- United States

- /

- Software

- /

- NasdaqGS:MGIC

First Merchants And 2 Other Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As the U.S. stock market experiences gains across major indices, with the tech-heavy Nasdaq and blue-chip Dow Jones Industrial Average showing positive momentum, investors are keeping a close eye on corporate earnings and inflation data that could influence Federal Reserve decisions. In this climate of cautious optimism, dividend stocks like First Merchants offer potential stability and income, making them an attractive consideration for those navigating today's unpredictable economic landscape.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (PEBO) | 5.83% | ★★★★★☆ |

| Huntington Bancshares (HBAN) | 4.00% | ★★★★★☆ |

| Heritage Commerce (HTBK) | 5.43% | ★★★★★★ |

| German American Bancorp (GABC) | 3.04% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.29% | ★★★★★★ |

| Ennis (EBF) | 5.81% | ★★★★★★ |

| Employers Holdings (EIG) | 3.10% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 3.89% | ★★★★★☆ |

| DHT Holdings (DHT) | 7.84% | ★★★★★☆ |

| Columbia Banking System (COLB) | 5.92% | ★★★★★★ |

Click here to see the full list of 142 stocks from our Top US Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

First Merchants (FRME)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: First Merchants Corporation is a financial holding company for First Merchants Bank, offering commercial and consumer banking services, with a market cap of $2.06 billion.

Operations: First Merchants Corporation generates its revenue primarily from the Community Banking segment, which accounted for $638.72 million.

