- United States

- /

- Software

- /

- NasdaqGS:INTU

Intuit (INTU) Reports Q4 Earnings Growth and Expands US$3,200 Million Buyback Plan

Reviewed by Simply Wall St

Intuit (INTU) reported robust fourth-quarter earnings on August 21, 2025, with net income of $381 million compared to a $20 million loss the previous year, and announced an increase in its equity buyback authority by $3.2 billion. Despite these positive updates, Intuit's stock saw a 1.81% decrease over the past week. This drop aligns with a 1.6% market decline, suggesting that broader market trends rather than company-specific news likely influenced Intuit's movement. This performance occurred in the context of Fed Chair Powell hinting at potential interest rate cuts, which buoyed markets towards week's end but was not enough to counter the earlier declines the stock experienced.

You should learn about the 1 warning sign we've spotted with Intuit.

The recent news of Intuit's increased equity buyback program, despite an initial share price decline, may enhance shareholder value and help stabilize investor sentiment over time. This aligns with analysts' projections of higher revenue growth and profitability driven by the company's focus on AI-powered solutions. Over the past five years, Intuit's total shareholder return, including stock price appreciation and dividends, was 108.68%, indicating strong long-term growth.

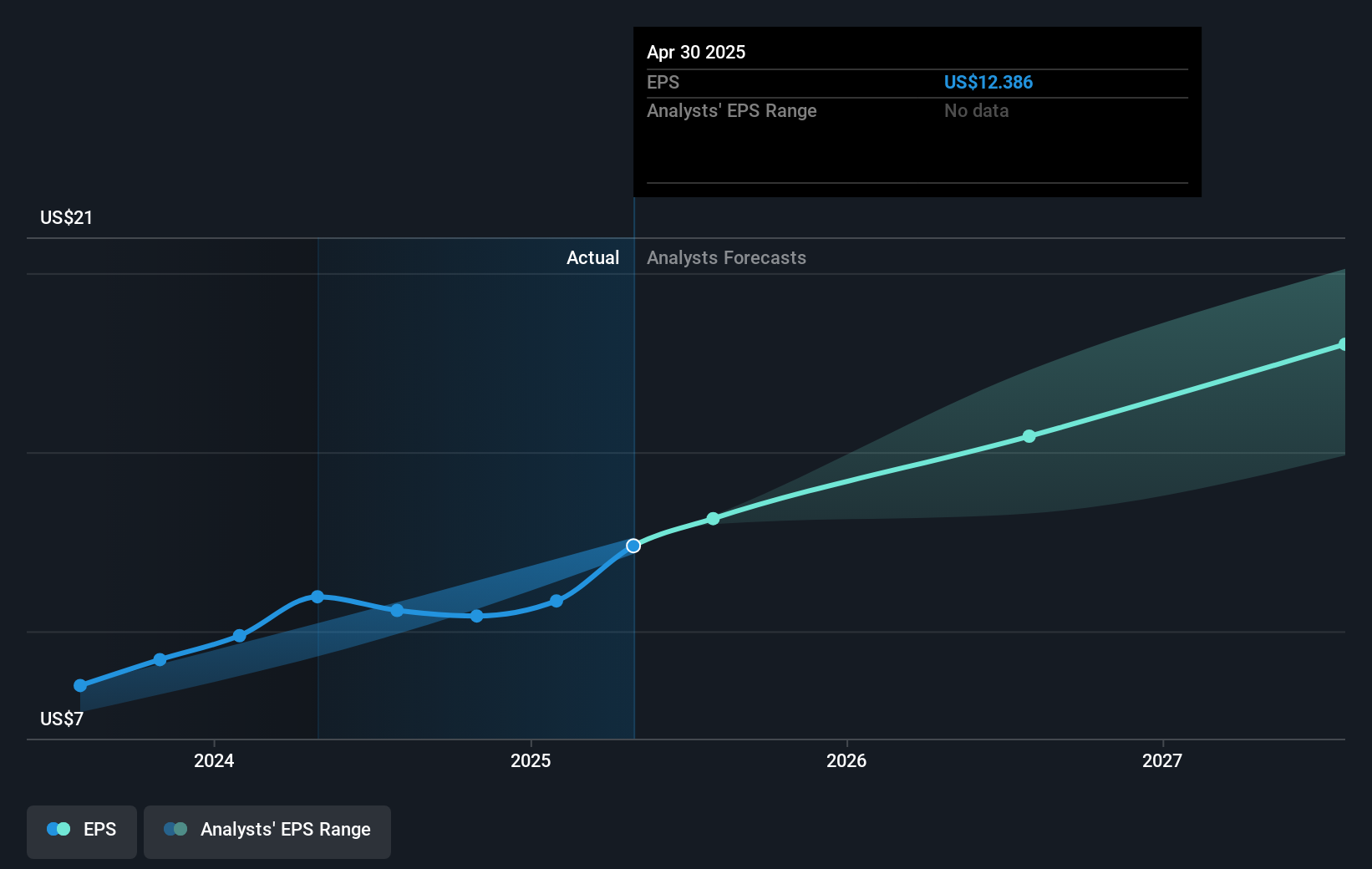

In the last year, however, the company's performance lagged behind the US Software industry, which returned 25.1%. The recent market movements, including a 1.81% decline in Intuit's share price over the last week influenced by overall market trends, highlight the ongoing sensitivity to macroeconomic factors such as potential interest rate cuts hinted at by Fed Chair Powell. Despite this short-term market reaction, the company's long-term strategy incorporating AI and expansion into the mid-market might bolster revenue and earnings forecasts, supporting analyst projections of US$181.84 billion in future revenues and US$3.468 billion in earnings.

Currently priced at US$697.76, Intuit's share value remains below the analyst consensus price target of US$834.66. This suggests that there is room for upside if the company's strategic initiatives translate into expected financial outcomes. Investors should consider these developments while evaluating potential investment in Intuit.

Assess Intuit's future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTU

Intuit

Provides financial management, compliance, and marketing products and services in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives