- United States

- /

- Auto Components

- /

- NasdaqGS:MBLY

3 Stocks Estimated To Be Trading At Up To 43.6% Below Intrinsic Value

Reviewed by Simply Wall St

In recent sessions, major U.S. stock indexes have shown resilience, rising despite initial declines due to disappointing private payroll data and adjustments in tech sector sales strategies. As investors navigate these fluctuating conditions, identifying stocks trading below their intrinsic value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Webull (BULL) | $9.00 | $17.92 | 49.8% |

| Warrior Met Coal (HCC) | $78.00 | $154.15 | 49.4% |

| Super Group (SGHC) (SGHC) | $10.93 | $21.59 | 49.4% |

| Sotera Health (SHC) | $16.93 | $33.49 | 49.5% |

| Lyft (LYFT) | $22.24 | $43.69 | 49.1% |

| Freshworks (FRSH) | $12.22 | $23.78 | 48.6% |

| First Busey (BUSE) | $23.50 | $45.34 | 48.2% |

| DexCom (DXCM) | $64.45 | $126.46 | 49% |

| BioLife Solutions (BLFS) | $25.37 | $49.72 | 49% |

| Ategrity Specialty Insurance Company Holdings (ASIC) | $18.75 | $37.29 | 49.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Mobileye Global (MBLY)

Overview: Mobileye Global Inc. develops and deploys advanced driver assistance systems (ADAS) and autonomous driving technologies worldwide, with a market cap of approximately $9.59 billion.

Operations: The company generates $1.90 billion from its advanced driver assistance systems and autonomous driving technologies.

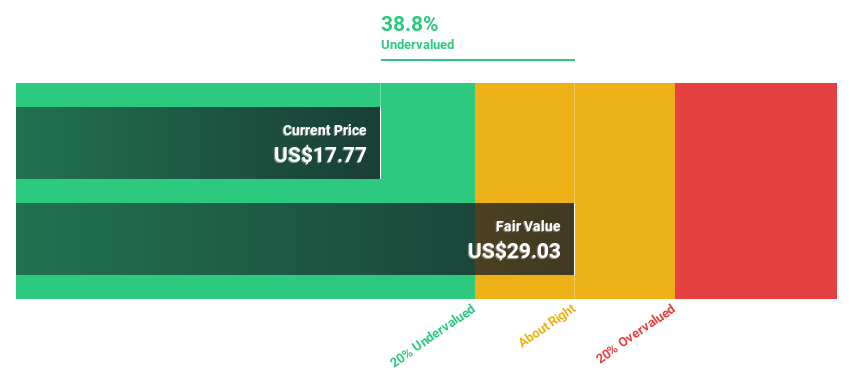

Estimated Discount To Fair Value: 43.6%

Mobileye Global is trading at US$11.78, significantly below its estimated fair value of US$20.89, suggesting it might be undervalued based on cash flows. Despite a current net loss, Mobileye's earnings are forecast to grow 58.39% annually, with revenue expected to outpace the US market growth at 18.2%. Recent partnerships in India and advancements in ADAS technologies highlight its strategic moves to capture emerging markets and enhance profitability prospects over the next few years.

- Our comprehensive growth report raises the possibility that Mobileye Global is poised for substantial financial growth.

- Dive into the specifics of Mobileye Global here with our thorough financial health report.

monday.com (MNDY)

Overview: monday.com Ltd., along with its subsidiaries, develops software applications globally and has a market cap of $7.66 billion.

Operations: Revenue from the Internet Software & Services segment amounts to $1.17 billion.

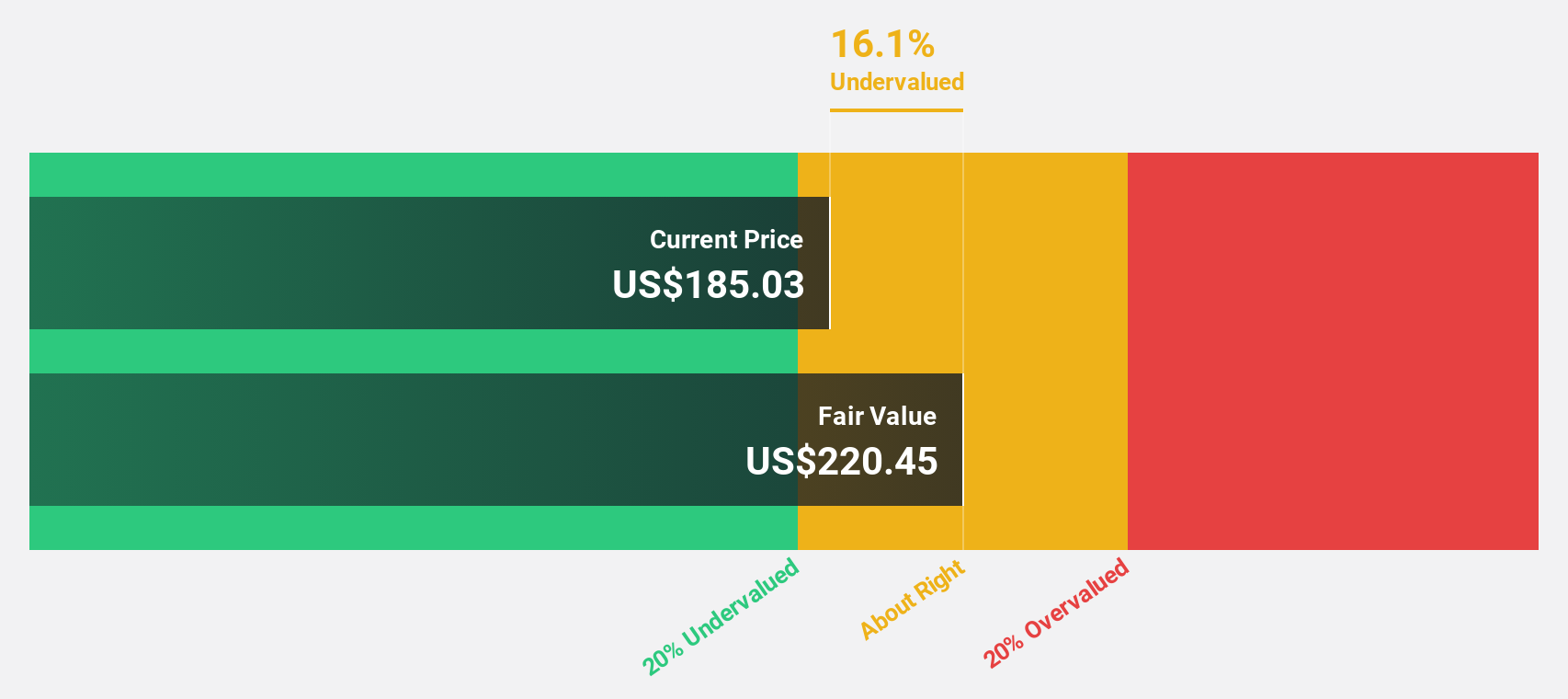

Estimated Discount To Fair Value: 29.4%

monday.com is trading at US$148.6, significantly below its estimated fair value of US$210.39, indicating it might be undervalued based on cash flows. Recent earnings show a substantial improvement with net income rising to US$13.05 million from a net loss last year, and revenue growth outpacing the market at 17.2% annually. Strategic partnerships and AI-driven product innovations further position monday.com for continued operational efficiency and potential revenue expansion in the competitive software landscape.

- According our earnings growth report, there's an indication that monday.com might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of monday.com.

Fortune Brands Innovations (FBIN)

Overview: Fortune Brands Innovations, Inc. provides home and security products for residential home repair, remodeling, new construction, and security applications both in the United States and internationally, with a market cap of approximately $6.23 billion.

Operations: The company's revenue is derived from three main segments: Water ($2.48 billion), Outdoors ($1.33 billion), and Security ($683.40 million).

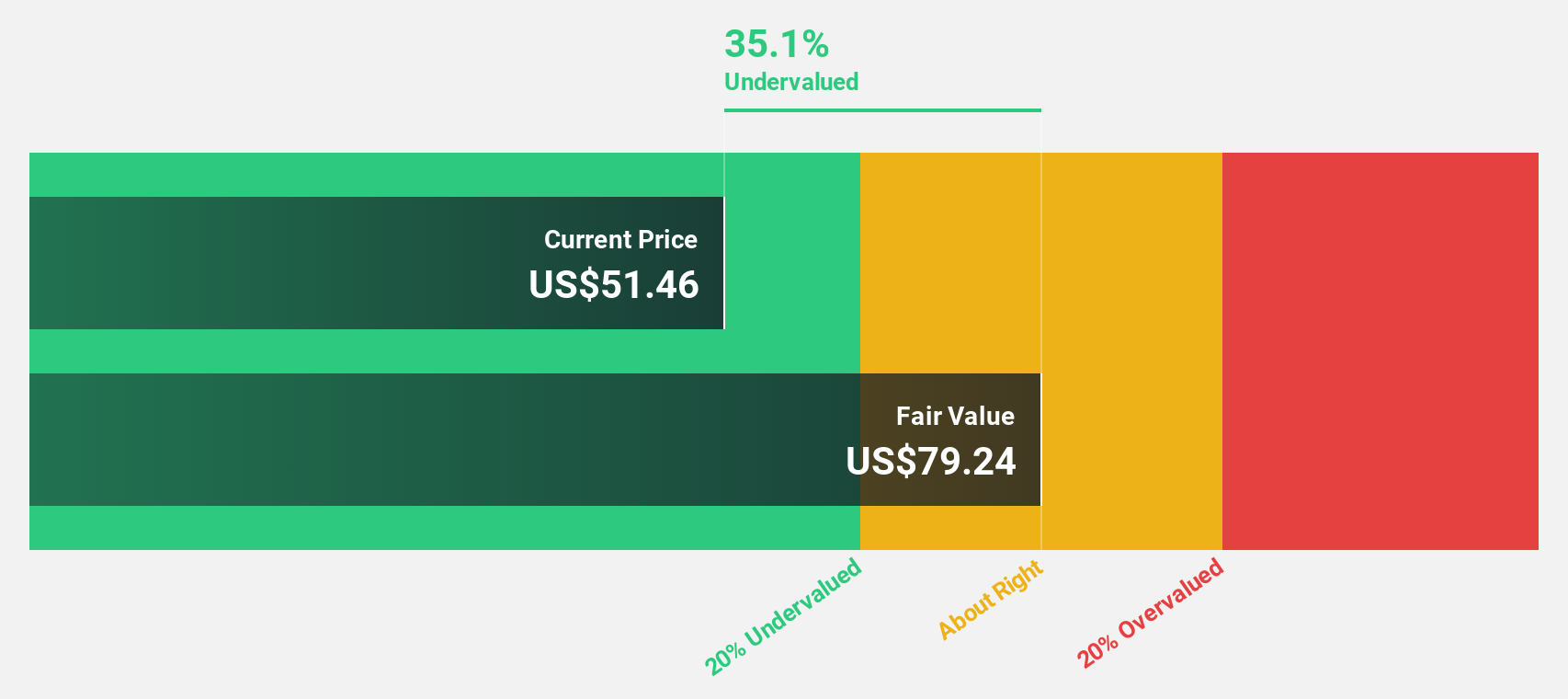

Estimated Discount To Fair Value: 35.3%

Fortune Brands Innovations is trading at US$51.37, below its estimated fair value of US$79.37, suggesting potential undervaluation based on cash flows. Despite a decline in net income to US$70.8 million for Q3 2025 from US$136.6 million a year earlier, earnings are projected to grow significantly at 24.6% annually over the next three years, outpacing the market average. The company is also expanding its workforce and facilities to support future growth initiatives and innovation efforts.

- The analysis detailed in our Fortune Brands Innovations growth report hints at robust future financial performance.

- Get an in-depth perspective on Fortune Brands Innovations' balance sheet by reading our health report here.

Key Takeaways

- Take a closer look at our Undervalued US Stocks Based On Cash Flows list of 214 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MBLY

Mobileye Global

Develops and deploys advanced driver assistance systems (ADAS) and autonomous driving technologies and solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026