Dividend Yield: 4%

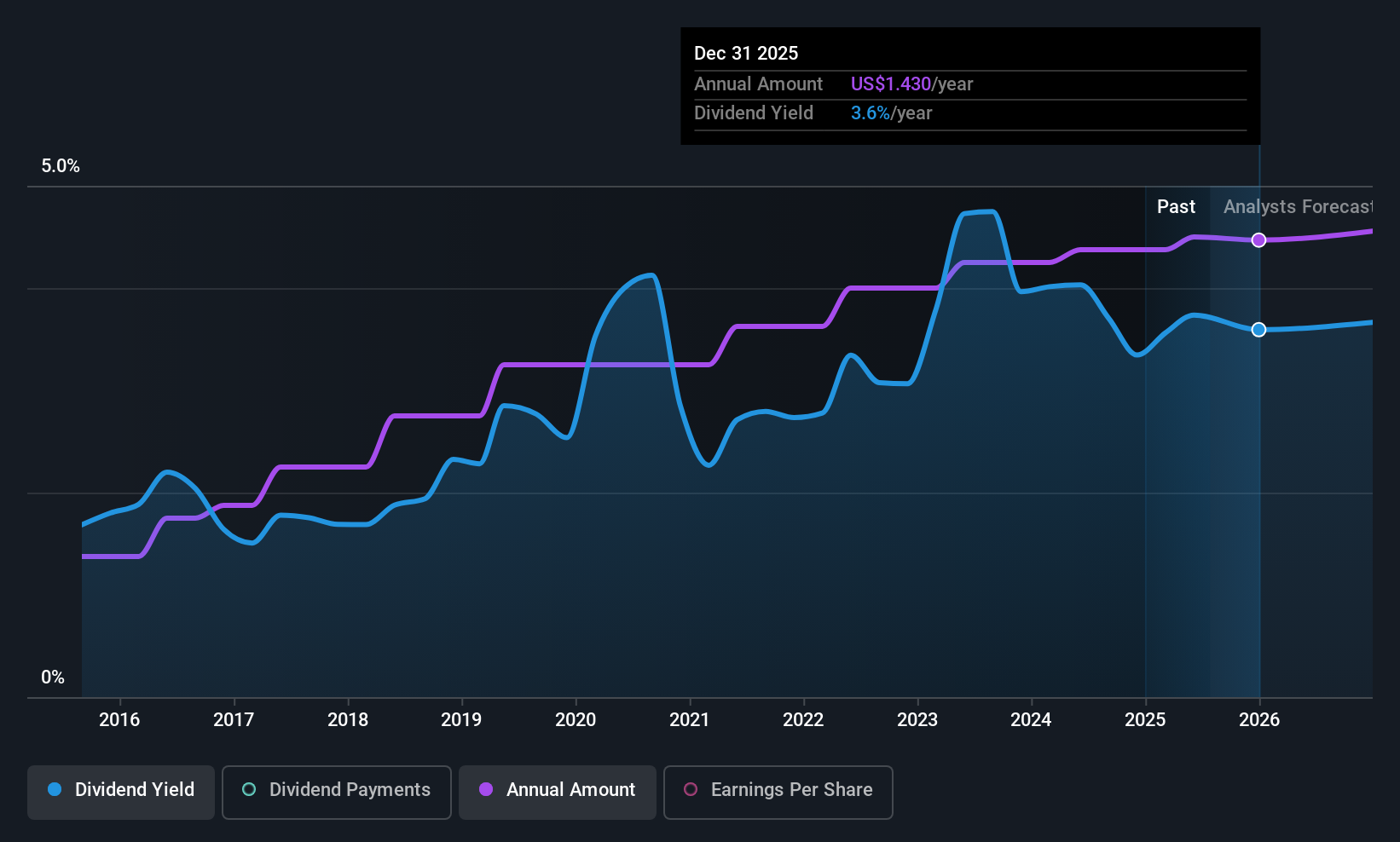

First Merchants Corporation offers a stable dividend profile with a current yield of 4.03%, supported by a low payout ratio of 36.5%, indicating dividends are well covered by earnings. The company has maintained reliable and growing dividend payments over the past decade, though its yield is below the top tier in the US market. Recent developments include an all-stock merger with First Savings Financial Group valued at US$241.3 million, potentially impacting future financial performance and dividend sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of First Merchants.

- Upon reviewing our latest valuation report, First Merchants' share price might be too pessimistic.

Huntington Bancshares (HBAN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Huntington Bancshares Incorporated is a bank holding company for The Huntington National Bank, offering commercial, consumer, and mortgage banking services in the United States, with a market cap of $22.62 billion.

Operations: Huntington Bancshares generates revenue through its diverse banking services, including commercial, consumer, and mortgage banking within the United States.

Dividend Yield: 4%

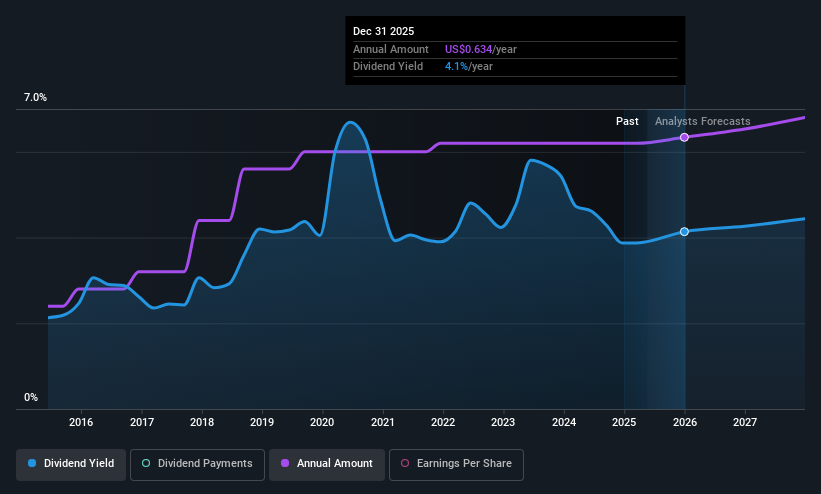

Huntington Bancshares offers a reliable dividend yield of 4%, supported by a sustainable payout ratio of 42.8%. Its dividends have been stable and growing over the past decade but remain below the top tier in the US market. The company recently affirmed its quarterly cash dividend, reflecting consistent shareholder returns. Huntington's recent earnings report showed strong growth in net income and interest income, bolstered by better-than-expected loan growth and higher net interest margins.

- Navigate through the intricacies of Huntington Bancshares with our comprehensive dividend report here.

- The analysis detailed in our Huntington Bancshares valuation report hints at an deflated share price compared to its estimated value.

Magic Software Enterprises (MGIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Magic Software Enterprises Ltd. offers proprietary application development, vertical software solutions, business process integration, IT outsourcing services, and cloud-based services globally with a market cap of $1.01 billion.

Operations: Magic Software Enterprises Ltd. generates revenue through its application development, vertical software solutions, business process integration, IT outsourcing services, and cloud-based offerings on a global scale.

