviewed by Simply Wall St

Most Popular Narrative: 35.6% Undervalued

According to the community narrative, monday.com is trading well below its estimated fair value, with robust growth prospects and optimism around its future earnings powering this bullish outlook. The calculated valuation incorporates community consensus on factors like AI-driven expansion and margin improvement.

Ongoing global shift toward digital transformation, remote and hybrid work, and rising SaaS adoption continues fueling strong demand for cloud-based productivity and collaboration platforms like monday.com. This demand supports high double-digit revenue growth and future annual recurring revenue (ARR) expansion.

What is driving such a high fair value for monday.com? This narrative points to dramatic improvements in enterprise growth and a focus on expanding into new markets. Want to discover what key financial assumptions have analysts so excited and the bold growth metrics behind their targets? Unpack the details that separate a typical tech story from a potential outlier and take a deeper look before everyone else.

Result: Fair Value of $282.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifting search algorithms and increased competition from other SaaS providers could quickly challenge monday.com's growth rates and future profitability assumptions.

Find out about the key risks to this monday.com narrative.Another View: DCF Adds a Second Opinion

While the community’s optimism is based on sales and optimism-driven multiples, the SWS DCF model also points to monday.com being undervalued. How do these two models compare when weighing future cash flows against market sentiment?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out monday.com for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own monday.com Narrative

If you see things differently or want to take a hands-on approach, you can dive into the numbers and craft your own story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding monday.com.

Looking for Smarter Investment Opportunities?

Why limit your growth to just one stock? Meet new opportunities head-on with ideas that match your goals, whether that means steady dividends, transformative technology, or future-defining healthcare breakthroughs. Make your next move with confidence and get ahead while others stay on the sidelines.

- Boost your portfolio with steady income streams by checking out dividend stocks paying yields above 3% through our dividend stocks with yields > 3%.

- Take advantage of the momentum in artificial intelligence, where emerging leaders are setting the pace in automation and innovation, all found via our AI penny stocks.

- Stay one step ahead by uncovering undervalued opportunities based on cash flows by using our powerful undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:MNDY

monday.com

Develops software applications in the United States, Europe, the Middle East, Africa, the United Kingdom, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)