Dividend Yield: 3%

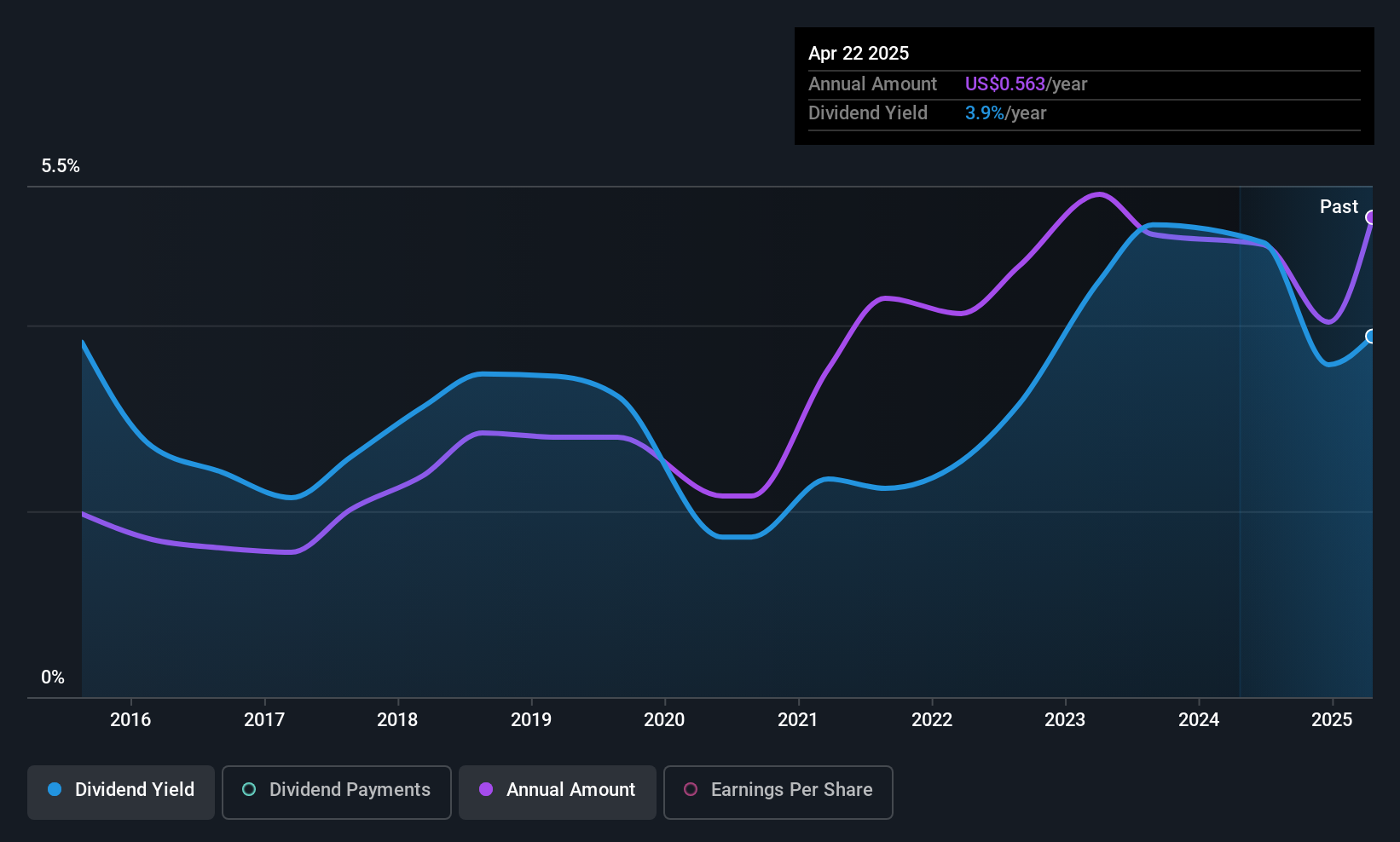

Magic Software Enterprises maintains a reasonable dividend payout ratio of 74.9%, indicating coverage by earnings, while the cash payout ratio of 60.3% suggests sustainability through cash flows. Although its dividend yield of 3.02% is below top-tier US payers, recent increases in dividends and revenue guidance to US$600-610 million for 2025 highlight operational momentum. However, the company's dividends have been volatile over the past decade, reflecting an unstable track record despite recent growth in earnings and revenues.

- Unlock comprehensive insights into our analysis of Magic Software Enterprises stock in this dividend report.

- Our expertly prepared valuation report Magic Software Enterprises implies its share price may be lower than expected.

Summing It All Up

- Get an in-depth perspective on all 142 Top US Dividend Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGIC

Magic Software Enterprises

Provides proprietary application development, vertical software solutions, business process integration, information technologies (IT) outsourcing software services, and cloud-based services worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)